Stock Market Rally Appears Complete

Stock-Markets / Stock Markets 2016 Nov 22, 2016 - 02:07 PM GMTSPX closed under 2200.00, as suggested. Whether that is the end of the rally will be ascertained at tomorrow’s open. All of the Waves appear to be complete and on time.

Note that two new potential catalysts have hit the internet. The first is a “Big Problem” has just emerged for Trump’s Economic Plan. It is expected to add $5.3 trillion to the debt over the next decade.

The second is that a powerful 7.3 magnitude earthquake has just hit off the Fukushima Prefecture of Japan. This comes with a tsunami warning. Later reports have downgraded the earthquake to 6.9.

This has had an effect on USD/JPY which, in turn, may have an effect on the liquidity of the markets.

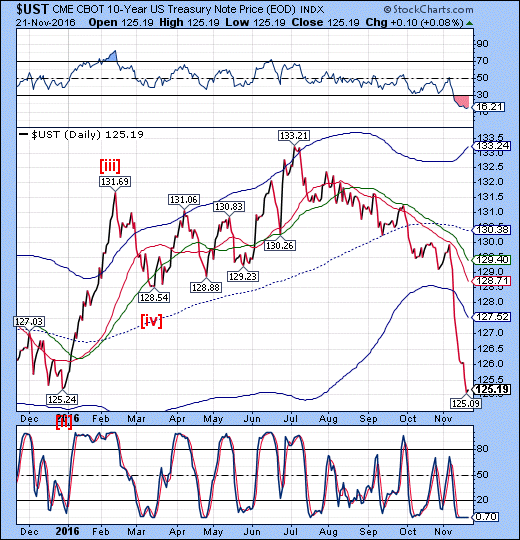

US Treasury risk has also spiked to a 3-year high after the 10-year T-note has declined over 6% from its July high.

ZeroHedge reports, “Riskless" US Treasury bonds are at their riskiest relative to "risky" stocks since the summer of 2013's Taper Tantrum... and at the same time, bonds are 'cheapest' to stocks in over a year...

US Treasury bond risk is at its highest in 9 months as US equity risk hovers back near 2-month lows pushing the relative risk to its highest since Aug 2013...”

There is a possible Master Cycle low due at the end of this week, but I am not sure that I can put a Wave structure on this chart quite yet.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.