US Stock Market Update: Trump Towers

Stock-Markets / Stock Markets 2016 Nov 11, 2016 - 03:24 PM GMTBy: Gary_Tanashian

There are more Trump Towers being erected by certain indexes (ref. Uncle Buck’s pants tent noted yesterday in an HUI update). As an aside, say what you will about the man, but the name and the persona are a natural for we financial writers and others not tasked to be sensitive about politics or politicians. I mean, how much fun could one make of Obama, a person who comes across as dignified and idealist? Bush was a little better, but even he was no Trump. The Clintons? Getting warmer. But Trump is a new thing all together, almost transcendent; more concept than man. I like this, speaking as a writer. Love it, actually.

There are more Trump Towers being erected by certain indexes (ref. Uncle Buck’s pants tent noted yesterday in an HUI update). As an aside, say what you will about the man, but the name and the persona are a natural for we financial writers and others not tasked to be sensitive about politics or politicians. I mean, how much fun could one make of Obama, a person who comes across as dignified and idealist? Bush was a little better, but even he was no Trump. The Clintons? Getting warmer. But Trump is a new thing all together, almost transcendent; more concept than man. I like this, speaking as a writer. Love it, actually.

On a more serious note, I think he is eventually going to be seen in a lesser light, as the true believers who thrust him upon their tired shoulders find out that promises are one thing and reality is quite another; if anything, he will deliver inflation, which adversely affects… anyone? Bueller?… the middle and lower classes. Asset owners – like Trump – always win and those who go paycheck to paycheck, always lose in inflationary/reflationary regimes. So if the hype proves true and exported jobs are repatriated, roads, bridges and walls are erected, tax breaks for big corporations are implimented and yet more deficit spending is enacted, it is not the true believers who are going to benefit.

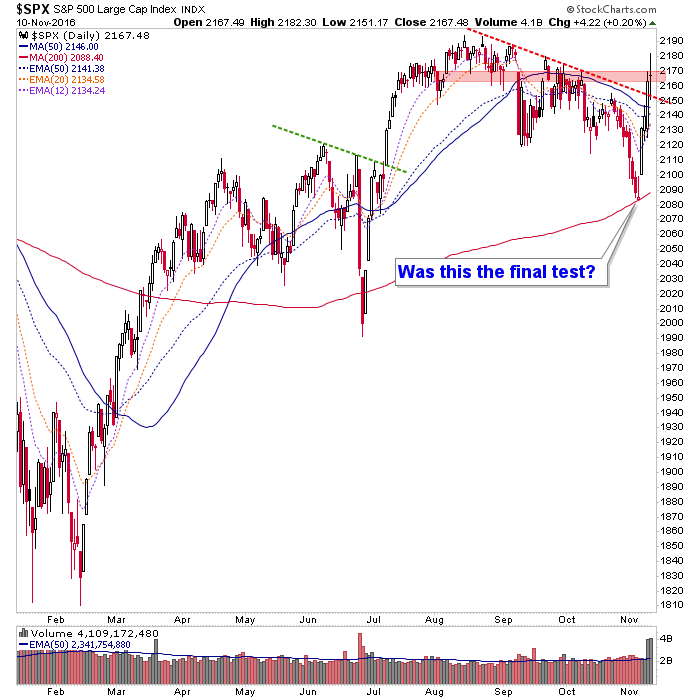

Off the stump, let’s look at SPX. It has made what qualifies as a successful test of the SMA 200 and a ‘higher low’ to June, which had been our ultimate bull/bear market parameter. The Dow has already made a new high while big tech is suffering a case of Trumpitis AKA ‘cheap assembly jobs repatriation’ fears. So it will be important to watch the big Nasdaq 100 companies along with the Semiconductors to see if their negative divergences persist. SPX meanwhile, is dwelling at resistance right at the would-be ‘bull doorway’ around 2160 (Dow’s Trump Tower is by the way, well into all-time highs).

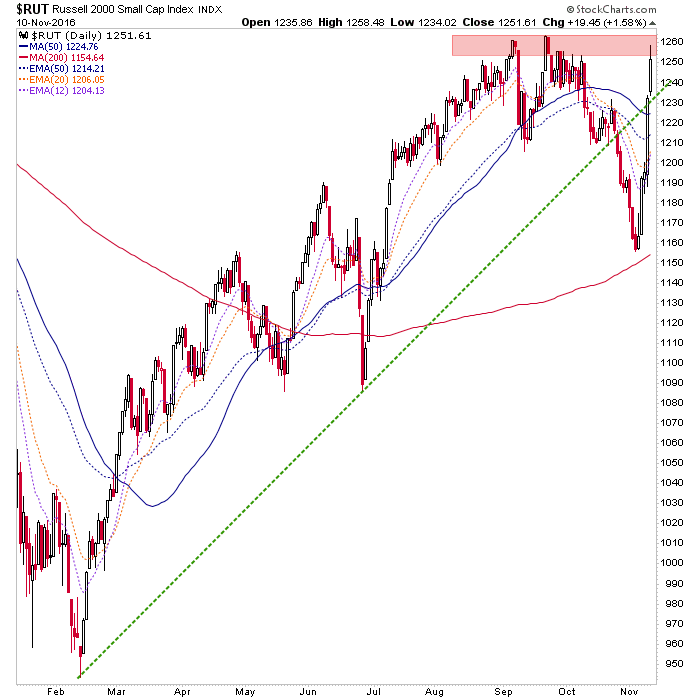

In the spirit of the ‘little guy’ who voted for Trump we have the ‘little guy’ index of stocks, the Russell 2000 Small Caps index, sporting a major Trump Tower of his own.

