Stock Market - Things are getting interesting...

Stock-Markets / Stock Markets 2016 Oct 31, 2016 - 09:56 PM GMT SPX did rally this morning, but only to the 61.8% retracement of Friday’s decline. That peak at 2140.72 marked 4.3 days from the previous high at 2154.79. An uninterrupted decline from that point for 8.6 days would put the low on the afternoon of November 9. It would also be 86 days from the All-time high in SPX on August 15 and 12.9 days form the NDX All-time high.

SPX did rally this morning, but only to the 61.8% retracement of Friday’s decline. That peak at 2140.72 marked 4.3 days from the previous high at 2154.79. An uninterrupted decline from that point for 8.6 days would put the low on the afternoon of November 9. It would also be 86 days from the All-time high in SPX on August 15 and 12.9 days form the NDX All-time high.

Bloomberg reports, “As the presidential election race narrows after Friday’s surprise FBI announcement, stock investors are finally showing some jitters.

Hedges against a market decline surged immediately following reports that the Federal Bureau of Investigation is reviewing files that may be related to an investigation of Hillary Clinton’s e-mail practices when she was secretary of state. The ratio of bearish versus bullish options changing hands on the Chicago Board Options Exchange jumped the most since June to match a four-month high. After falling 20 points in 40 minutes following the news on Friday, the S&P 500 Index rose less than 0.1 percent to 2,127.55 at 3:21 p.m. in New York.”

VIX has broken above its 2-hour Cycle Top, but not above its prior high, yet. There should be no need to remind you that VIX is on a confirmed buy signal.

ZeroHedge reports, “For the last couple of weeks, VIX and VIX based ETFs and ETNs (UVXY, TVIX, VXX, XIV, etc) have only been on the fringe of radar screen. They were there, but they were only mildly interesting.

What I had noticed at the time was:

1. VIX ETPs were seeing shares outstanding increase as VIX dropped (doubling down)

2. Then last week as VIX was rising I commented on the fact that funds were not seeing large decreases in shares outstanding – a signal that the ‘hedgers’ were prepared to be resilient

3. Over the past few days I have had more and more discussions about VIX again and think the one thing worth pointing out for those who like to dismiss it as a ‘pure retail’ product is that UVXY alone has about 25% of the outstanding Nov VIX Futures contracts and almost 30% of the outstanding Dec VIX Futures contracts. That is a large percentage of any market – let alone one where the product doubles down on direction each night to maintain its leverage balance. “

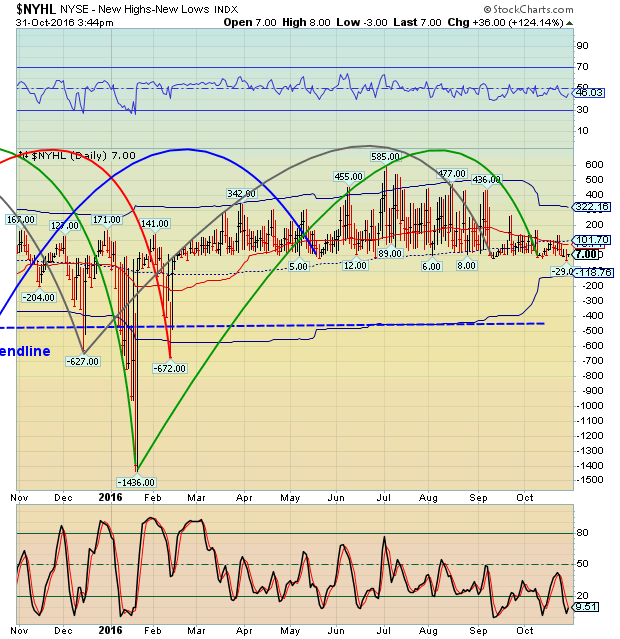

I may have failed to remind you that the NYSE Hi-Lo Index has also given its confirmed sell signal last Friday by making its deepest low since February.

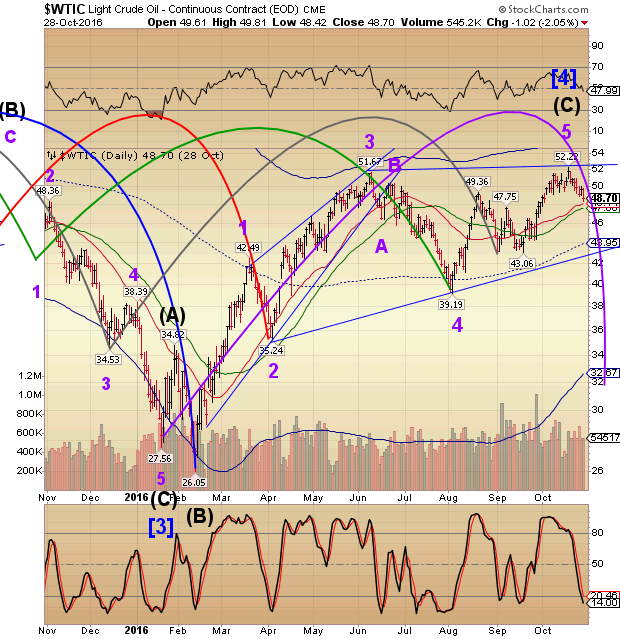

Crude oil also made a very deep new low. There is a strong correlation to the SPX, so I expect that the SPX is simply “hanging on” until the Fed news release on Wednesday. Whether it makes it that long is another thing.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.