Silver and the Train Wreck

Commodities / Gold and Silver 2016 Nov 15, 2016 - 03:35 PM GMTBy: DeviantInvestor

The U.S. National Debt is a “train-wreck.” The official debt is nearly $20 trillion and the unfunded liabilities are $100 – $200 trillion, depending on who is counting.

The U.S. National Debt is a “train-wreck.” The official debt is nearly $20 trillion and the unfunded liabilities are $100 – $200 trillion, depending on who is counting.

- It can never be repaid. Implications are dire.

- Official debt doubles about every 8 years. Does $80 trillion of official debt in the early 2030s sound viable?

- Per Krugman there is no problem. Consider the source.

- Denial is not a winning strategy, but it does prolong the period before the crash.

- The losers in the crash will probably not be the financial or political elite. That leaves the rest of us.

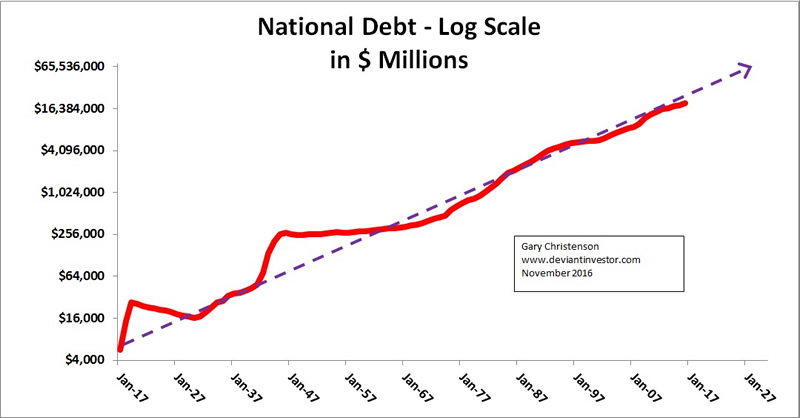

This graph shows the US official national debt – log scale in $millions – for a century. There is ample reason to believe this 100 year trend will continue and possibly accelerate.

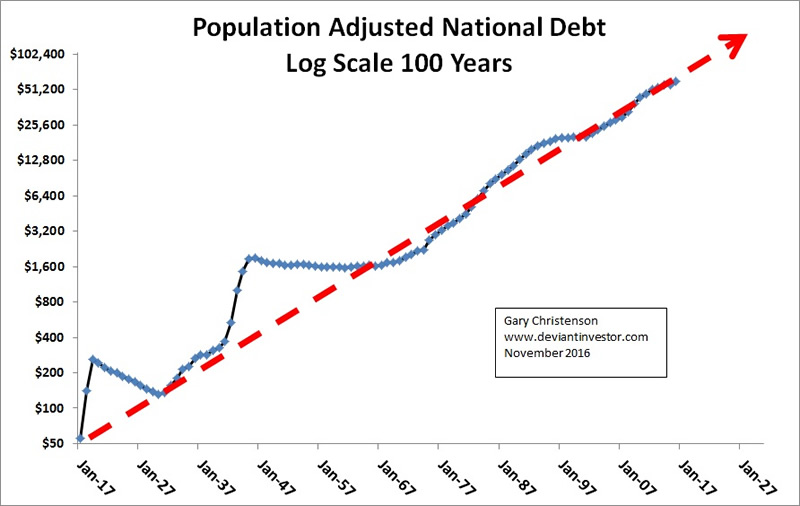

However you might say, “But the population increased several times in the last century.” The graph below shows the official debt per person – the population adjusted national debt.

Debt increased exponentially in both nominal dollars and adjusted for population.

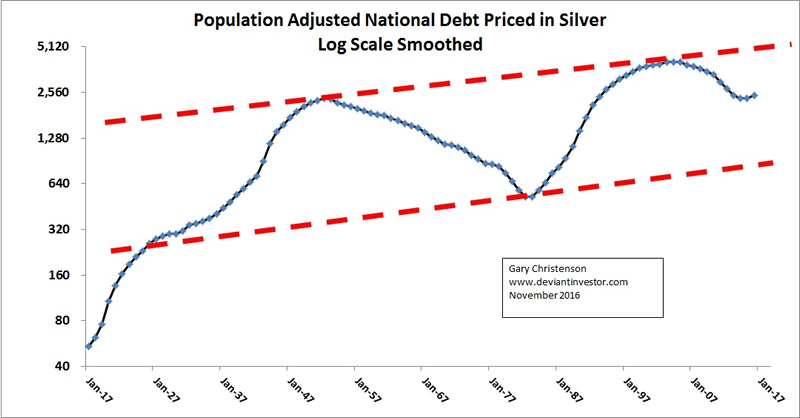

You might say, “Yes, but central bank created inflation has increased the total debt.” The graph below shows the population adjusted debt priced in real money – silver. (Gold graph has a similar form but is not shown.)

