US Election Whatever the Outcome, all Stock Market Paths Appear to Lead Down

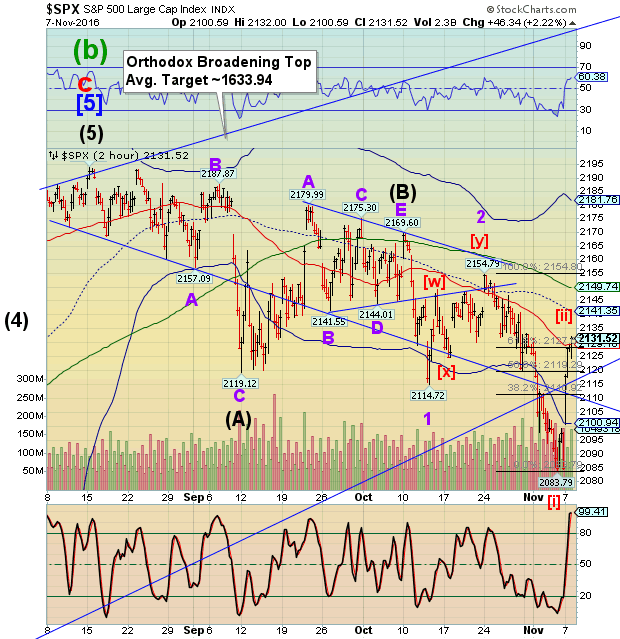

Stock-Markets / Stock Markets 2016 Nov 08, 2016 - 04:00 PM GMT The SPX Premarket is down this morning, having broken beneath Short-term support at 2129.10. Since it is election day, there is no telling what events or outcomes will affect the markets. There are a couple of alternate paths that SPX may take, but they all lead down at this time.

The SPX Premarket is down this morning, having broken beneath Short-term support at 2129.10. Since it is election day, there is no telling what events or outcomes will affect the markets. There are a couple of alternate paths that SPX may take, but they all lead down at this time.

ZeroHedge observes, “The day has finally arrived and as of minutes ago voters in eastern states have begun voting for the next US president. Polls are open in eight states, including battlegrounds Virginia and New Hampshire, as well as in New York, where Clinton votes at a public school in Chappaqua, Trump at a public school in Manhattan.”

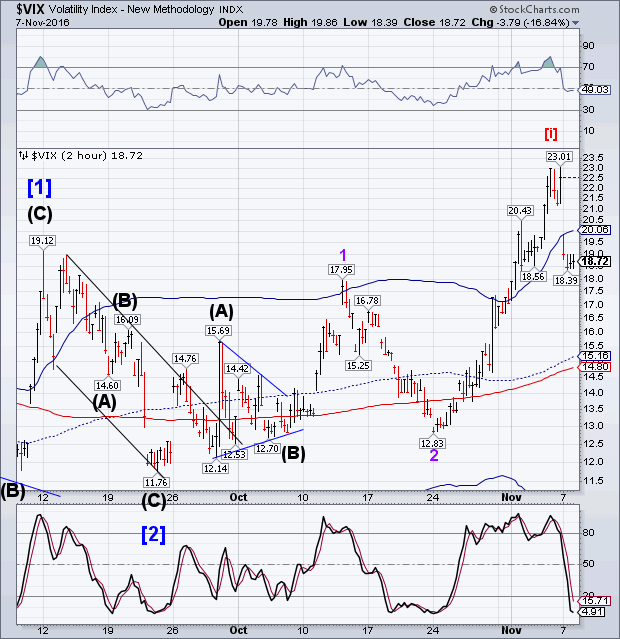

VIX had a surprisingly shallow retracement, as hedgers appear reluctant to give up their downside protection.

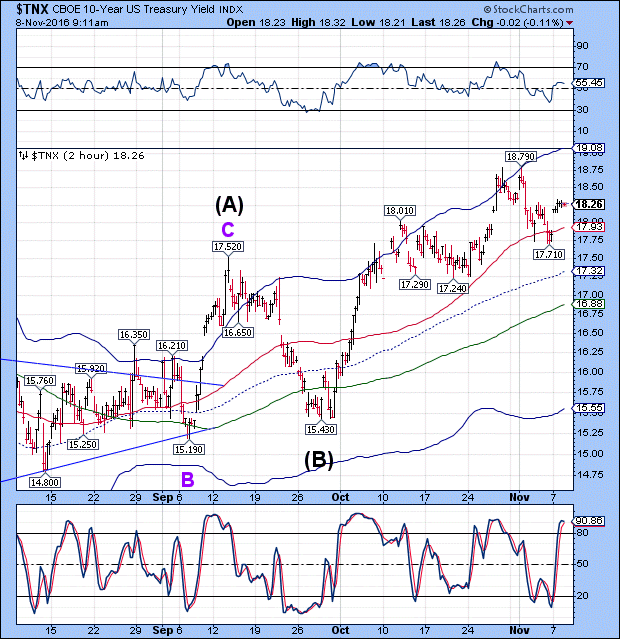

TNX appears to be calm, but its overbought condition leaves me a bit wary of what’s next. TNX is overdue for a Master Cycle low in the next week or two. The Wave structure may become clearer as the pattern develops.

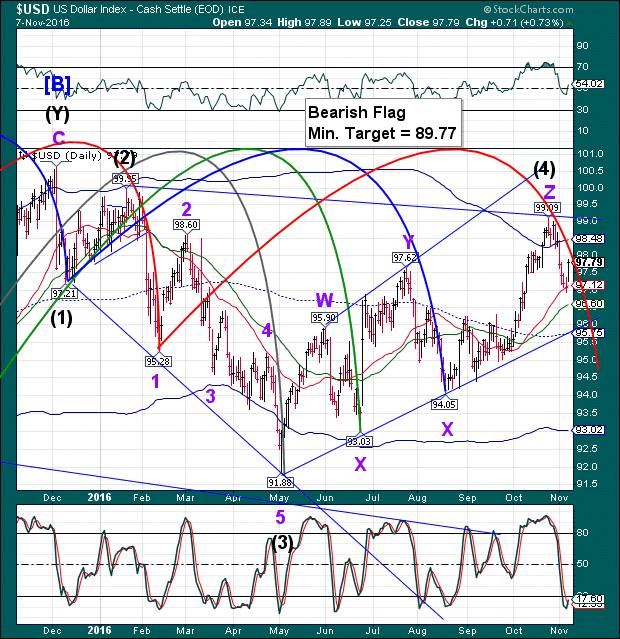

USD is also due for a Master Cycle low in the next week, possibly two. In this cast, it appears ready for a Minute Wave [c] that may decline at least to the mid-Cycle support and trendline at 95.75 within the next week.

ZeroHedge reports, “While overnight vol in USDJPY exploded higher as it appears more than one person is drastically hedging ahead of tonight's decision, the most-sensitive of financial instruments to a possible Trump victory is rallying back to its highest since the final debate.

Carry traders are aggressively hedging a possible Trump win - buying overnight protection in USDJPY...”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.