The Market Just Gave Us Three “Tells” But Few Are Paying Attention

Stock-Markets / Stock Markets 2016 Oct 31, 2016 - 05:18 PM GMTBy: Graham_Summers

Are you worried about a market drop?

I’m not, we’ve been preparing for what’s coming for weeks.

Why do I think the markets will be dropping?

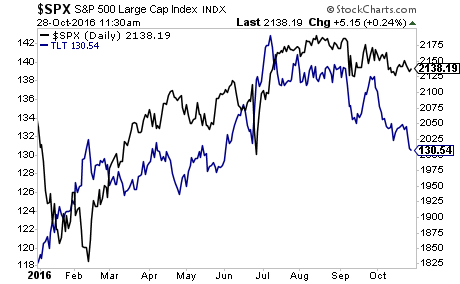

- Globally bond yields are spiking. With bond yields rising, earnings yields will follow. The only way for earnings yields to rise is for stock prices to FALL.

Long bonds lead stocks to the upside this year. They’re now leading DOWN.

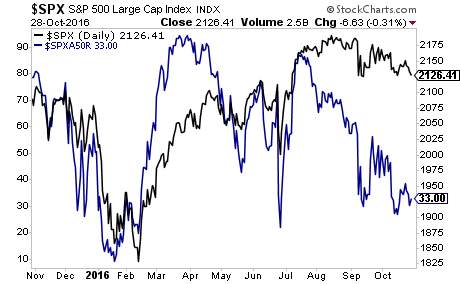

- The market is being held up by just 5-6 stocks.

The number of individual companies above their 50-day moving averages has been in a virtual free-fall since February. Literally a handful of companies remain strong. Everything else is breaking down.

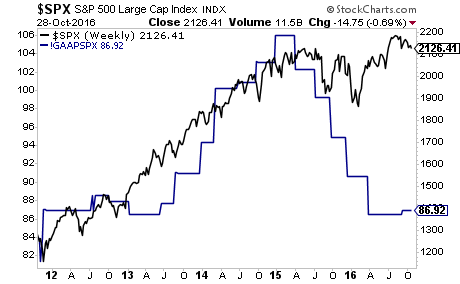

3) Earnings have already collapsed to 2012 levels.

At the end of the day, investors buy stocks for earnings. But earnings have already collapsed to levels not seen since 2012.

Stocks would need to CRASH over 25% to below 1,500 just to catch up.

Bond yields spiking? Stock internals in a free-fall? Earnings in a severe collapse?

This has the makings of a financial crisis. The whole mess is starting to feel a LOT like 2008 again.

The time to prepare is now.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Prepare and Profit From the Next Financial Crisis that outlines simple, easy to follow strategies you cThe an use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 70 left.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/Prepare2.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.