The Fed’s LITERALLY Broadcasting That a MAJOR Monetary Event Is About to Happen

Stock-Markets / Financial Markets 2016 Oct 31, 2016 - 01:44 AM GMTBy: Graham_Summers

The biggest moves… the ones that make the MOST money in the markets are the ones no one is talking about for months.

With that in mind, you NEED to know that the Fed is going to let inflation run wild in the US.

That is not a hypothesis. In the last month we’ve had THREE different Fed officials state that they WANT inflation and that the Fed will let it run BEYOND the Fed’s target 2% rate.

Scratch that… make it FOUR Fed officials…

St. Louis Federal Reserve President James Bullard said on Monday that a single U.S. interest rate rise would be all that was necessary for the time being, repeating comments he had made recently.

Source: Reuters

Folks, 99% of investors get caught up in the day-to-day moves in the market. But the Fed is LITERALLY broadcasting that it’s going to let a MAJOR monetary event happen.

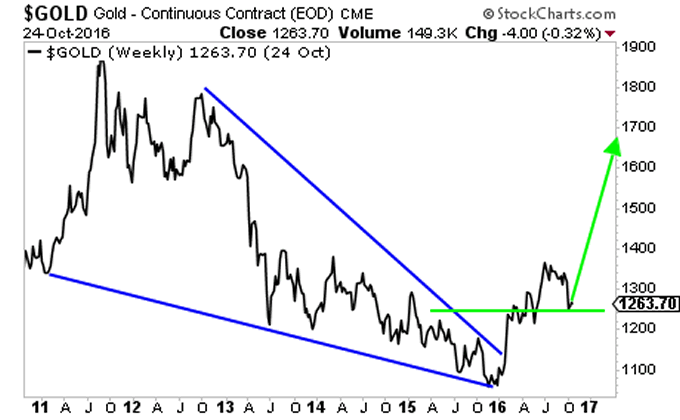

Gold’s figured it out. It just put in a base and is about to go STRATOSPHERIC.

Over 99% of investors have missed this. They continue to focus on stocks. They’re missing a once in 30 years event that has begun in the metals markets.

HUGE money will be made from this trend going forward.

To that end, in the last two weeks Private Wealth Advisory subscribers have opened SIX new inflation trades.

As I write this, ALL SIX OF THEM ARE SOARING: THEY’RE NOW UP BETWEEN 6% AND 12% EACH.

Let me be clear, this is just the beginning of this move. By the time we’re done, I expect all six of these to be TRIPLE digit winners.

Seriously at this point, if you’re not taking out a trial subscription to our Private Wealth Advisory newsletter, I don’t know what else to tell you.

First of all, 109 of our last 111 trades were WINNERS.

That is not a typo. We’ve only closed TWO losers in the last TWO YEARS.

This is a record in investing, a winning rate of 98% over a 24 month period. And we’ve done this during one of the most difficult eras in investing history.

In September alone we’ve closed WINNERS of 6%, 8%, 11%, 14% and 19%.

If you don’t believe me, you can take out a trial for 30 days for 98 cents.

If you find Private Wealth Advisoryis not what you’re looking for, simply email us and you won’t be charged another cent.

However, I have no doubt you, like our other subscribers will stay with us. Most subscribers make enough money on a single one of our trades to cover the cost of an entire YEAR’S subscription (just $199).

Indeed, less than 10% of subscribers choose NOT to stay with us. And the ones that DO cancel do so because they’re simply not active investors and prefer owning a single mutual fund.

I know you’re not that kind of investor. You’re looking for regular market crushing gains and minimal losers to grow your capital like a rocket ship.

To take out a 30 daytrial subscription to Private Wealth Advisory for just…. 98 cents.

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.