The Real Barrier To Trump's Economic Policies!

Economics / US Economy Nov 20, 2016 - 02:39 PM GMTBy: Gordon_T_Long

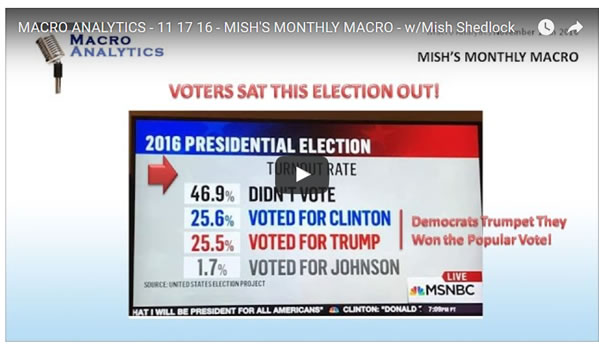

Gordon T Long, Co-Founder of MATASII.com sat down with Mish Shedlock to get his views on what the new Trump Administration and its "Trumponomics" policies will mean to the markets and investment strategies in 2017.

Gordon T Long, Co-Founder of MATASII.com sat down with Mish Shedlock to get his views on what the new Trump Administration and its "Trumponomics" policies will mean to the markets and investment strategies in 2017.

Here are a few of Mish's current views on some of the Key Economic Platforms of "Trumponomics":

'TRUMPONOMICS"

POLITICAL DISRUPTIONS & DESTABILIZING EVENTS

EUROPE: "Trump wants Europe to pay more on its defense as he hasn't changed his position on NATO."

MEXICO: "Trump is adamant he is going to build this wall"

CHINA: "Trump is going to start a trade war with China - that is pretty clear as he sees them as a currency manipulator."

EMERGING MARKETS: Current Fed Policy and the resulting strong US$ are "just clobbering emerging markets"

IRAN: "Trump has promised to renegotiate the deal with Iran!"

INFRASTRUCTURE

"I don't see all this Infrastructure occurring .... at least in a hurry!"

WHAT WILL STAND IN TRUMPONOMICS WAY

Mish feels the following are going to stand in the way of Trump's plans:

ANTI-GLOBALIZATION & PROTECTIONISM

"The big story here which everyone is missing is the big change in attitude towards Globalization.

GLOBAL TRADE BUST TO DRIVE ANOTHER DEFLATIONARY SCARE

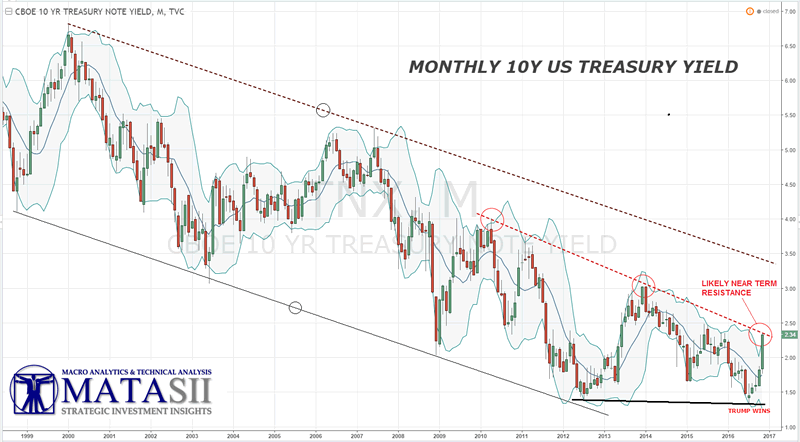

Mish observes that "the dollar is ahead of itself, treasury yields are ahead of themselves and they are pricing in this massive inflation here that I don't think we are going to see, at least in the short term. I think there is another deflationary scare coming up first because of a global trade bust. There are some pretty severe deflationary undercurrents occurring and a collapse in global trade is a real possibility!"

GLOBAL MACRO PICTURE TO MISH "LOOKS PRETTY AWFUL"!

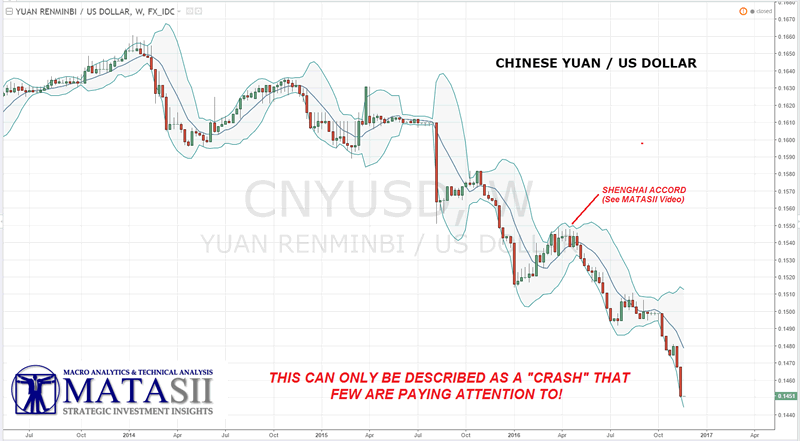

- Deflationary forces coming out of China with Mish expecting another major devaluation in the Yuan by China to stop capital flight,

- A Strongly Rising US Dollar which hurts US exports and Emerging Markets,

- A Collapse in Global Trade,

- Populist "Anti-Globalism" Fueling Protectionism,

- Major Elections Coming in Europe (Germany, France)

MISH SEES A US RECESSION AS A REAL POSSIBILITY

- Rising rates is killing housing,

- Manufacturing production has peaked,

- Services are falling "and could take the rest of the economy with it".

"I think we are on the verge of another deflationary bust here.We will see if trade tips the scale, whether a rising dollar tips the scale, whether protectionism tips the scale or simply rising interest rates and fed rate hikes tip the scale. There a re a lot of things priced here into the stock market that all of this good inflation thanks to Trump - WE WILL SEE!"

View the complete dialogue in this 21 minute video accompanied with 26 slides.

For more articles signup for GordonTLong.com releases of MATASII Research

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.