War On Cash Goes Global – India and Citibank In Australia

Interest-Rates / War on Cash Nov 24, 2016 - 12:52 PM GMTBy: GoldCore

War On Cash Goes Global – India, Australia and Citibank

War On Cash Goes Global – India, Australia and Citibank- India shock cancellation of nation’s two highest-denomination notes

- India effectively invalidates & removes 86% of cash from circulation

- India sees “runs on banks” & severe financial difficulties

- Citi to makes all Australian branches cashless

- Australian pilot programme restricts 80% of payments on card

- UBS proposes Australia eliminates $100 and $50 bills

- What can we do about this?

- Conclusion

By ;@Skoylesy . Editor ;@MarkTOByrne

In a world of ultra low and negative interest rates, bail-ins and increasing corporate and government surveillance, the war on cash will be damaging to savings and wealth protection, it will primarily benefit governments and banks.

These were the primary conclusions we came to in our recent research note on the ‘Cashless Society’. Within the article we touched on several points that we felt were of concern in the growing war on cash.

Going cashless meant greater risk to your wealth, control of your assets and even personal information. We cited a number of examples where the ‘war on cash’ and indeed the push for a cashless society is set to intensify and rapidly escalate.

However, we could not have known that within a month of that article being published Prime Minister Modhi of India shocked his country (and the rest of the world) by suddenly declaring “a surprise cancellation of the nation’s two highest-denomination notes, effectively invalidating 86 percent of total currency in circulation” as reported by Bloomberg.

This was, argued the government, a move to combat the ‘black money’ market, tax avoidance, fighting counterfeiting and terrorism financing. All noble aims that we would all support.

This was followed by an announcement from Citi Bank that it’s Australian branches will be going cashless (with near-immediate effect), telling customers that it ‘will no longer handle notes and coins in branches because of a lack of demand.’

Neither move has been done for what are seen as unorthodox reasons. Most are ‘on message’ in the ‘echo chamber’ that these latest moves towards a cashless society is good for economies and indeed citizens.

Tell that to people in Indian who could not buy food, water, medicine or medical services since the shock move. Tell that to small and medium size businesses who are struggling and some may go bankrupt due to the radical and some would say extreme move.

Indian elite sees cash as criminal

Modhi’s announcement to remove two large denomination notes meant about 86% of the cash in circulation would no longer be legal tender. Despite this the Indian government had no qualms about suddenly announcing and enacting this draconian measure, with no notice and giving the public and businesses in India no time to prepare.

The decision to act in this way was based on a widely peddled belief (across the globe) that if you are holding cash then you are potential involved in illicit activities, evading tax or worse you are a terrorist.

Therefore, why should you be given notice, or the right to hold your money and savings in your preferred medium.

As the Times reported

“Much of the wealth that India has accumulated since economic reforms began in the 1990s has never been taxed or accounted for, parked instead in real estate, gold, foreign investments and, in some cases, bundles of cash sitting at home.

It is those stacks of bills that Modi, who took office 2½ years ago on promises to curb corruption, aimed to bring into the open. Supporters of the prime minister’s plan said those holding cash stockpiles would have to deposit them at banks, where huge amounts would draw the scrutiny of tax authorities, or allow their value to evaporate.”

Unlike in Australia, cash still plays a major role in the Indian economy for both day-to-day transactions and savings. Estimates of how much payments are cash based range between 70 and 85%. So rare is it to be completely without cash that the BBC reported on one village in the western state of Gujarat that went cashless a year ago.

Reports circulated about women queuing throughout the night to bank decades’ worth of savings they had been keeping as personal security and their life savings due to a lack of trust in Indian banks and the Indian banking system.

Small shops were unable to manage cashflow, and medical travellers across the country unable to prove the source of funds in order to bank the cash they had brought, and then continue with treatment.

Huge financial inconvenience, disruption and chaos created. Indeed, arguably the move will make Indians less trusting of the banking system and government and more likely to opt for the age old store of value in India – gold.

