Gold, Commodities, Forex and Stock Market Forecasts

Stock-Markets / Financial Markets 2016 Nov 22, 2016 - 04:34 PM GMTBy: Ken_Ticehurst

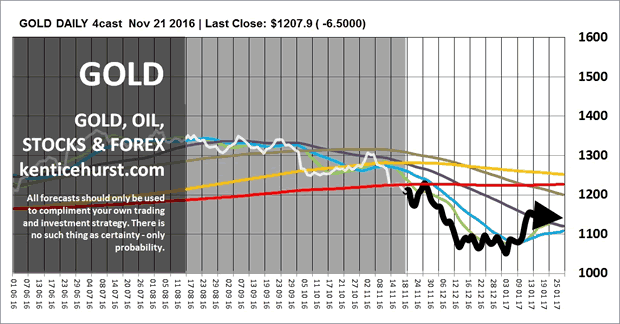

We continue to be bearish on Gold as we have been for months, our only recent change is that we are expecting a significant low earlier in 2017 than previously forecast. We have consistently maintained that this bearish phase is just a short term consolidation before we begin a new and significant rise that could well lead to new all time highs.

We continue to be bearish on Gold as we have been for months, our only recent change is that we are expecting a significant low earlier in 2017 than previously forecast. We have consistently maintained that this bearish phase is just a short term consolidation before we begin a new and significant rise that could well lead to new all time highs.

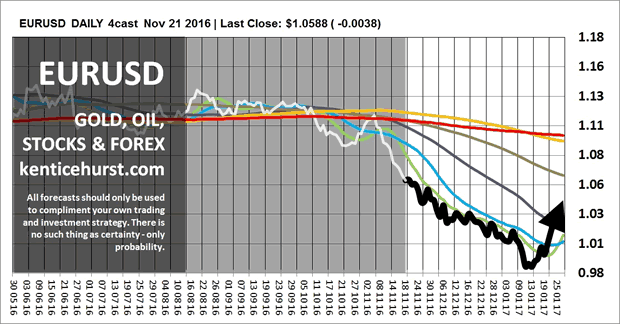

Our Euro forecast is now back on track, we have been forecasting that the Euro would break down against the Dollar in the fourth quarter of 2016 and so it has transpired. We still expect the Dollar to outperform most major currencies as we head in to 2017. The Euro having made a back-test against the Dollar is now likely to continue falling heavily as we end the year and we expect parity in the first quarter of 2017.

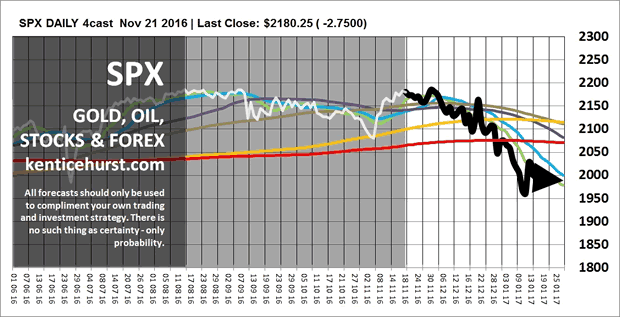

We have been forecasting a correction in global stocks over the next six months. Our S&P500 forecast has remained on track for months, it has been indicating that we are on the verge of a period of weakness. Having recently seen lows not seen since July US stocks were the main beneficiary of the volatility seen earlier this month. However we do not expect this volatility and short term noise to have any meaningful effect on the long term and we still expect to see the market drop as we head towards the end of the year.

So far we have our stronger Dollar and weaker commodities, the Yen has not yet shown the increase in strength we are expecting and we are still forecasting a breakdown in global stock markets over the coming months. The volatility experienced earlier this month is beginning to fade and a number of markets are expected to resume their previous trends as the strength of the Dollar continues to exert significant pressure on numerous markets.

You can view live short term forecasts at our website, they are a representation of our medium and long term forecasts which always show the full picture, prices tend to be more random day to day than they are week to week or even month to month. Our short term forecasts are always anchored against these larger patterns that barley change from week to week, this is what allows us to be so confident with our shorter term forecasts in spite of the increase in volatility.

Taking patterns in nature that repeat over different time frames like fractals as the basis for the forecast methodology, our forecast patterns can last for months and years, we create a most probable long term fractal pattern and then continually test it and model it over multiple time frames to ensure the pattern remains a probable event.

Ken Ticehurst is the publisher of forecasts for a wide range of markets at kenticehurst.com he has a BSC (Hons.) in Industrial Design and decades of experience as a data analyst. Having used technical analysis during over ten years of trading, he became frustrated with how backward looking it is and set about creating a logical mathematical approach to analysing future prices.

Copyright 2016, Ken Ticehurst. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.