The Gold Bears Are in For a Massive Surprise

Commodities / Gold and Silver 2016 Nov 24, 2016 - 12:59 PM GMTBy: Graham_Summers

If you’re serious about making money from investing in the financial markets, you need to be able to read the crowd… and go against it.

If you’re serious about making money from investing in the financial markets, you need to be able to read the crowd… and go against it.

Let me give you an example… Currently one of the consensus views is that the Gold rally is over and gold is dead as an investment.

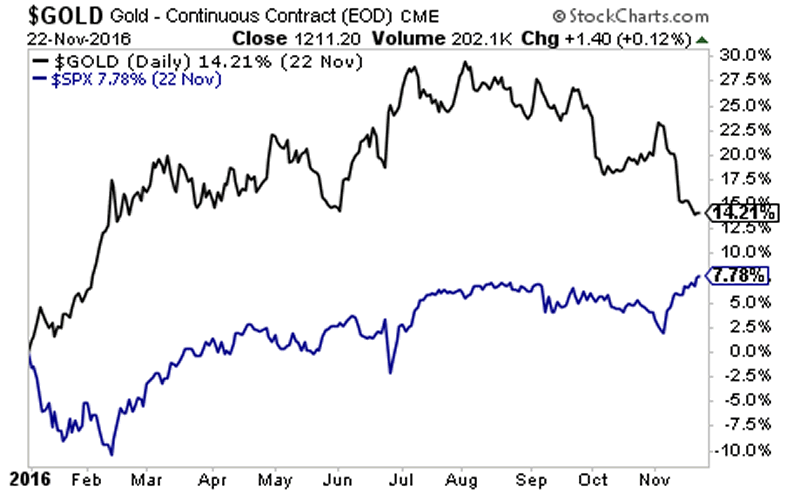

Right off the bat, you know this sentiment is at an extreme. Despite its recent sell-off, Gold is still crushing stocks in terms of performance year to date.

This is a massive “tell”: people believe Gold is doing very badly when in reality it’s nearly doubling stocks’ performance year to date.

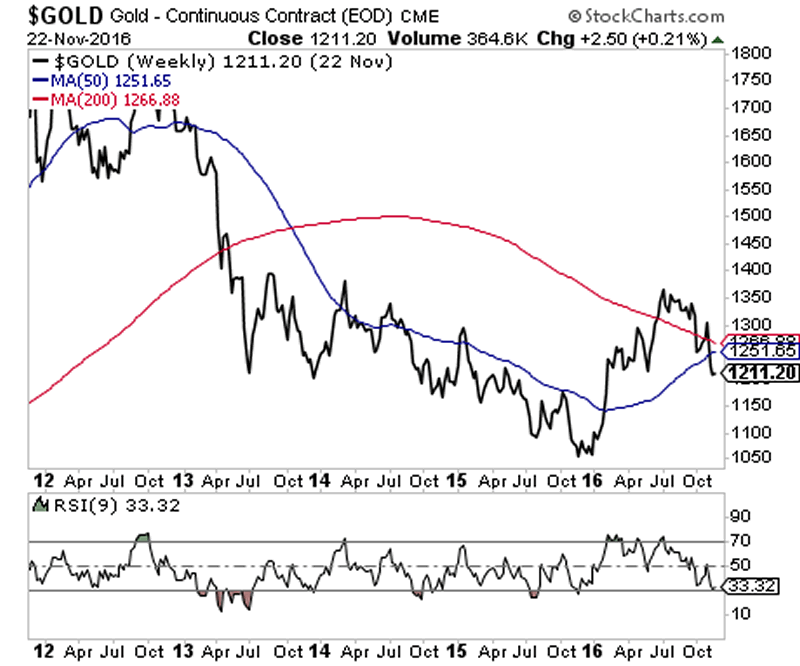

Another “tell” is technical in nature. Investor sentiment is acting as though Gold is dead… when in reality Gold is both oversold and about to stage a bullish crossover (when the 50-wma breaks above the 200-wma).

Put another way, Gold is due for a snapback bounce at the very least… at the exact same time that it’s about to stage a massively bullish long-term signal.

This is a textbook recipe for a “rip your face off” rally.

Again, with Gold today we’ve got:

- Terrible sentiment.

- An oversold security.

- A massively bullish long-term buy signal about to trigger.

You can ignore this all you like. But all of the above suggest Gold will be much higher in the coming weeks.

If you’re looking for a high-octane means of playing Gold’s next move higher, we offer a FREE investment report detailing an unique play on Gold that has the potential to rise 250% or more in the next 12 months.

To pick up a copy swing by:

http://phoenixcapitalmarketing.com/GM2.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.