Stocks, the Politically-Driven S.O.D. to Lose Again

Stock-Markets / Stock Markets 2016 Nov 24, 2016 - 04:11 AM GMTBy: Gary_Tanashian

You know who they are; they are the ones who denied and denied the ginned up bull market in US stocks that nearly tripled under the socialist regime, circa 2009-2016. They are the ones who clung to gold well past the caution point last summer. They are (yes, it’s another snappy buzz phrase to either entertain, bore or annoy you… ) the S.O.D., AKA the Sons of Druckenmiller, AKA politically biased and newly activated market participants. Reference…

You know who they are; they are the ones who denied and denied the ginned up bull market in US stocks that nearly tripled under the socialist regime, circa 2009-2016. They are the ones who clung to gold well past the caution point last summer. They are (yes, it’s another snappy buzz phrase to either entertain, bore or annoy you… ) the S.O.D., AKA the Sons of Druckenmiller, AKA politically biased and newly activated market participants. Reference…

Druckenmiller: Get out of the stock market, own gold (this helped load the boat full of ill-fated gold bugs in the spring).

The night Trump was elected president, Stanley Druckenmiller dumped gold (this signaled the beginning of reparations to gold’s sentiment profile). He also became very bullish on the stock market; go figure.

Still feel like following the MSM and these media stars they shove down gullible peoples’ throats?

So the well known and much respected Druck was bullish on gold and bearish on the US stock market until he famously flipped his script literally upside down in a knee-jerked response to the presidential election, which cast off the commies and brought in a man who promised to ‘reshore’ America’s outsourced industries (folks, the smoke stacks are gone and they are not coming back, although more Robots may well be, in time).* He has promised to cut taxes including especially, corporate taxes, and he has promised myriad other fixes to help the economy trickle down to the long-abused middle class.

This is not an article about the future efficacy of these changes; it is an article about a contrarian setup, in which market sentiment is all tied up with politics to finally bring on the climax that any major cyclical bull market needs to experience before it flames out.

Now before you (NFTRH subscribers and regular nftrh.com readers know my views) go thinking “he’s a politically motivated liberal” or “he’s a perma bear” I will let you know that neither of these are true. What I am is someone whose job it is to see the markets for what they are, through no other lens than the one that will give us the best probabilities going forward. Period, end of subject. Get your politics out of my face and while you’re at it, get your politics out of your own market management processes; I beg of you.

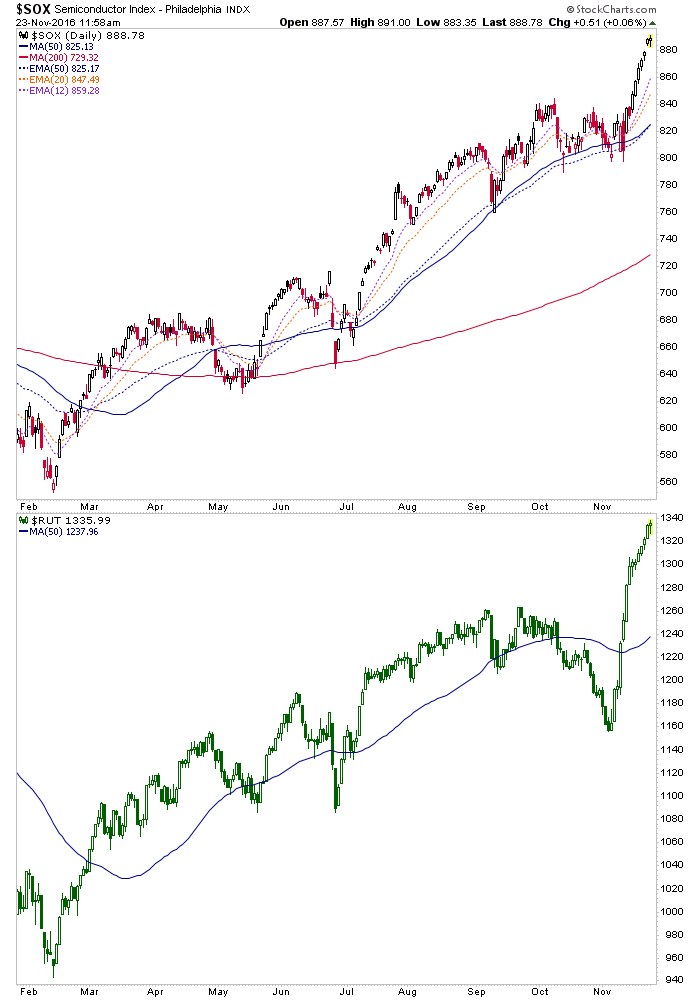

We were right to be bullish the Semiconductor sector for instance, for reasons belabored repeatedly back in the spring. See AMAT Chirps, B2B Ramps, Yellen Hawks and Gold’s Fundamentals Erode among several other posts back then. Now I am telling you that things may be changing, both with the Semi sector (we covered key details in an NFTRH update this morning) and in the broad market’s sentiment backdrop.

