Investment Survivor

Stock-Markets / Investing 2017 Nov 18, 2016 - 04:55 PM GMTBy: David_Galland

Dear Parader,

Dear Parader,

My favorite reality TV show, Survivor, was created by the energetic and entirely self-made Mark Burnett.

A British expat with zero experience in show business, Burnett managed to go from selling T-shirts on a rented fence in Venice Beach, California, to heading up MGM Television.

I’m not alone in enjoying Survivor, as it ranks as the #1 summer TV show of all time.

The premise of Survivor is quite simple. You strand a group of strangers in remote exotic locales, remove all but the most basic of necessities, then make them compete in a variety of physical and mental contests for the grand prize of one million smackers.

At the end of each episode, one person is voted out of the game until there are just three finalists left.

The winner of the million sawbucks is decided in a final episode after a jury made up of losing players grills each of the finalists as to why they are most deserving of the prize, followed by a vote to decide who gets the cabbage.

The game’s motto, “Outwit, Outplay, Outlast,” is a good description of the skills needed to win all the Benjamins. There is no second prize.

Within that broad framework, the producers have come up with an array of twists, usually involving separating the castaways into groups based on certain characteristics. In the current season, the groups were initially divided into two groups, Millennials and Generation-Xers.

While the physical challenges are intense—often undertaken in extreme conditions—only rarely has a player had a sufficiently strong physical advantage to win individual immunity (which makes them safe from being voted out of the game) in a streak long enough to get to the end.

So, what traits do the winners usually possess? In my casual observance, they include:

- Personable, but not overly so. It is important to be likeable, but not to the point where you are viewed as a social threat.

- Strong, but not too strong. In the early days of each game, people are pleased to be teamed up with someone who can help the team win the physical challenges. However, as the number of players are whittled down, strong players always find themselves with large targets on their backs.

- Be helpful to your teammates. Being helpful around camp places a weight on the right side of the balance. Conversely, the slatternly sorts who lounge around the camp all day while others do the work soon find themselves on the outs. Nobody likes a mooch.

- Be willing to take a chance. In every game, the producers hide a certain number of “immunity idols” near the camps. It’s considered bad form to overtly seek advantage by hunting for the idols, but the upside of taking a chance by doing just that—and finding one—is huge. Likewise, winners invariably take chances within the social context of the game by trying to organize blind-sides of stronger players.

- Make sure your enemies are voted out early. Remember Bugs Bunny’s maxim: never start a fight, but when someone starts a fight with you, take them out quickly.

- Don’t be mean to others. Every season, someone forgets they ultimately need the support of others to win and for no important reason bully or humiliate another player. In addition to making an enemy of the person they antagonize, they cast themselves as a villain in the eyes of the other person’s allies and of people who don’t much care for bullies.

- Don’t be openly scheming and deceitful. Though the game is stinky with deceit, the players who openly wheel and deal are inevitably voted out of the game for the simple reason that no one trusts them.

- Don’t be overconfident. In every game, one player, or a group of players, position themselves at the top of the pecking order and engage in premature self-congratulation. Others can see the situation for what it is and, wanting the million clams for themselves, energetically try to vote off those in the pole position.

- Be able to build strong alliances. Allying with one or more people you can trust, and who trust you, is always helpful in being able to outmaneuver the others.

- Trust, but not too much. This is one of the more difficult aspects of the game to master. While alliances are important, you can never take them for granted.

- Be persistent. I cannot tell you how many times an individual, or a small group, finds themselves at the bottom of the pecking order, yet manage to duck and weave and, with a bit of luck, make it to the end. Never give up.

With some exceptions, Survivor is basically a microcosm of everyday life as a member of the tribe of human apes. Using the recently concluded US presidential election as illustrative, one can see that while Trump may not have possessed all the traits found in winners, he possessed enough to prevail.

On the other hand, Clinton tripped up most egregiously on a couple of the key points, especially being overtly scheming and deceitful, as well as being overconfident. While I can’t speak for others, heading into the election, I couldn’t help but wish she would lose—solely to see the condescending smile wiped off her face.

If you aren’t yet a Survivor fan, I highly recommend you give it a try. I think you’ll find that every episode contains useful lessons on how to succeed in working with others. Or at least on how to avoid getting sideways and finding yourself an outcast, be it in a corporation, family unit, country club, or any other social grouping.

On the topic of surviving, I would like to take this moment to pivot to a new course by sharing some thoughts on surviving in these uncertain economic times.

Investment Survivor

We all want to believe the Trump administration will prove favorable for the economy and, by extension, investment markets.

However, not even Trump himself can say how things will work out. In truth, the exact opposite economic outcome may occur.

If you accept that it is impossible to predict what’s going to happen with the general economy over Trump’s first term, how can you organize your portfolio to be sure your assets survive and even prosper?

As readers of any duration already know, I believe there is only one pretty much foolproof way to invest and sleep well at night. And that is to buy great companies at great prices.

Easy to say, but how can one find great companies selling below their intrinsic value?

The answer involves multiple facets, many of which are explained in our free Dimes for Dollars Report. To name just a few:

- Screen for value. We use several screening programs, including our proprietary CIQS quant screener, to digest a huge amount of data on thousands of US stocks. At the end of our screening process, only a handful of issues will meet our metrics for value.

- Dig deep for fatal flaws. Some companies are cheap for a reason. Coal stocks, for example, are selling at historically low prices, even though 34% of the baseload power in the US still comes from coal. However, for reasons I will expound upon momentarily, the long, dark winter for coal is almost certain to continue for years.

In any event, in this phase of our search for value, our analysis focuses entirely on identifying potential risks that could result in our target companies going out of business or suffering a serious setback.

