Gold Surges 5% After America Votes Trump President

Commodities / Gold and Silver 2016 Nov 09, 2016 - 02:12 PM GMTBy: GoldCore

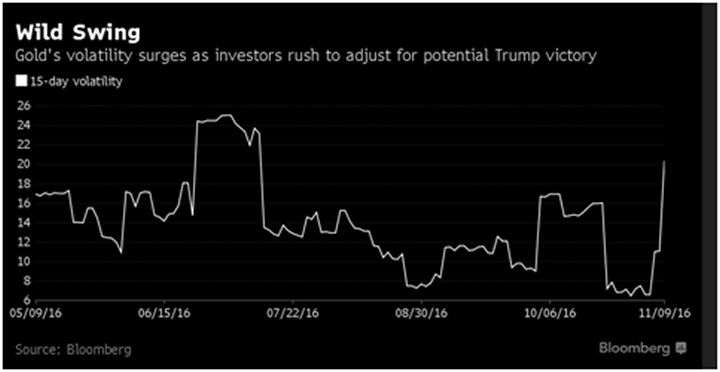

Gold surged over 5% – from $1,270/oz to $1,335/oz prior to profit taking

Gold surged over 5% – from $1,270/oz to $1,335/oz prior to profit taking- Gold jumped to its highest level in six weeks on early reports that Trump had won the race to the White House; Largest gains since Brexit shock

- For the next few days, we can expect to follow the “Brexit playbook”

- “We are looking at very real prospects that the Fed would defer that rate hike into 2017…”

Gold has surged more than 3% to over $1,300/oz today after the shock election of Donald J. Trump as the next President of the United States of America. At one stage gold was 5% higher having risen from $1,270/oz to $1,335/oz as the dollar and stocks globally saw sharp falls.

The world isn’t sure what to make of it, other than concluding that perhaps Brexit wasn’t a mistake at all. Instead, it was a sign of the deep seated resentment and anger with the political and economic status quo foisted on the working and middle classes by western governments in thrall to corporation and banks.

Brexit and what will no doubt be seen as Brexit II, have both sent shockwaves through the US economy this year. Back in January had you asked for odds of both the UK leaving the EU, or the presenter of the Apprentice winning the US election, you probably would have been laughed out of the shop.

But that attitude has caused much turmoil. We are not seeing as big a shock in the markets as we saw in Brexit, however there is a flight to safe havens. Early this morning investors were piling into gold, bitcoin, Japanese yen and government bonds as yet again investors, bookmakers and the media were wrong-footed and completely wrong with their definitive predictions of a Clinton win.

The gold price jumped to its highest level in six weeks on early reports that Trump had won the race to the White House. It marks gold’s biggest daily gain (so far today) since Brexit when the price rose as much as 8% and closed on June 24, up 4.8%on the day.

At present the jump in gold lags that seen over Brexit, but the Trump victory is likely the beginning of uncertainty and panic setting in across global markets given the massive political and economic uncertainty that has been created.

The surprise of Brexit and Trump means we have gone from pricing in the known to pricing in the unknown.

Brexit II and the politics of anger?

“For the next few days, we can expect to follow the “Brexit playbook”.A big sell-off of US assets is a given, as is a subsequent bounce. Emerging markets will be a particular victim due to their dependence on trade. They appeared to be at the beginning of a renaissance; that is now in question. Markets tend to overshoot, and this will produce some buying opportunities and bargains.” wrote John Authers in the FT.

But will the markets begin to recover as they did with Brexit, in the aftermath of the result and the calm before it becomes a reality in January? Therefore, what is happening today or for the rest of the month, does it matter? Surely the zeitgeist, the forces that brought in Brexit and Trump will continue to make an impact.

“With so many years of low and non-inclusive growth, we are witnessing the politics of anger at play, a phenomenon that polls have underestimated on both sides of the Atlantic. Both the establishment and expert opinion are being challenged in a big way,” Mohamed El-Erian, chief economic adviser to Allianz, told the FT.