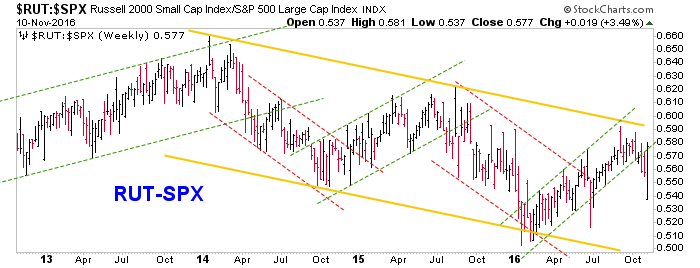

Looking at a couple leadership charts, we see that RUT-SPX has snapped back to the 2016 uptrend channel. I don’t buy it. The post-2013 downtrend channel still controls this indicator. Small Caps are not the place to be relative to Large Caps, at least not yet. What they are is higher risk.

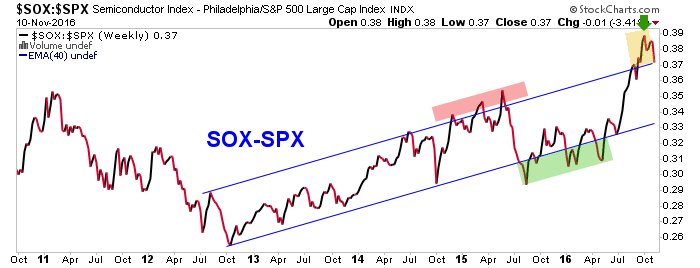

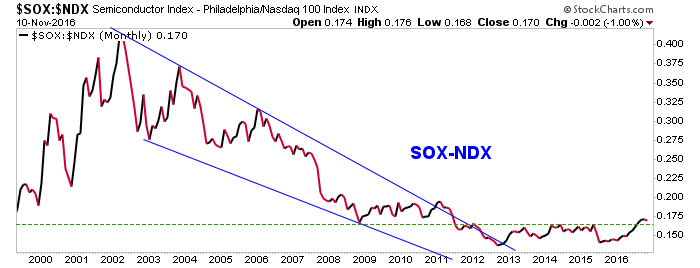

Back to our leader of leaders (post-2012), the Semiconductors are taking a much needed break in leadership, which is still very positive, overall. As we have been noting in NFTRH, these were over done with ‘come lately’ momentum and needed to cool down.

Semis have by the way, made a big picture breakout vs. big tech and this will be an interesting relationship to keep an eye on. But not all Semis are created equal. There is Semi equipment, materials and specialty/mobile vs. PC oriented chips within the general constellation of items.

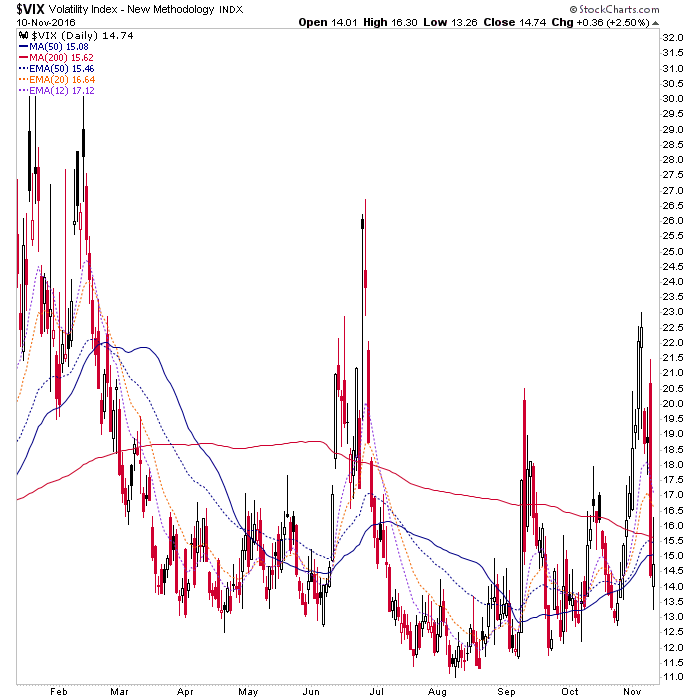

Back to the broad US market view, while we can only cover its technicals, sentiment, indicators and macro fundamentlas in detail in the weekend report, the VIX has been sent back to a troubling position if you are a complacent bull sporting a mental Trump Tower of your own. As noted in an NFTRH update yesterday…

“One concern I do have in that regard is that the VIX got destroyed on the euphoria, all the way back to trend. It begs caution on the whole shootin’ match in that people went from manic fear to comatose comfort in a nanosecond.”

Happy Veteran’s Day to all who have served the country. Here is hoping that as part of what is sure to be a Trump focus on building up an already bloated weapons arsenal, Veterans Affairs get some of the pie as well. Juxtapose the massive spending on killing machines with the greatly lacking spending on the needs of veterans and hope that Trump towers above his predecessors in this regard. I won’t hold my breath.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.