Stock Market SPX Trendline Reversal?

Stock-Markets / Stock Markets 2016 Nov 18, 2016 - 04:59 PM GMT It appears that the SPX reversed at the Diagonal trendline in the first hour of the day. The initial impulse may go as low as 2171.00 to 2175.00 before a bounce. If it follows Cycles timing guidelines, we may see the top of the bounce between 2:00 and 3:00 pm.

It appears that the SPX reversed at the Diagonal trendline in the first hour of the day. The initial impulse may go as low as 2171.00 to 2175.00 before a bounce. If it follows Cycles timing guidelines, we may see the top of the bounce between 2:00 and 3:00 pm.

Using that bounce to go short would be a highly aggressive play, so you may consider only a partial position.

The VIX ix still beneath its 50-day Moving Average, so there is no actionable signal at this time from this indicator.

The Hi-Lo Index challenged its mid-Cycle support at 111.00 this morning, but bounced. We are looking for a close beneath the mid-Cycle support before a sell signal is given. Check back after 3:00 to see if it may be back beneath the mid-Cycle before taking more than a partial plunge.

The USD made a slightly higher high, but appears to be running out of steam. I’m not calling a top, yet. However, it appears to be getting close…

ZeroHedge reports, “The Dollar Index just broke to fresh 13.5 year highs, up an unprecedented 10 days in a row. The USD buying panic began as US equities opened...

and sparked selling in every USD-priced asset as stocks, bonds, gold, and oil all tumbled...

As Bloomberg reports, “Massive blocks in several asset classes all went off at the same time,” including UST and E-mini S&P 500, Mischler Financial trader Glen Capelo said; “Must be a program of some type”

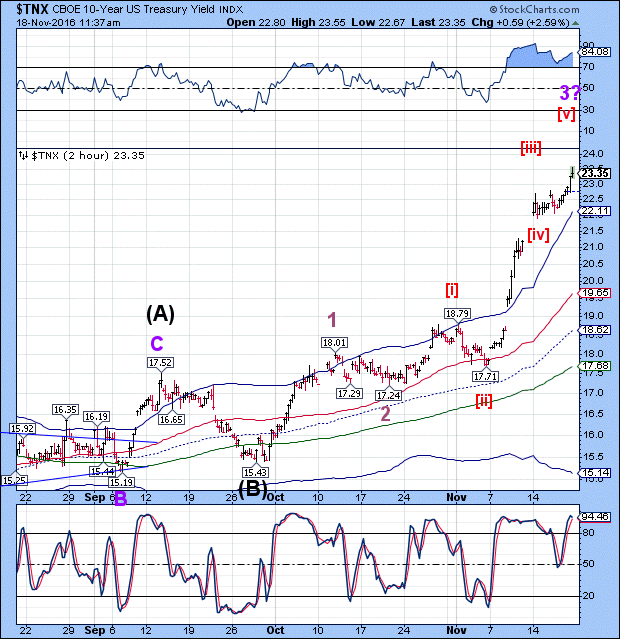

TNX exceeded the upper target of this rally at 23.55 before settling back. There appears to be yet another probe higher to complete Wave [v] of 3.

ZeroHedge comments, “10Y Treasury yields are up a stunning 65bps from the Trump-win lows, spiking to 2.35% - the highest since Dec 2015.

5Y Yields have also reached their 2016 highs...

In fact the entire Treasury yield curve is now higher in yield on the year...”

It appears that this may be the catalyst for a very large turn in the markets.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.