SPX May Rally, But Weakness Remains

Stock-Markets / Stock Markets 2016 Oct 31, 2016 - 02:57 PM GMT The SPX Premarket is running higher this morning and the best Wave analysis I can give is that the Wave [ii] correction may not be over. This may comport with the FOMC meeting on Tuesday and Wednesday with a statement, but no press conference on Wednesday.

The SPX Premarket is running higher this morning and the best Wave analysis I can give is that the Wave [ii] correction may not be over. This may comport with the FOMC meeting on Tuesday and Wednesday with a statement, but no press conference on Wednesday.

The trendline of the Broadening Top offered a support area for a bounce. The target for this retracement may be in the range of the 61.8% level at 2141.01 or as high as Intermediate-term resistance at 2147.58, which is also the 78.6% retracement level.

A break of the trendline and prior low at 2119.36 negates this analysis.

ZeroHedge comments, “Asian shares traded mixed, European shares slid while US equity futures posted a modest rebound after Friday's surprising political news that the FBI reopened its probe into Hillary Clinton, after OPEC failed to agree supply cuts at a meeting in Vienna.”

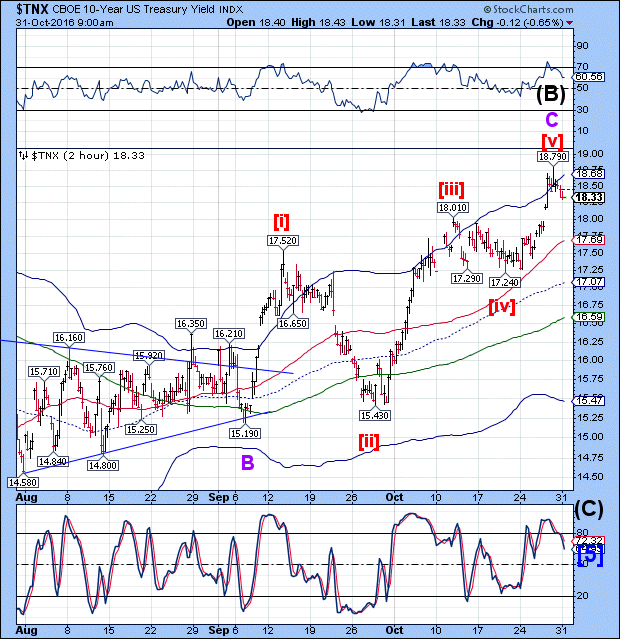

TNX is lower, but there is not enough movement to do a proper analysis. TNX may have one more probe higher today before making its decline, as Wave [v] does not appears complete.

Crude oil has broken beneath the 48.00 handle and may be an indicator of possible weakness in stocks. It has fallen beneath its Intermediate-term support at 48.14 and may threaten its 50-day Moving Average at 47.69 later today. If this gets out of hand, the SPX may break its supports also.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.