Markets Not Much Action but Don’t Get Careless

Stock-Markets / Financial Markets 2016 Nov 06, 2016 - 06:43 AM GMTBy: Dan_Norcini

The payrolls report came in pretty much as expected and thus seems to be a non-event for the most part.

The payrolls report came in pretty much as expected and thus seems to be a non-event for the most part.

The Dollar is slightly weaker, bonds are higher, oil is lower and gold is a tad higher. Mining shares are showing weakness today.

I honestly do not think we are going to get much in the way of any CONSISTENT direction in these major markets ( with the exception of crude oil) until after the election results become clear.

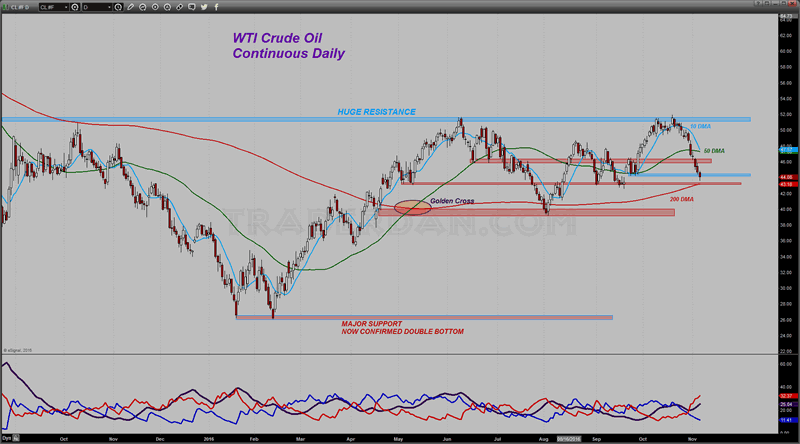

Oil is at a 6-week low with the Baker Hughes rig count up 12 this week to 569. Most of the growth is in the Permian basin.

Oil has been losing one support level after another. Falling through the 50-day moving average was a big deal. After that it lost support near $46, then near $44 and now it is struggling to stay above that latter level. The 200-day moving average is now a real possibility for a test as it is only about a dollar lower than where this market is currently trading.

If you are short, keep lowering your upside stop.

Oil has not been below the 200-day moving average since April with the exception of only two brief days in early August after which it rebounded sharply. If it falls below that key level again, and cannot bounce right back up past it, there is going to be more pain in the oil patch. It does make you wonder about this rising rig count and whether or not what many feared was going to happen indeed has happened, namely, producers pounced on the opportunity to take some rigs out of mothballs and fire them up way too soon.

My concern is a Hillary Clinton victory is going to do NOTHING to help the oil patch especially with her pipe dream of alternative energy sources and her disdain of fossil fuels.

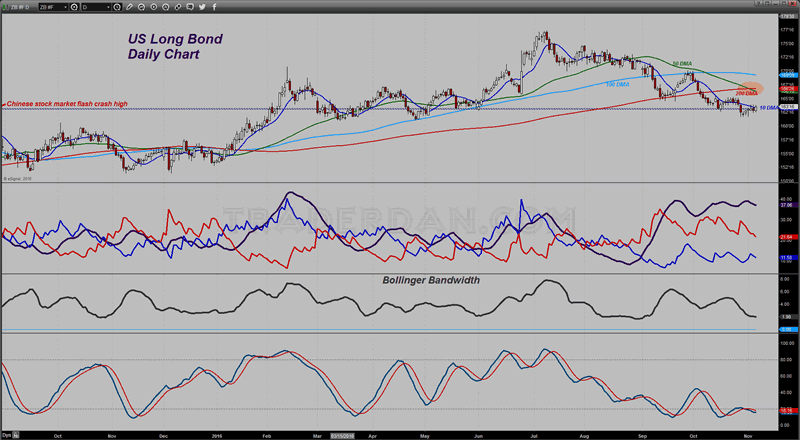

This drop in oil could be partially responsible for the rise in the bond market. Some of the bond move higher is due to safe haven concerns ahead of a Trump victory due to the unpredictable nature of some of his proposed policies on trade; however, with energy prices dropping sharply ( oil and natural gas and the oil products) and with food prices flat at the wholesale level, inflation pressures are going to have to come from wages. Today’s payrolls report did not seem to contain enough of a push in that department to spook bond traders.

Bonds are hugging the old high from the 2015 summer Chinese stock market crash. The 10-day moving average seems to be acting as a sort of magnet for the short term movements.

It is worth nothing that the 50-day just completed a downside crossover of the 200-day moving average forming the so-called dreaded “Death Cross”. That is a long term chart signal which puts the market in a long term bearish posture. For the time being traders are shrugging this off as there appears to be a lack of aggressive selling ahead of the election. We might very well have a big move in the bonds come Tuesday night or Wednesday morning.

For now, I am doing nothing in the bonds either. There are simply too many variables and unknowns for my taste at this time.

I remain long term bearish bonds but the short term moves can really hurt you in this market as they can produce “rip your face off” rallies in this environment of such uncertainty and confusion. Be careful if you are holding a large position in either the futures or in the bond ETF’s out there. Do not get careless.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.