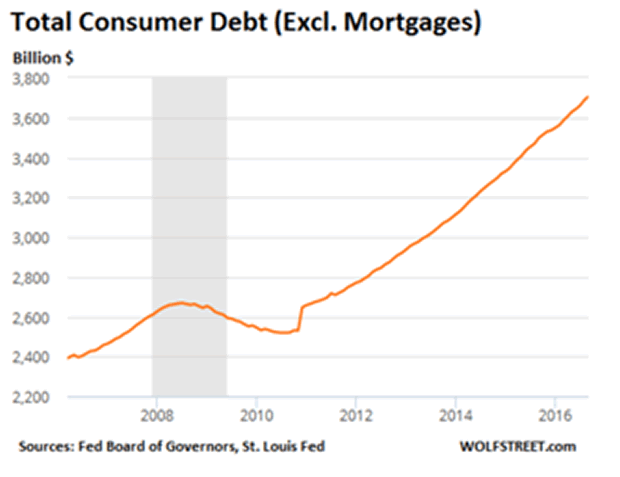

With this in mind we should be considering the medium-long term future, rather than the fall-out from a Trump win today, and Brexit win this year. The reality of the US economy is unlikely to improve – in has been in this poor state for many years.

When the financial crisis emerged in 2008 it was expected that a political crisis would soon follow. In many ways we have been lucky that it has taken this long to appear.

Central bankers, financial institutions and the ‘one percent’ have been blamed for eight years, now the electorate has had enough and are looking for a shake-up in the status quo that has for so long failed to serve them. Feeling disenfranchised from government is “now a permanent statement of affairs in the United states” Robert Shapiro told Bloomberg this morning.

Very few saw it coming.

“Brexit showed that polls are imperfect, and we are in an era of populism which is playing havoc with normal assumptions,” said Matt Peron, head of equities at Northern Trust, told the FT.

This also shows that Brexit was not a mistake as so many Remainers want the world to believe. Now the US, along with the UK has voted against aspects of globalisation. Economic insecurity felt by the individuals who were voting was a common thread across both the US and those in the UK during Brexit.

Soon they may well not be the only two in the Western world to do so.

We have key events coming up in Italy, France, the Netherlands and Germany. This may be good for the US markets and the dollar in the short-term, as markets may well end up quickly refocusing their attention on the Eurozone and the challenges facing the euro.

How will gold react now?

As we have written about extensively in the last few days, gold will be the one of the few winners in this election. In the immediate future, this is still all about uncertainties, no one knows how Trump will play the President role. We have a President-elect who has never served in public-office before, this adds a huge amount to the amount of unease that is not only being felt in the United States but across America.

John Authers wrote this morning, “The certainties that had reassured the investors and financiers since the era of Thatcher and Reagan and that are now in question include a global commitment to free trade, independent central banks, a financialised version of capitalism, and relatively limited social safety nets.”

This morning we saw gold’s rally pull back slightly during Trump’s victory speech, one that showed a man who is in fact able to be calm, measured and suggest an inclusive government that works for all.

“Gold’s near-term moves will be determined by how much the president-elect tones down his strident rhetoric [if at all] and therefore whether this reassures or spooks the markets,” Jon Butler, precious metals strategist at Mitsubishi stated.

However, he made a series of promises to a volatile electorate, it is how these will play out, against a backdrop of geopolitical mayhem, that will really impact the gold price.

“Although the Trump campaign’s more radical political objectives would be unlikely to make it through Congress, the push-back against free trade and more protectionist agenda would represent a further drag on global growth,” ICBC/Standard Bank strategist Tom Kendall said earlier in the week.

The yield on the US 10-year government bond initially dropped this morning before recovering as is the more policy-sensitive 2 year note. A rate hike in December might be seen as a little early now, and this is hitting the US Dollar. Prior to the election result, the probability of the Fed Hike was around 80-90%, now commentators are pointing to a 50% likelihood of a rate rise.