Indeed, demand for gold in India has not suprisingly soared since the ban.

Australia was going cashless anyway.

The move by Citi in Australia is nowhere near as dramatic as Modhi’s announcement. However, it shows that the move to go cashless by western banks is quietly gathering pace.

Australia, like many Western countries has been using less and less cash. 53% of payments currently made in Australia are cashless, according to a 2015 Westpac Survey. The same survey found 79% of Australian smartphone users agree making payments via a smartphone will soon become the norm and that the country is expected to become a cashless society by 2022.

Citi bank is saying that the move to go cashless is due to falling levels of cash usage with Citi’s customers. The bank says that less than 4% of customers have made cash transactions in branch, in the last year.

‘This move to cashless branches reflects Citi’s commitment to digital banking and we are investing in the channels our customers prefer to use,” stated Janine Copelin, head of retail banking at Citi.

Cashless is something that is being introduced and pushed for by governments as well as by the banks in Australia and internationally.

The Australian government are taking on those who are perhaps not so concerned about a possible deposit bail-in but those on welfare. In Ceduna, on the South West Australian coast, a 12-month pilot programme is testing a cashless welfare card. 80% of payments on the card are restricted in order to prevent spending on gambling, alcohol or abusive substances.

Why the push for cashless?

This is one potential positive of a cashless society. However, most of the risks are being ignored.

A government that has the power to restrict welfare payments to citizens, is a government that could restrict payments to citizens who it decrees should not be paid – whether they be social justice campaigners, anti austerity or anti war protesters or indeed simply supporters of Donald Trump or any opposition political party or movement.

This tool in the wrong hands could be damaging to civil rights and personal freedom. Totalitarian states and leaders dream of such powers.

Decisions like this, by banks, cannot always be attributed to customers ‘going digital’. In 2015 Citi introduced a new policy in the US that prevented customers from using cash in their credit card and mortgage repayments.

In our recent cashless piece we highlighted the controls that are now in place within banks, when you deposit what they perceive to be a large amount of cash.

Since the Citi announcement UBS has proposed that eliminating $100 and $50 bills would be “good for the [Australian] economy and good for the banks.” The notes account for 92% of the circulating cash value.

UBS analyst Jonathan Mott said last week that there are three times as many Australian $100 notes in circulation as there are $5 notes. Echoing the moves of the Indian government he argued that the elimination of large denomination notes would be “good for the economy and good for the banks.”

As human beings we are always looking for the most efficient solutions. There is little doubt that paying on card, using contactless, or mobile payment is speedier than withdrawing and transacting in cash, hence why it is not surprising that such transactions are falling.

It is not an impossible concept, in developed countries, to live with out cash on a day-to-day basis.

Also, the push to reduce illicit activities that are criminal, tax avoiding and harmful is of course a worthy move. However, it is a unworthy move when government and bank measures that are there to prop up a banking system are done under the guise of do-gooding, cost saving and efficiency.

Banks, with special mention to European ones here, currently have low levels of capital and negative interest rates. The phrase bail-in is no longer whispered, so likely it is becoming.

Meanwhile, governments are attempting to create a cashless society thanks to a banking system (over which they have regulatory control) that will hold all the savings and much of the wealth in the economy.

This lack of diversification and concentration of risks in monopoly banks will make the financial system and economy even more fragile. Savers and their savings will be more exposed to banks and the banking system

Economic Professor Joseph Salerno, told Ron Paul in 2015 that the real war on cash seeks to “force the public to make payments to the financial system” in order to “enable governments to expand their ability to spy on and keep track of their citizens’ most private financial dealings in order to milk their citizens out of every last dollar of tax payments that they claim are due.”

He stated another reason to try and eliminate cash from the banking system is to “prop up the unstable fractional reserve banking system which is in a state of collapse all over the world …”

What can we do about this?

