Brexit Makes This US Presidential Election So Uncertain

ElectionOracle / US Presidential Election 2016 Nov 07, 2016 - 06:38 PM GMTBy: GoldCore

Ignore election theory, this one’s too uncertain

Ignore election theory, this one’s too uncertain

- This year’s election breaks the mould in a number of important ways

- Markets seem to be agnostic as to which party is in control of the White House.

- However, likely that uncertainty will drive markets for time-being

- Polls might be victim to ‘the Bradley effect’

- Hillary is seen as lower-risk and less volatile than the Republican.

For most of us this election is like nothing we have ever seen. Frank Holmes agrees , arguing that we need to, “Forget Everything You Know About Presidential Elections”

“this year’s election breaks the mold in a number of important ways, it raises the question of how closely it will hew to past elections, at least where market reaction is concerned.”

Just with the candidates alone we are dealing with two unknowns:

“If [Clinton] pulls it off, she’ll become not only the first woman and first first lady to rise to the country’s highest office but also the first Democrat to succeed another two-term Democrat since Martin Van Buren succeeded Andrew Jackson in 1837.”

“…Meanwhile, if Donald Trump manages an upset, he will become the oldest person ever to take the oath of office and the first to transition directly from the business world to the presidency without any past experience as a high-ranking government official (like William Howard Taft and Herbert Hoover) or military officer (like Zachary Taylor, Ulysses S. Grant and Dwight D. Eisenhower). To Trump’s supporters and many others, of course, this is one of his main assets.”

Trump or Clinton winning the polls?

If Brexit has taught us anything it is that polls aren’t the be all and end all, and listening to them can lead to unexpected results. For Frank Holmes, polls ‘can often be misleading’ and he points to Brexit polls that suggested as much. He also refers to the ‘Bradley effect’:

“California polls gave L.A. mayor Tom Bradley a wide lead in the days leading up to the 1982 gubernatorial election, and yet he was roundly defeated. Known today as the “Bradley effect,” the accepted theory is that voters told pollsters they supported Bradley, an African-American, so as not to appear racist. But in the privacy of the voting booth, those same voters pulled the lever for his opponent.”

Holmes argues that we may now be seeing a ‘reverse Bradley effect’ where those polled do not want to admit their support for Donal Trump, “the least-liked person ever to run in U.S. history, followed closely by Hillary.”

However both Reuters and Bloomberg have disputed this in recent days. On Bloomberg this morning it was reported that as the majority of polls are online, those polled are unlikely to be embarrassed to admit their political leaning to a computer or their iPhone.

Polling is also proving an area of some debate when it comes to the swing voters, are there as many as are believed to be? Not in the medium to long-term, no. Support consistently remains the same. Reuters looked at a cross-section of polls and concluded that, “momentary swings disappear when we instead look at monthly averages. The larger slices of time show that the rapid swings in voters’ views always return to a rough equilibrium. In fact, there has not been any real change in Trump’s and Clinton’s relative position over the past three months.”

For those of us watching the polls and believing that this is all about swing voters, Ipsos has a word of warning for us, “Observers need to distinguish between whether voters are switching candidates or simply becoming more excited about their candidate of choice. For the candidates themselves, it means the sprint to the finish is about keeping their supporters fired up while demoralizing the other side’s base.”

Two ‘unknown’ candidates

Frank Holmes points to the rare situation we find ourselves, where neither candidate is seeking re-election, and how this creates uncertainty in the markets.

“…no incumbent’s name appears on the ballot. This is rarer than you might initially think. Since 1947, when the number of terms was limited to two, only five people have been elected twice and completed two full terms.”

This situation can make the electorate and markets even more nervous than were there an incumbent on the ticket.

“…markets are faced with the reality that someone new will be occupying the Oval Office soon, complete with a new cabinet, new agenda, new governing style and new policies…This uncertainty has historically given investors the jitters—even when they’re in favor of the incoming president.”

As Holmes argues, no matter how big a Trump supporter you are, you have to admit that Hillary is seen as lower-risk and less volatile than the Republican. This is a common theory.

For Simon Johnson, former Chief Economist at the IMF, “Investors in the stock market currently regard a Trump presidency as a relatively low-probability development. But, while the precise consequences of bad policies are always hard to predict, if investors are wrong and Trump wins, we should expect a big markdown in expected future earnings for a wide range of stocks – and a likely crash in the broader market.”

