Silver Price Is Looking Really Bullish In Dollars, Euros and Rands

Commodities / Gold and Silver 2016 Nov 02, 2016 - 01:02 PM GMTBy: Hubert_Moolman

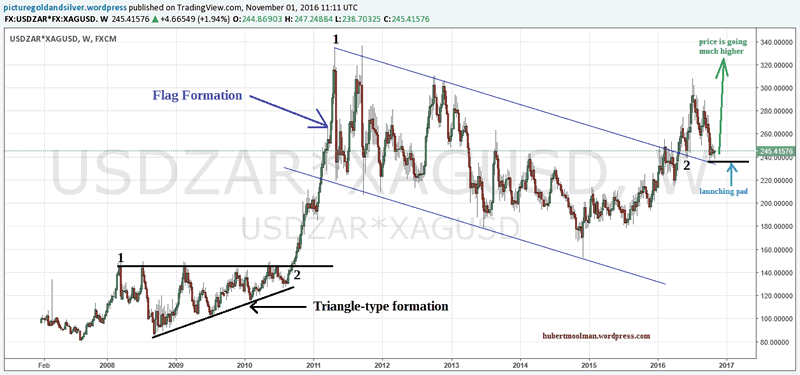

Silver in South African Rand

Silver in South African Rand

The South African rand is often a leading indicator for where silver (in dollars) is going, as previously explained. Furthermore, the chart of the silver price in rands can often provide very clear signals or patterns of what might happen to price.

Currently, the silver price in rands provides the clearest signal (in my opinion) that silver is going to go very high in price. Below is a silver chart in South African rands:

The clear signal comes in the form of a flag-type formation. The price has already broken out of the line at the top of the flag, and is currently busy with a retest of the breakout area. When the retest is successfully completed (which might be soon), then price will spike higher in a very aggressive manner.

The correction since 2011 is similar to the one since 2008, except that the formation is a flag-type one instead of a triangle-type one since 2008.

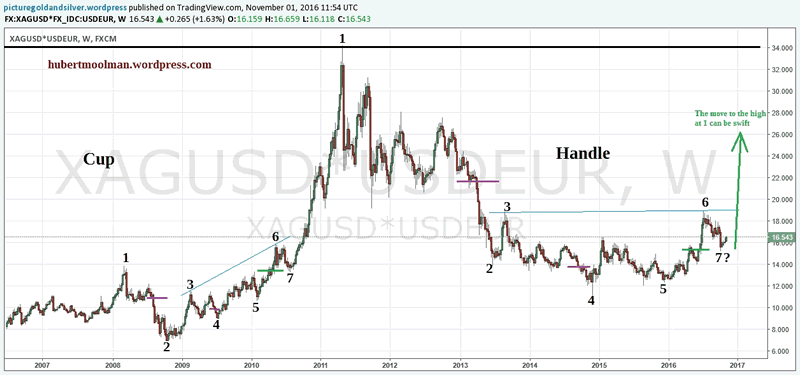

Silver in Euros

The euro silver chart also has a flag-type pattern, however it is not as clear as the one on the rand silver chart. Furthermore, the comparison of the post 2011 and post 2008 consolidation is also not so apparent.

However, if we apply some fractal analysis techniques, then the picture becomes clearer. Below, is a silver chart in Euros:

On the chart, I have marked the two consolidations (1 to 7) to show how they might be similar. Based, on the comparison, we are now at a point similar to August 2010. Once point 7 is confirmed, then the silver price could move very quickly to the high at point 1.

Due to the position of the current point 7, within the larger pattern (cup-and-handle pattern); I do not expect the move to the high at point one to take as long as the move in 2010/2011 took – it will be much quicker.

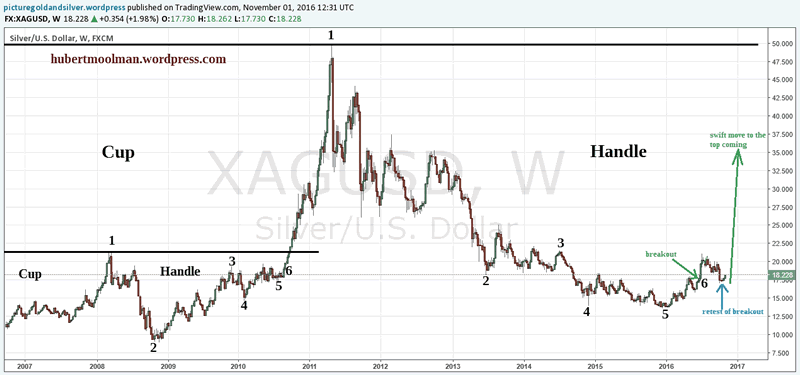

Silver in US Dollars

Currently, Silver in US dollars is probably more bullish than in any other major currency. Below, I have also applied some fractal analysis techniques on the US dollar silver chart:

On the silver chart, I have highlighted two patterns that appear similar. I have marked them 1 to 6 to show how they might compare. Both patterns start from a significant silver top. Both patterns represent the end part or handle of a cup and handle-type pattern. If the comparison is justified, then we are currently just after point 6, the point where a major breakout occurred.

We have now retested point 6, and could see a swift move to the all-time high over the coming months. The move might be extremely fast, for the same reasons given above (see Euro Silver Price).

For more on this and this kind of fractal analysis, you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2016 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.