“If the dust settles then the Fed may not find it necessary to renege on their inclination to hike rates sooner than later. But if market uncertainty doesn’t abate then we are looking at very real prospects that the Fed would defer that rate hike into 2017,” Vishnu Varathan, senior economist at Mizuho Bank, told Reuters.

A delay in raising rates, by the US Federal Reserve, will provide yet more upward momentum for the gold and silver price.

Where now for Trump?

Perhaps strangely, we turn to Paul Krugman and his analysis of what this might mean for America and the rest of the world, “Under any circumstances, putting an irresponsible, ignorant man who takes his advice from all the wrong people in charge of the nation with the world’s most important economy would be very bad news. What makes it especially bad right now, however, is the fundamentally fragile state much of the world is still in, eight years after the great financial crisis….what if something bad happens and the economy needs a boost? The Fed and its counterparts abroad basically have very little room for further rate cuts, and therefore very little ability to respond to adverse events.

“Now comes the mother of all adverse effects — and what it brings with it is a regime that will be ignorant of economic policy and hostile to any effort to make it work. Effective fiscal support for the Fed? Not a chance. In fact, you can bet that the Fed will lose its independence, and be bullied by cranks.

“So we are very probably looking at a global recession, with no end in sight. I suppose we could get lucky somehow. But on economics, as on everything else, a terrible thing has just happened.”

Editors Note:It is worth remembering that the likes of Krugman were alarmist and wrong in stating that Brexit would mean a collapse of the UK economy. His warnings now regarding Trump are exaggerated, highly partisan and based on ideology rather than facts.

The money printing, faux QE “recovery” that Krugman has lauded is on its last legs and Krugman and his ilk know it. Indeed, it has merely, as we all know, “kicked the can down the road” and created an even more unbalanced, vulnerable debt laden world.

Gold in US Dollars (1 Week)

The currency debasing, monetary policies of recent years have failed the working and middle classes of the world and are set to fail. Krugman and the central bank loving uber-Keynesian, interventionist economists look set to try and blame Trump for the coming U.S. recession and indeed global recession or depression.

Macroeconomic, systemic, geopolitical and monetary risks remain heightened. One such risk is the fact that the U.S. is in effect insolvent with a near $20 trillion nominal national debt and over $100 trillion in unfunded liabilities.

These risks were largely ignored by the Presidential candidates and the media in the superficial ‘Punch and Judy’ election that we have all been subjected to. Blaming Trump for these risks is simplistic, silly and plain dangerous.

Gold will protect investors in the coming months and years from these risks and remains an important diversification for those seeking to protect and grow wealth in the next four years.

Gold Prices (LBMA AM)

09 Nov: USD 1,304.55, GBP 1,050.42 & EUR 1,176.84 per ounce

08 Nov: USD 1,284.00, GBP 1,034.26 & EUR 1,162.02 per ounce

07 Nov: USD 1,286.80, GBP 1,036.13 & EUR 1,162.50 per ounce

04 Nov: USD 1,301.70, GBP 1,042.79 & EUR 1,172.57 per ounce

03 Nov: USD 1,293.00, GBP 1,040.61 & EUR 1,165.90 per ounce

02 Nov: USD 1,295.85, GBP 1,056.51 & EUR 1,169.76 per ounce

01 Nov: USD 1,284.40, GBP 1,048.58 & EUR 1,167.52 per ounce

Silver Prices (LBMA)

09 Nov: USD 18.81, GBP 15.12 & EUR 16.96 per ounce

08 Nov: USD 18.26, GBP 14.72 & EUR 16.54 per ounce

07 Nov: USD 18.22, GBP 14.67 & EUR 16.47 per ounce

04 Nov: USD 18.30, GBP 14.65 & EUR 16.48 per ounce

03 Nov: USD 18.07, GBP 14.50 & EUR 16.32 per ounce

02 Nov: USD 18.54, GBP 15.05 & EUR 16.70 per ounce

01 Nov: USD 18.24, GBP 14.91 & EUR 16.54 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.