May Never Get Another Opportunity to Buy Gold at this Level Again

Commodities / Gold and Silver 2016 Nov 18, 2016 - 02:05 PM GMTBy: Chris_Vermeulen

America has chosen Donald Trump to be its next President and the world markets, whether metals, gold, bonds, equities or Forex are all highly volatile. In fact, I got long GDX and NUGT last week for a quick 5% and 11% gain with gold miners, a get-in and get-out type of trade to take advantage of these extreme volatility levels.

America has chosen Donald Trump to be its next President and the world markets, whether metals, gold, bonds, equities or Forex are all highly volatile. In fact, I got long GDX and NUGT last week for a quick 5% and 11% gain with gold miners, a get-in and get-out type of trade to take advantage of these extreme volatility levels.

While the initial projections were for a Brexit type turmoil in most markets, those predictions did not prove to be correct. The markets quickly reversed course and gave a strong Thumbs up to Trump’s policies.

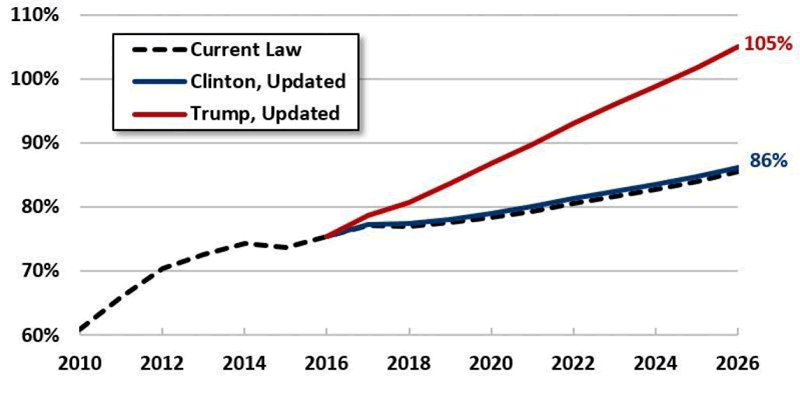

Trump’s economic plans will increase national debt

The mammoth US debt stands at $19.8 trillion and it will increase under the new President, considering his lenient tax cuts and plans for infrastructure spending.

The proposed tax cuts, inclusive of accrued interest and macroeconomic effects will increase the national debt by $7 trillion over the next decade and by $20 trillion in the next two decades, according to Forbes. There is no detail on how the President-elect plans to finance these tax cuts.

Though Trump says that he will make it deficit-neutral, there are no specifics available at this point in time.

All these will stoke inflation, which is what the investors are focused on right now and as a result, the safe havens are being dumped, while risky assets are on the rise.

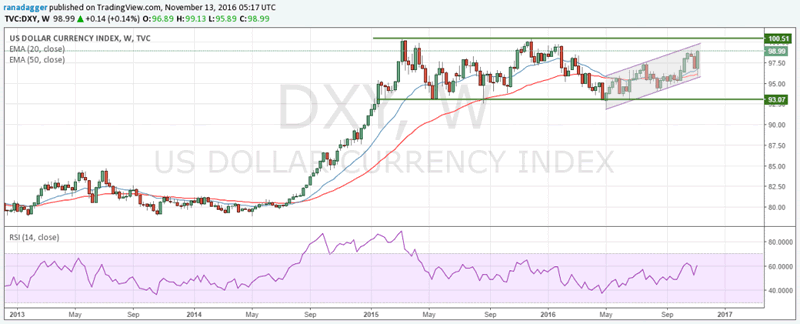

The dollar is flying as higher inflation is likely to force the FED to increase rates at a much faster pace than previously anticipated.

Protectionism will dent part of the above benefits

Candidate Trump had radical plans to tear long-standing trade agreements like the NAFTA, levy taxes on the Chinese imports, etc.

However, in a highly global world, every action that President Trump takes will have an equally strong reaction. This global trade war is unlikely to benefit either the US or the global economy, which is already struggling with anemic growth.

It is not clear if the US public will be happy to pay higher prices for the imported goods. After all, offshoring has also given a boost to the American industries, which have managed to bring down their cost of production. A costlier iPhone is likely to reduce the demand for the product, both at home and abroad.

The markets are currently discounting only the positives and are not addressing the related negatives that will tag along.

Without knowing the finer details of the proposed policies, the markets have run up far ahead of themselves, leaving a very small margin of error.

The Fed is unlikely to raise rates in December

The Fedwatch tool is projecting an 81.1% probability of a rate hike in December. I have been advocating throughout this year that the FED will not raise rates and I believe that this time too it will not be any different.

The FED will develop cold feet and is likely to postpone its rate hike to March 2017 wanting to know more about the policies of the new President before hiking rates.

If I am proven correct for the umpteenth time on the FED’s action, the market will be greatly disappointed and the dollar will fall.

With the above-mentioned uncertainties, it is unlikely that the dollar is going to breakout of the strong overhead resistance.

The dollar has returned from the 100.5 levels on two previous occasions. In the short-term, the dollar will face resistance from the channel line close to 99.5 levels and also from the 100.5 levels, which should be a more formidable resistance to cross. Hence, I believe that the path of least resistance for the dollar is down.

Gold is in a win-win situation

Gold has always been touted as a hedge against inflation. If Trump’s policies increase inflation, gold is a winner.

If President Trump implements his trade protectionist policies, it is likely to lead to a global economic and geopolitical turmoil, which will be even better for the buyers of gold.

So, whichever way you look at it, gold will benefit its buyers.

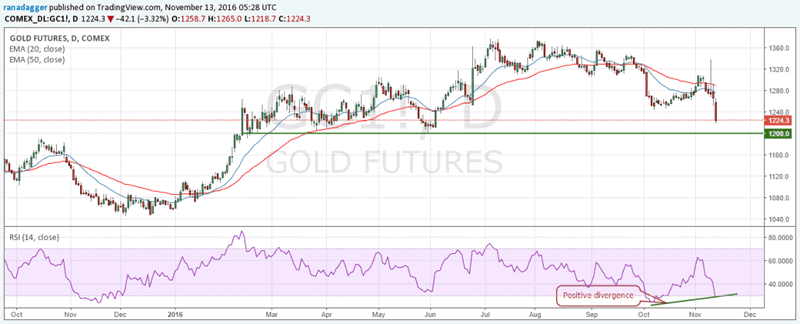

The current fall in gold is retesting the strong support area of $1200/toz. Can it break under it?

Yes, it certainly can, but the break is likely to be short lived.

The RSI has formed a positive divergence, i.e., while price of gold has fallen, the RSI has held above the lows, which is a positive sign and a sign of a bottom. Markets usually take off when positive divergences form at the bottom.

The Bottom Line

The speculators had accumulated short-term positions in gold, expecting a Brexit type rally if Trump were to be elected. However, when that hasn’t happened, they are in a hurry to close their positions, which has exacerbated the fall.

Once these positions are cleared, the stronger hands are likely to step up their purchases because gold is available on a ‘SALE’. We expect these prices to be the lowest in our lifetimes.

Hence, be ready to buy gold in large quantities for the long-term. Follow me at www.TheGoldAndOilGuy.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.