A little perspective on the post-election Gold market

Commodities / Gold and Silver 2016 Nov 24, 2016 - 04:04 AM GMT Most of gold’s downside is geared not to the financial decisions of millions of investors around the globe, as the mainstream media would have you believe, but rather to linear computer algorithms geared to the dollar index. The trading part of the software has been told to automatically place trades at certain correlated price levels and that is why we get these waterfall drops. The rocket launch trajectories to the upside come when the trading function is told to buy and cover the previous shorts.

Most of gold’s downside is geared not to the financial decisions of millions of investors around the globe, as the mainstream media would have you believe, but rather to linear computer algorithms geared to the dollar index. The trading part of the software has been told to automatically place trades at certain correlated price levels and that is why we get these waterfall drops. The rocket launch trajectories to the upside come when the trading function is told to buy and cover the previous shorts.

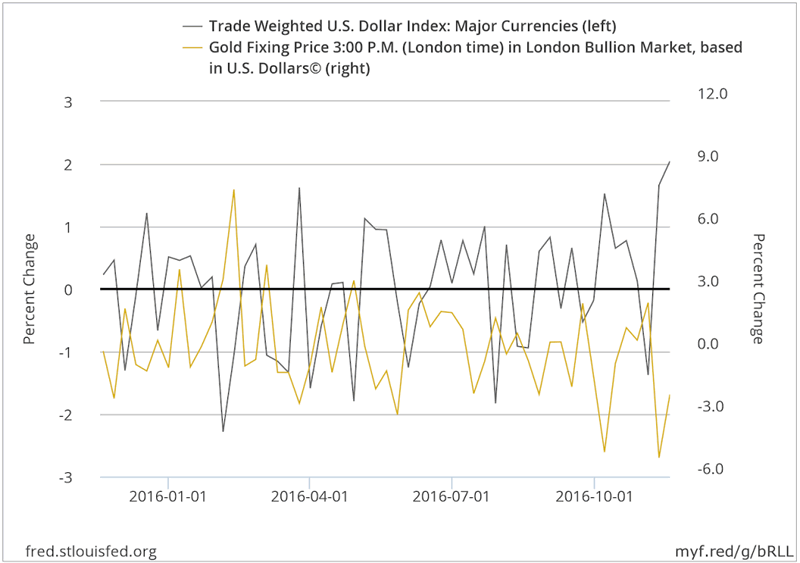

In the chart above, we are showing the percentage change in the price of gold over the past year against the percentage change in the dollar index. Our purpose is to provide a little perspective as to what is really going on in the gold market and to belay the interpretation that something has gone fundamentally wrong with gold.

Algos cannot peer around the corner. There is no rationale for their function other than what its programmers have fed into the governing equation. Thus, if the algo says sell gold when the dollar rises, it sells gold when the dollar rises. It doesn’t stop to think that the dollar is rising in a milieu of crashing currencies globally and the potential consequences. It doesn’t stop to consider that it will take months for the Trump administration to get a tangible, workable economic program through the Congress, and then months more for the program to have an effect on the overall economy. Such critical thinking is left to the rest of us who are not tethered to computer trading programs.

(Along those lines, we are reminded that the computerized polling prior to the election was also algo-based, and you see where that got those who believed the polls to be reliable. Surprise! We missed something!)

So it is that buying opportunities are created in the gold market (and betting opportunities for those who like to gamble on elections). Some consider such opportunities a gift. As you can see by the top chart, there is a cadence to the market action – upsides are followed by downsides, downsides followed by upsides. When you zoom out and look at the dollar index chart from afar, here is what it looks like:

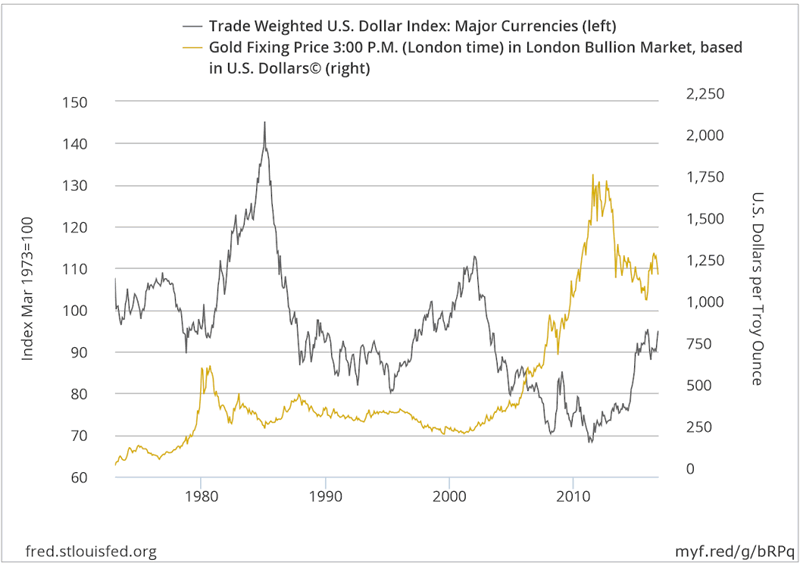

As you can see, even in a world of generally declining fiat money across the spectrum of currencies, the dollar is in a long-term downtrend and gold is in a long-term uptrend. The dollar appears to be enjoying a secular bear market rally and gold appears to be suffering a bull market correction. What that tells the longer-term gold owner about the today’s pricing in a nutshell is that gold might be a good buy at current prices. It’s all a matter of perspective. . . .that and the courage to act on one’s convictions even in the prototypical euphoric period just following a presidential election.

One further point, and once again a matter of perspective, we should all remember that gold is still up over 12% on the year and silver is still up over 18%. That should not get lost in the shuffle. Meanwhile, the Dow Jones Industrial Average, after all the hoopla of the last several days, is up by comparison only 9%.

Some comforting perspective for our fellow gold owners as we go into the Thanksgiving holiday weekend. . . . Wishing all a warm and comfortable Thanksgiving.

_______________________________________________________

We cordially invite you to subscribe to our monthly newsletter.

News & Views

Forecasts, Commentary & Analysis on the Economy and Precious Metals

FREE SUBSCRIPTION

Immediate access to this month’s edition. Publication alerts by e-mail.

We welcome your participation!

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.