As the graph shows, population adjusted national debt has exponentially increased even when measured in silver. Note that this graph used a 10 year moving average to smooth the price data.

WHAT ABOUT SILVER, GOLD, AND CRUDE OIL?

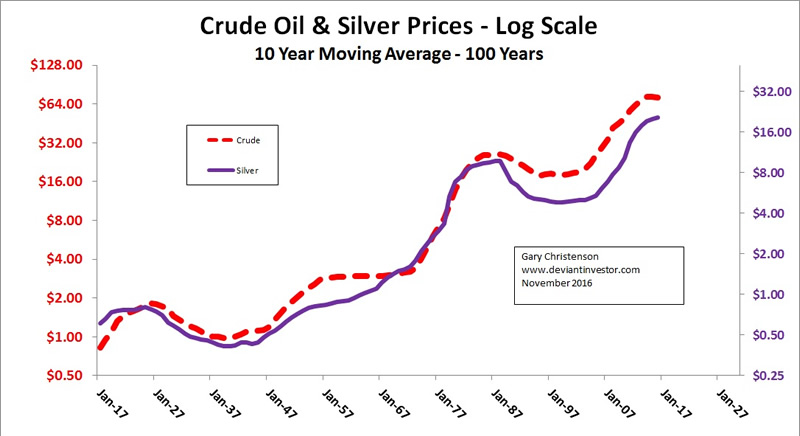

The graph below shows smoothed (10 year moving average) silver and crude prices. Gold price patterns are similar to silver prices and are not shown. Note that silver and crude prices increased erratically but exponentially.

Silver prices are currently low based on their 20 year “megaphone” pattern. Expect much higher prices.

CONSIDER:

- Debt has increased exponentially for over 100 years. Debt will continue to increase.

- The US economy is not robust. A recession/crash is coming which will reduce tax revenues while increasing borrowing and spending because politicians will “stimulate” the economy with projects, “helicopter money,” a guaranteed income, more “giveaways,” and probably many more.

- War cycles (Edelson and Armstrong) indicate increasing warfare in the next five years. Wars are currently expensive and the new ones will be worse. More spending, more debt …

- Baby boomers are retiring. Their Social Security and Medicare benefits are costly and accelerating rapidly. More debt and more spending…

The list goes on, but the prognosis is more debt, more spending, higher prices for what we need, and an acceleration of debt creation into the crash or reset. What happens after a crash or reset is less clear.

Silver and gold prices erratically increase along with debt. Given that silver prices are near the low end of their 20 year “megaphone” pattern, expect much higher silver prices. Further, the cost of production is increasing rapidly and the ore quality is declining. Expect prices to increase based on limited supply.

Given the precariousness of the central bankers’ fiat currency Ponzi Schemes and the coming realizations about the intrinsic value of paper investments and debt instruments, silver and gold prices should move much higher in the next five years due to heavy demand.

ALTERNATE CONSIDERATION:

From Paul Krugman, PhD and Nobel Prize Winning Economist:

“… there’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt.”

He might be right, 33,000 “missing” emails might concern yoga pants and weddings, the military buildup in the middle-east is merely for show, massive debt helps the average person, you can keep your doctor, Obamacare will save you money, he did not have sexual relations with that woman, hope and change have been a resounding success, Santa’s elves are making really cool toys for Christmas, a single F-35 helmet that costs $400,000 is a bargain, and herds of Easter Bunnies are bringing “nest eggs” for everyone who earns less than $100k per year. Yes, he might be right…

But if the above ideas don’t fit your basic beliefs, silver and gold should be far more successful than investments in unpayable debt, paper currencies, and levitated stock and bond markets.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.