Here's Why Investors Should Ignore Corporate Earnings Season

Companies / Corporate Earnings Nov 08, 2016 - 04:25 AM GMTBy: EWI

Shattering the myth about earnings and the stock market

Shattering the myth about earnings and the stock market

[Editor's Note: The text version of the story is below.]

It's earnings season, and most investors are paying close attention (Reuters, Oct. 9):

"If there's something that can help the outlook for earnings, then it's going to be good news for the stock market. It is the most important variable," said [a] chief investment officer.

The belief that earnings drive stock prices permeates Wall Street. That sentiment was also expressed in an Oct. 21 CNBC article:

Strategists are watching whether earnings growth will sustain further gains in the market.

But do corporate earnings really determine the stock market's trend? In a word, the answer is "no." Let's look at just one sample of the evidence from the February 2010 Elliott Wave Theorist:

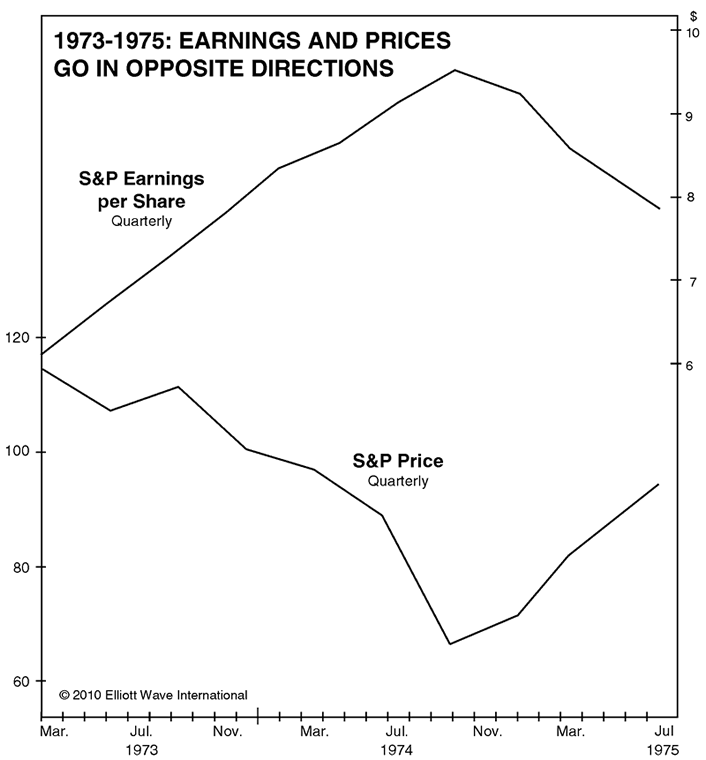

The chart shows that in 1973-1974, earnings per share for S&P 500 companies soared for six quarters in a row, during which time the S&P suffered its largest decline since 1937-1942. This is not a small departure from the expected relationship; it is a history-making departure. Earnings soared, and stocks had their largest collapse for the entire period from 1938 through 2007, a 70-year span! Moreover, the S&P bottomed in early October 1974, and earnings per share then turned down for twelve straight months, just as the S&P turned up!

Many market commentators either ignore or are unaware of the evidence which challenges the bedrock theory that earnings drive stock prices.

Hence, investors feel safe when corporate earnings are good. They are wary when earnings are bad. These sentiments make sense in an exogenous-cause world. But, as the Theorist has noted:

Financial market prices are not set in an exogenous-cause world. You don't buy stocks on record earnings; you buy them on bad earnings.

The idea of buying stocks on awful earnings might seem radical, but think back to February-March 2009, when S&P companies were reporting losses, not gains. Even though most of the investment world was gripped with fear, a Special Investment Issue of the Theorist published on Feb. 23, 2009 and said:

I recommend covering our short position at today's close. ... Our main job is to keep the money we have. If we exit now, we will do that.

Just 10 trading days later on March 9, 2009, the Dow Industrials bottomed and has since advanced about 177%.

That market call was based on the Wave Principle, not an exogenous factor like corporate earnings. Remember, the Dow Industrials started its years-long advance when corporations were reporting losses.

Unleash the power of the Wave PrincipleMuch like a great sports play; to appreciate a great market forecast, you have to see it. In fact, we'd like to show you four. Our examples do indeed show what can happen when Elliott analysis meets opportunity. But we're not asking you to attend a class in 'good calls.' In each of these four markets, the unfolding trends have (once again) reached critical junctures. You really, really want to see what we see, right now. Get your report -- How to Find Real Opportunities in the Markets You Trade -- FREE |

This article was syndicated by Elliott Wave International and was originally published under the headline Here's Why Investors Should Ignore Earnings Season. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.