- Understand why they are undervalued. There are any number of reasons as to why a company is selling on the cheap, from broad market trends, to regulatory issues (think Volkswagen), to a temporary business setback resulting in an earning miss, etc.

The companies we are looking for are those with a healthy balance sheet, a dominant position in their respective industries, strong management, and a clear path to a positive revaluation.

- We ask if the companies are in sync with a strong trend. As no one can see the future, this is the most subjective part of our analysis. That said, there are always clear trends in motion that, all things considered, should stay in motion. For example, the exponential growth in computational power will continue to produce technological advancements with the potential to destroy old industries, while creating entirely new ones.

While there are several key themes we are investing in sync with now, I will mention just one here. If we are right—and so far, we have been—investing in harmony with this trend should continue to be money in the bank.

An Investment Theme You Can (Probably) Count On

And that key theme could be summed up as “Energy Prices Are Locked in a Range.” Despite blatant attempts by OPEC to sink the industry, and constant assaults by the enviro-loonies, US fracking may be down, but it is certainly not out. In fact, it is getting more efficient with every passing day, with new technologies now allowing US oil producers to make money at oil prices as low as $35 per barrel.

Meanwhile, US energy giants like Exxon are also adjusting to the new normal of lower prices by slashing costs and improving efficiency.

Toss into the mix a near-certain détente between Trump and Putin, which should result in more Russian oil coming onto the market. Russia is the world’s third-largest oil producer, so its fiscal budget depends heavily on oil and gas revenue, and it won’t be cutting production anytime soon.

As global energy prices are set at the margin, with new supplies always waiting in the wings at the right price—and with the right price trending toward $40 a barrel or less—the pricing power of Saudi sheiks is greatly diminished.

Unless the Middle East is turned into a parking lot, energy prices are likely to remain in a tight range around where they are today. For years.

So, which businesses benefit from low energy prices? There are a number, but one we like is refining. That’s because refineries make their money on the spread between the cost of their feedstock (oil) and the price they get for their refined products. Thus, as oil prices fall, they have greater latitude to expand their margins.

In the August edition of Compelling Investments Quantified, we recommended a refiner selling for a price-to-earnings ratio (P/E) of just 10.78 and a price-to-book ratio (P/B) of 2.36. As a kicker, it paid a dividend yield of 2.60%.

✔ By comparison, the average S&P 500 stock trades for a P/E of over 24, and a P/B of 2.87 while paying a dividend of

2.08%.

So, a good value. In just over two months, we are already up almost 15% on the position, but as the stock has a long way to go before it reaches its fair market value, we expect to hold it for some time to come.

What if the market crashes before we take our profits?

No big deal, as the company has a very healthy business and a ton of cash. People are not going to stop using refined petroleum products. After the dust settles, the company will almost certainly bounce back quickly. Remember, it’s not a loss unless you sell a stock while it’s down.

I sincerely don’t know a better way to invest and would strongly suggest you train yourself to laser focus on value.

Fortunately, building a winning portfolio isn’t particularly complicated. Mostly, it requires deciding on the exact criteria a stock must meet before you’ll buy it, then having the patience to wait until you find the stocks that meet those criteria. There’s a lot more on the topic in our free Dimes for Dollars Report.

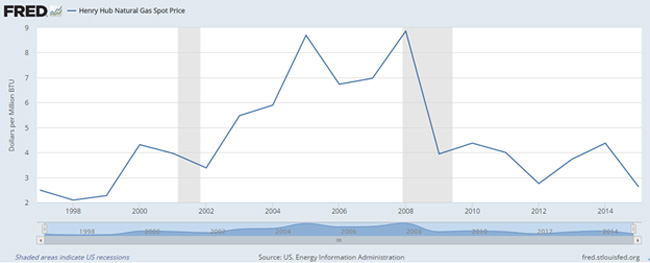

Finally, following up on my earlier comment on coal, the problem with coal is the second-place source of baseload power, natural gas.

Over the last eight years, natural gas prices have been cut in half, then cut in half again.

As many power generation plants are designed to switch between different feedstocks, cheap and clean natural gas has taken a lot of market share from coal. It will continue to do so because, for many of the same reasons oil prices will remain low, so will natural gas. And until natural gas prices rebound, coal is toast.

Here Come the Clowns

Doomed! In last week’s edition, I mentioned my concern about the enviro-cultists. To give you just the slightest of insights into the species, the following is an exchange reported on in the Huffington Post between one minion in the Democrat party as he stood and (correctly) chastised DNC chairperson Donna Brazile for backing the wrong candidate.

Some DNC staffers started to boo and some told him to sit down. Brazile began to answer, but Zach had more to say.

“You are part of the problem,” he continued, blaming Brazile for clearing the path for Trump’s victory by siding with Clinton early on. “You and your friends will die of old age and I’m going to die from climate change. You and your friends let this happen, which is going to cut 40 years off my life expectancy.”

If Zach does die young, I suspect it will come from worrying that the weather will cut 40 years off his life.

Secretary of Snow? As you probably know, the Secretary of State is a senior position in the federal government, with a mandate to guide US foreign policy.

In that role, the secretary is expected to oversee high-level negotiations with the leaders of other countries to reach mutually beneficial outcomes.

So why, pray tell, did the US government just spend millions of dollars to send current Secretary of State John Kerry to Antarctica? You know, the uninhabitable block of ice at the bottom of the world with no permanent residents?

You guessed it… ROAD TRIP!!

And with that, and thanking you for subscribing and reminding you to sign up for our free Dimes for Dollars Report, I will sign off for this week and next, as I will be checking into a hospital for a hernia operation on Tuesday.

Until next time, enjoy the parade!

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.