The Winners and Losers of a Global Trade War

Economics / Global Economy Nov 23, 2016 - 04:58 PM GMTBy: Harry_Dent

My research in recent months has focused increasingly on how the surprise Brexit vote and Trump’s victory are actually not that surprising after all. They’re a clear sign of a growing number of everyday people rejecting the massive globalization trend that has surged since World War II.

My research in recent months has focused increasingly on how the surprise Brexit vote and Trump’s victory are actually not that surprising after all. They’re a clear sign of a growing number of everyday people rejecting the massive globalization trend that has surged since World War II.

The world “shrinking” seemed to be a win-win at first. Countries could focus on what they do best and export to others while importing what they need. And, yes, longer-term that does work, as Adam Smith first espoused in 1776.

But there’s a catch, as Australian Steve Keen, one of those rare economists who truly understands how the world works, says. That is, you can’t just switch from one major industry to the other without some major costs to infrastructures and labor unemployment. So once you’ve set off down a particular path of specialization, there’s really no turning back.

You can’t turn a steel mill into a semiconductor factory, or at least not without major retooling and costs. And the skills that staff must possess to work in each kind of plant differ wildly.

In short, specialization of labor is good, until it turns bad. So too, globalization has been an economic boon, until now…

We’ve reached that point where it’s time for a reset before we can progress once again.

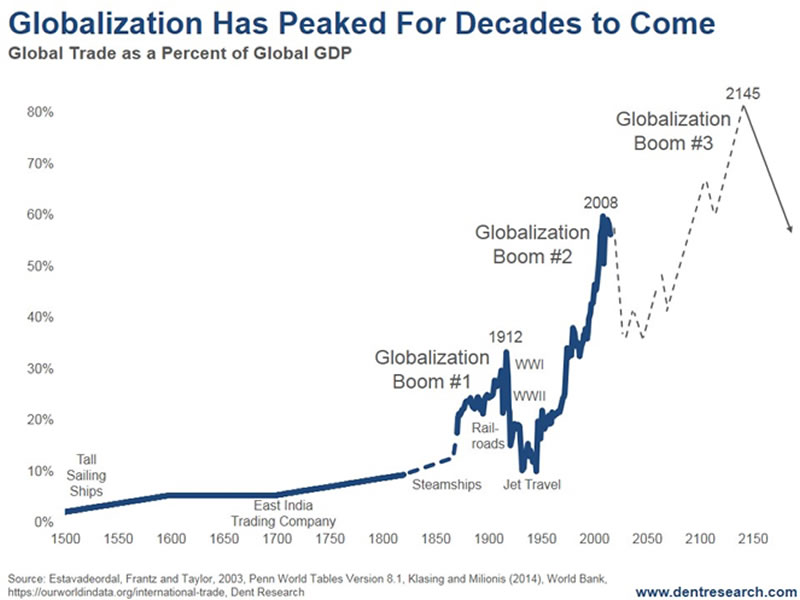

Global trade, just like any other trend, surged and has now hit its limits. It must reset and consolidate before it can resurge again.

This is the nature of any cycle!

And as you can see…

… globalization has reached its second peak, so the backlash against it is a natural progression in this cycle.

That’s not to say globalization is dead. It is very much alive, and will continue after this looming reprieve. After all, we’re only 52% urban now compared to where we were in the mid-1850s. But no surge has the steam to move perpetually.

The first globalization surge peaked in 1912 as World War I hit. The second boom only started after the end of World War II. That means, for 33 years, globalization retreated. And as you read this, we’re heading into the next great retreat.

There is no arguing that there’s a revolt of everyday workers in the developed world against globalization – not just Brexit or Trump America. Fractures along religious, political, racial and gender lines have turned into fissures.

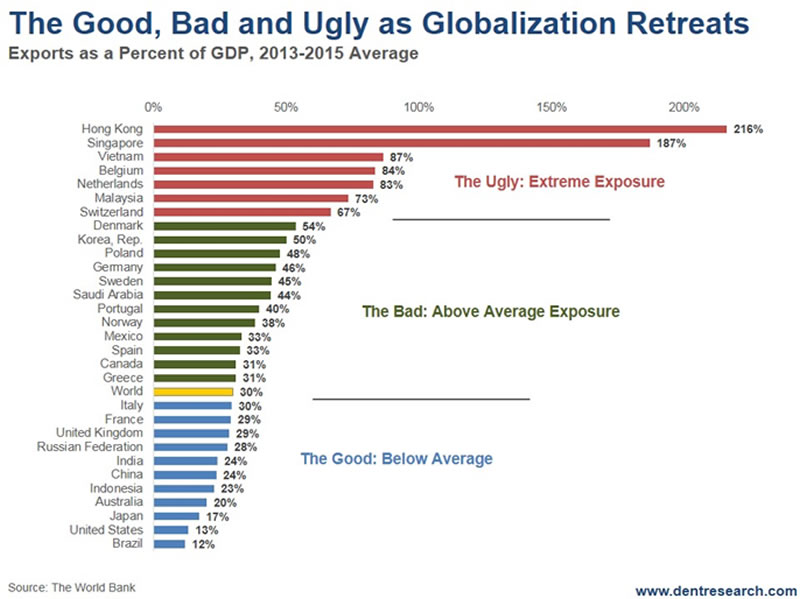

The question now is: Which countries will be hurt the most by another protectionist era and sharp contraction of global trade?

Well, that depends on which countries rely most on exports rather than domestic and internal demographic-driven demand for their growth? Basically, those with the greatest, most focused, specialization of labor.

Here’s how 30 major countries rank on exports as a percent of GDP.

Look at the “ugly” group – the greatest losers in a global trade war…

- Hong Kong;

- Singapore;

- Vietnam;

- Belgium;

- The Netherlands;

- Malaysia; and

- Switzerland

The rest of Europe, East Europe and the Middle East make up most of the “bad” group. They have higher than average exposure compared to the global average, which is 30% exports to GDP.

The least exposed group starts with Italy and moves down to the very least at risk being the U.S. at 13% and Brazil at 12%…

Just another notch in our belt as the best house in a bad neighborhood. And it’s another reason the U.S. dollar will rise in at least the early stages of the next global financial crisis.

In short, most countries lose in the developing trade war (just like what we saw from 1913-1945). But some do better than others, as is natural in the shakeout phase in any longer-term cycle. The U.S. comes out the best on this measure in the developed world, and the U.K. and France better than most of Europe. Brazil and India come out the best in the emerging world.

The battle lines are drawn. Are you ready?

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.