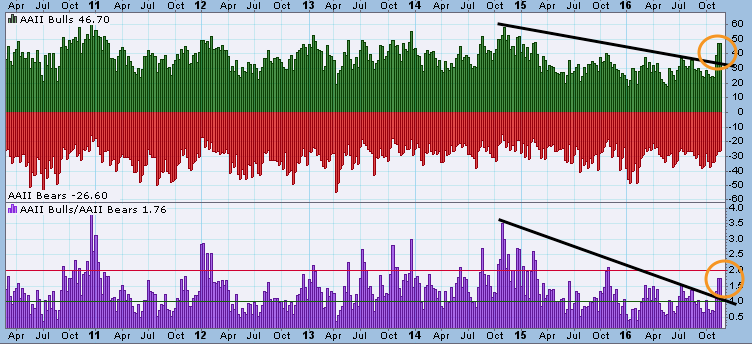

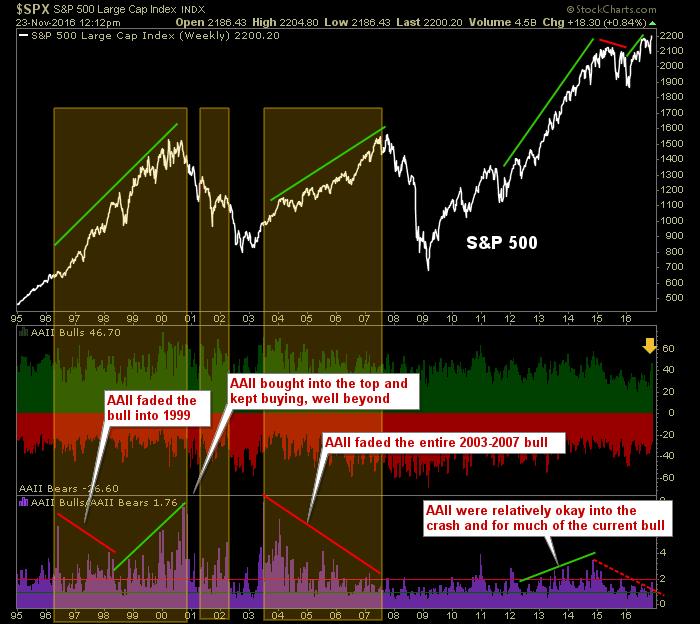

From a sentiment standpoint, let’s again point out that the AAII, a massive contrary indicator from 1996 to 2007, needed to buy the bull. AAII has surged over the last 2 weeks, post-election.

For a larger perspective on the ‘little guy’, we have a long-term chart showing AAII’s history. Our thesis has been that they may need to figuratively at least, forgive themselves for the sins of 1996 to 2007 before the current bull market can end. They are on their way.

The little guy voted Trump into office and the little guy feels hope for America now. So he’s buying the things he likes best, among which are the Semis and Small Caps.

Here I’ll repeat the closing thought (and chart) from NFTRH 422 once again…

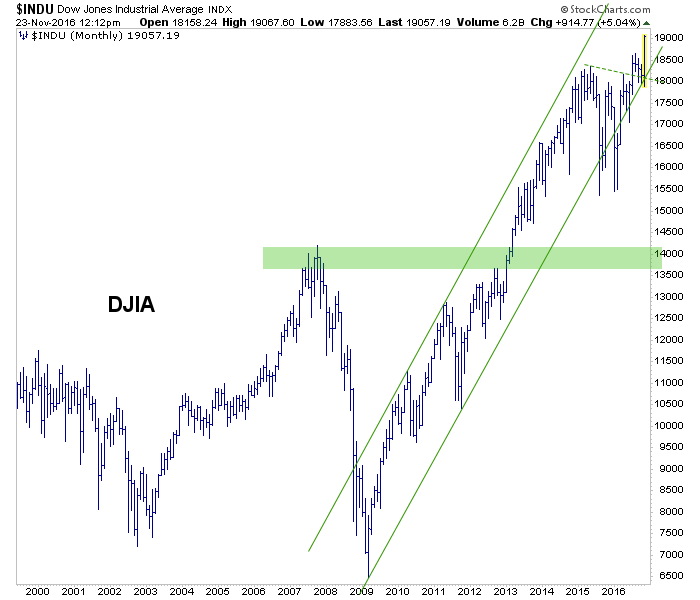

“I am thinking about what kind of power may have been unleashed by the market’s view of ‘liberation’ from the yoke of socialism that it perceives had been constraining things. One problem with that bias is this chart of the Dow showing what the market did during that socialist phase of constraint (green channel). An opportunity for a contrary play?”

I am not telling anyone to run out and short the market right now (I have zero short positions and still hold hopefully well-selected longs), but I am telling them that this is not going to end well. People managing the markets through a political lens are going to get a double whammy. Using Druckenmiller as a blueprint, they will suck on stocks hook, line and sinker and puke up gold. It will be exactly opposite to their stance last summer.

Happy Thanksgiving.

* As a former manufacturing guy, I thoroughly enjoyed this short article by Dean Baker discussing Trumponomics, the factory of the future and the man and his dog it will take to run one.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.