If you are holding cash, as an individual or company, it is now prudent not to keep your cash in high denominated bills, instead split it between 10, 20s and 50s.

But what about in the long-term? Given the war on cash risks creating a ‘cashless society’ – what should savers do?

As we know, in the long term deposits and cash are a very poor store of value. We have all heard the expression that ‘cash is king’ and this has certainly rung true in times of zero-interest rates and financial crises, but only in short-time frames.

Whatever the reason to go without cash, the end-result is still the same, if you, your bank or your government decides to go cashless then will you join the list of unsecured creditors should the bank fail.

For this reason assets outside the banking system are becoming more and more important as a way to protect and grow wealth.

Conclusion

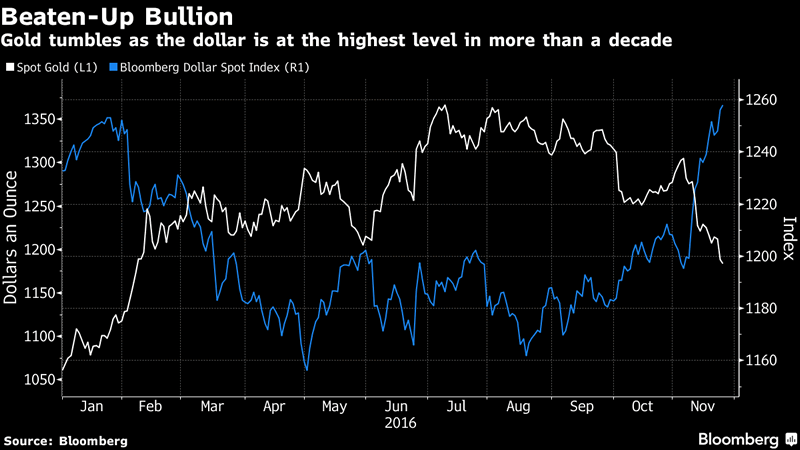

Gold and silver coins and bars have been good stores of value historically and were shown to be again before and during the financial crisis.

They are borderless currencies that cannot be decreed worthless overnight by governments, cannot be eaten away at by negative interest rates or deposit ‘levies.’

Not can they be confiscated in bank bail-ins and or indeed debased and devalued by the printing presses or the massive electronic currency creation of this age.

If held in one’s possession or in allocated and segregated storage in the safest vaults, in the safest jurisdictions.

Gold Prices (LBMA AM)

24 Nov: USD 1,187.25, GBP 995.36 & EUR 1,125.04 per ounce

23 Nov: USD 1,213.25, GBP 998.00 & EUR 1,143.00 per ounce

22 Nov: USD 1,217.55, GBP 997.89 & EUR 1,144.98 per ounce

21 Nov: USD 1,214.95, GBP 984.72 & EUR 1,143.39 per ounce

18 Nov: USD 1,206.10, GBP 971.15 & EUR 1,135.54 per ounce

17 Nov: USD 1,232.00, GBP 988.19 & EUR 1,148.10 per ounce

16 Nov: USD 1,225.70, GBP 984.36 & EUR 1,144.68 per ounce

15 Nov: USD 1,228.90, GBP 988.65 & EUR 1,138.70 per ounce

Silver Prices (LBMA)

24 Nov: USD 16.31, GBP 13.09 & EUR 15.43 per ounce

23 Nov: USD 16.56, GBP 13.36 & EUR 15.59 per ounce

22 Nov: USD 16.76, GBP 13.46 & EUR 15.77 per ounce

21 Nov: USD 16.68, GBP 13.47 & EUR 15.69 per ounce

18 Nov: USD 16.51, GBP 13.30 & EUR 15.54 per ounce

17 Nov: USD 17.04, GBP 13.65 & EUR 15.87 per ounce

16 Nov: USD 16.95, GBP 13.64 & EUR 15.85 per ounce

15 Nov: USD 17.00, GBP 13.68 & EUR 15.80 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.