Financial Markets were caught flat-footed. Will there be a recovery?

Stock-Markets / Financial Crisis 2016 Nov 09, 2016 - 04:33 PM GMT The markets woke up this morning to President-elect Trump.

The markets woke up this morning to President-elect Trump.

ZeroHedge reports, “As it dawned on markets that they had been caught flatfooted for the second time in half a year, first with Brexit and then with the historic election of Donald Trump which nobody except a few fringe websites had anticipated, their reaction was identical: a slow selloff at first, followed by a furious dump, which led to a limit down halt in NASDAQ and Emini future trading. However, it was not meant to last, and after realizing that Trump's economic plan of flooding the economy with debt, coupled with fiscal stimulus, and that his policies would likely be much more moderate than his initial framing, U.S. stock-index futures trimmed about two-third of their declines as investors reassessed Trump stunning victory.”

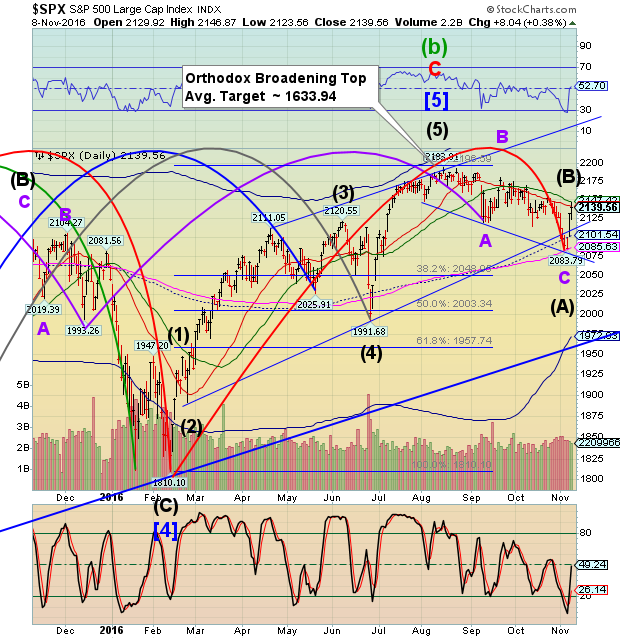

Despite the wild round trip of 100 points, the SPX Premarket has recovered enough to open above the mid-Cycle support as I write.

WIX futures appear capable of opening at or above its Cycle Top support/resistance at 20.45. It will bear watching after the open to see whether it resumes its rally or not.

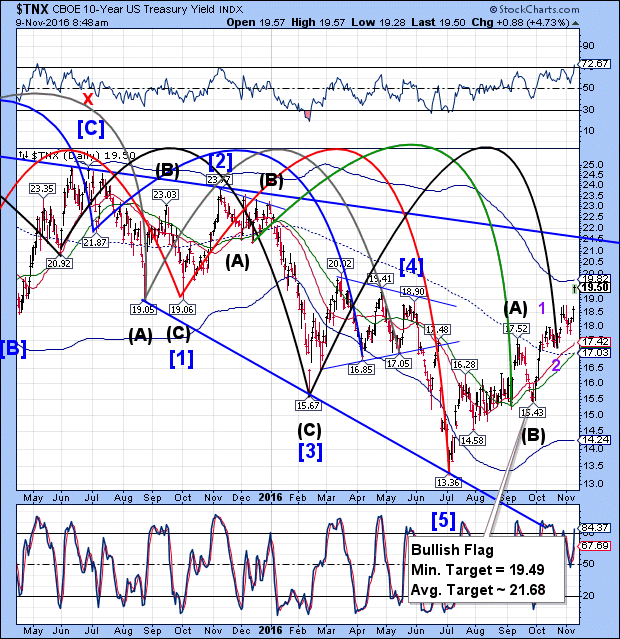

TNX appears to be in a third Wave rally that may challenge its daily Cycle Top, at the very least.

USB declined to 158.42, breaking it Cycle Bottom support at 158.81, which I will discuss tonight.

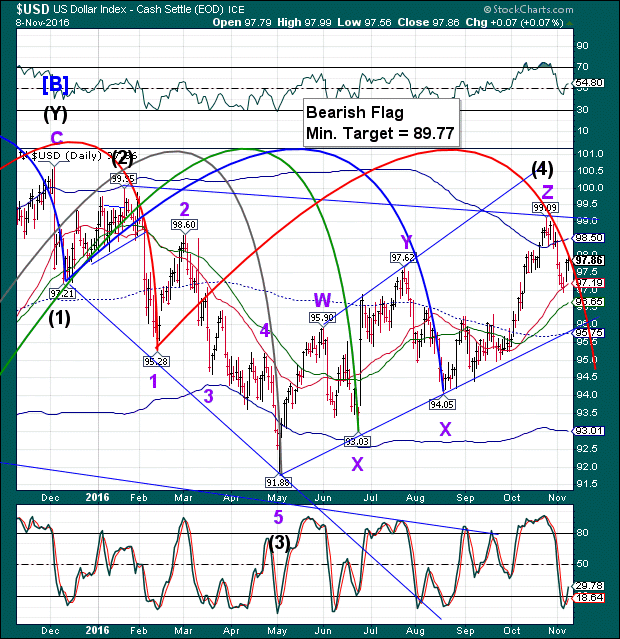

USD challenged its mid-Cycle support and ascending trendline at 95.75 in the overnight session. It appears to be challenging it 50-day Moving Average at 96.65.

That implies probable lower levels of liquidity to fuel the markets’ rally.

To sum it up, the markets need some time to settle and find their true direction after this event.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.