This echoes much of what Jim Rickards highlighted in an interview we brought to you a few weeks ago – you’re better to bet on a Trump win as the market’s are priced to see the opposite.

“it’s the policies that matter, not necessarily the party.”

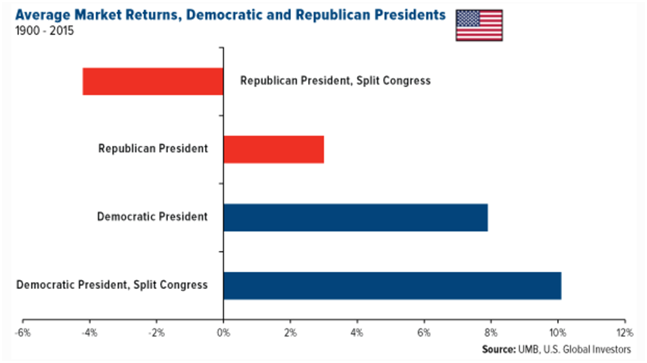

Whilst voters might struggle to believe this, Holmes argues that data-ming shows that,“there is evidence that stocks have performed slightly better when a Democrat is president, especially when Congress is split, as it was during most of Barack Obama’s administration.”

Ultimately though, “markets seem to be agnostic as to which party is in control of the White House. So many other factors exert just as much, if not more, influence over market performance, including monetary policy, inflation/deflation and whether the country is at war or peace.”

Russell Jones, a partner at Llewellyn Consulting, told Al Jazeera this week that no matter who wins, history shows that “the populists very rarely get what they say they are going to deliver when they actually get into power” as the markets have a way of exerting their influence and discipline on politicians.

Scott Wren, of Wells Fargo, agreed telling MarketWatch, “We believe there is only the slimmest of possibilities that the new president will be able to change the trajectory of the economy over the first 12 or 18 months that he or she is in office. The market knows this.”

Uncertainty looms no matter who wins

A recent World Economic Outlook paper from the IMF paper succinctly summarise the current zeitgeist that has driven much of these shock campaigns, “The U.K. vote to leave the European Union and the ongoing U.S. presidential election campaign have brought to the fore issues related to labor mobility and migration, global trade integration, and cross-border regulation. Institutional arrangements long in place are now potentially up for renegotiation.”

Regardless of who wins, these issues will not be put to bed and will be near impossible for the winning candidate to manage without protest, disruption and significant financial impact on the economy.

As with Brexit, the level of angst following the US election is unlikely to dissipate in the immediate aftermath, if at all. No matter if the polls are right or wrong, or who brings in the most disruptive policies regarding fiscal, monetary, trade etc. there are far greater uncertainties for both American citizens and on the world stage than there were if this election had taken place 8, 12, 16 years ago.

As we explained, recently, the heightened uncertainty and possible Trump win, “is an excellent opportunity for investors, particularly those who have an allocation to physical gold” we later explained the significant upside for the precious metal, and how gold may well be the only winner in this election.

Gold Prices (LBMA AM)

07 Nov: USD 1,286.80, GBP 1,036.13 & EUR 1,162.50 per ounce

04 Nov: USD 1,301.70, GBP 1,042.79 & EUR 1,172.57 per ounce

03 Nov: USD 1,293.00, GBP 1,040.61 & EUR 1,165.90 per ounce

02 Nov: USD 1,295.85, GBP 1,056.51 & EUR 1,169.76 per ounce

01 Nov: USD 1,284.40, GBP 1,048.58 & EUR 1,167.52 per ounce

31 Oct: USD 1,274.20, GBP 1,046.25 & EUR 1,163.22 per ounce

28 Oct: USD 1,265.90, GBP 1,042.47 & EUR 1,160.96 per ounce

Silver Prices (LBMA)

07 Nov: USD 18.22, GBP 14.67 & EUR 16.47 per ounce

04 Nov: USD 18.30, GBP 14.65 & EUR 16.48 per ounce

03 Nov: USD 18.07, GBP 14.50 & EUR 16.32 per ounce

02 Nov: USD 18.54, GBP 15.05 & EUR 16.70 per ounce

01 Nov: USD 18.24, GBP 14.91 & EUR 16.54 per ounce

31 Oct: USD 17.76, GBP 14.59 & EUR 16.22 per ounce

28 Oct: USD 17.61, GBP 14.51 & EUR 16.13 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.