Obamacare Is Draining Our Financial Reserves

Politics / Healthcare Sector Oct 27, 2016 - 05:13 PM GMTBy: John_Mauldin

Barack Obama will stop being president on January 20. He will leave behind the signature accomplishment of his eight years in office: Obamacare. Some see it is a disaster, and others see it as a triumph. But I think everybody agrees that there needs to be changes.

Barack Obama will stop being president on January 20. He will leave behind the signature accomplishment of his eight years in office: Obamacare. Some see it is a disaster, and others see it as a triumph. But I think everybody agrees that there needs to be changes.

Yes, millions more people now have access to health insurance. That’s a very good thing—but access to health insurance is not the same as access to healthcare. And access to healthcare is not the same as access to affordable healthcare.

The recipients of Obamacare

The whole point of insurance is to spread the risk of unpredictable, expensive events. Everyone pays a little to avoid being the one who must pay a lot. It works well for things like fires and earthquakes.

Health insurance starts off flawed because everyone will get sick, given enough time. Assorted patches, like the Affordable Care Act (ACA), have papered over the problems and made the business model work for a while. Now the ACA may be reaching its expiration date.

The ACA covers only a very small portion of the population, about 20 million out of 300+ million Americans. Most people who have health coverage get it in other ways. We have Medicare for the 65+ and disabled, Medicaid for the poor, and employer-sponsored coverage for many working people.

So the fact that most people can’t afford Obamacare obscures the fact that most people don’t use or need Obamacare.

This is the core problem. Obamacare is a kludged-together catchall program designed for people who can’t get health insurance any other way. They are not a random sample of the population. And as a group, they are sicker than average. That translates into higher-than-average claims once they have insurance.

That wouldn’t matter if enough younger and healthier people were in the risk pool. But they aren’t buying into the ACA, except for those poor enough to receive tax credits that can make the program inexpensive or even free. And middle-class people can’t afford it.

Here’s who pays for Obamacare

We have offloaded a great deal of the cost onto the wrong group of people. These are less well-off individuals who don’t make all that much money. And here’s the problem: they make too much to get any of the subsidies yet have to buy their own insurance rather than getting it through a company.

Consider this example from a Health Affairsstudy:

[A] family of four living in Roanoke, Virginia with an income of $60,000 in 2016 would have a premium payment of $4,980 for the year for the second-lowest-cost silver plan. That plan has a $5,000 deductible. That means the family could spend almost one-sixth of their pre-tax income on health costs before they received any insurance payment.

In contrast, the tax for going uninsured would be about $725. Of course, an uninsured household would face the risk of paying entirely for major medical expenses out of pocket. But that risk is limited. The ACA allows individuals to purchase insurance at least once a year without paying a premium penalty—even if they have incurred very expensive medical bills and regardless of whether they had previous coverage.

This is nuts. The premiums alone are 8.3% of the family’s income. Then they have to spend another $5,000 on coinsurance before the insurance company pays anything. So for them, Obamacare is effectively a 17% income tax with no deductions. (Yes, they get a few benefits like wellness checks, vaccinations, etc. That helps, but the value of the benefits is a fraction of the premiums paid.)

Healthcare costs keep rising

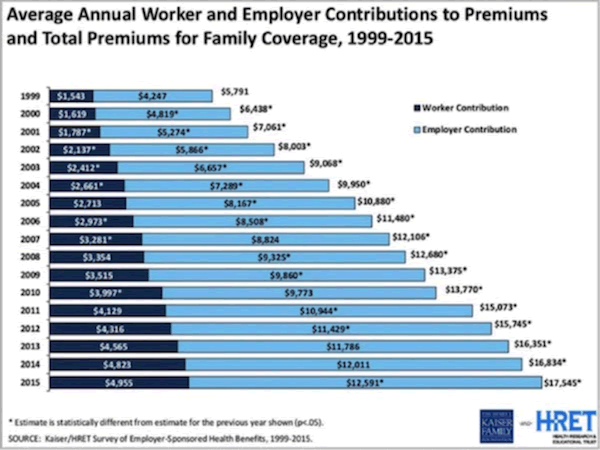

The rise in healthcare costs is not a recent phenomenon. Costs have risen dramatically since 1999 and are up roughly three times since then. This is true for both worker and employer contributions to insurance premiums.

The chart below (from the Kaiser Family Foundation via Mike Roizen) shows that the average family paid $5,791 for coverage in 1999. Using the Internet inflation calculator, you’ll see that today’s cost for that coverage would be $8,372 (if cost increases equaled inflation). That is less than half of what the average family paid in 2015, or roughly 45% of 2016’s likely final cost.

Dr. Roizen then calculated the actual cost for a worker making $40,000 a year ($19.83 an hour). He used actual medical costs and assumed 2% inflation and a 2.5% annual raise since 1999.

What he found was that the worker’s take-home income minus his medical costs and adjusted for inflation was equal to only 94% of what he made in 1999. In terms of his ability to spend money on things besides medical expenses, if the wage earner wants healthcare for their family, they are walking backwards.

Rising costs hurt the economy

Let’s take a look at some basic necessities. In 1999, gas was $1.14 a gallon; now it’s roughly a dollar higher per gallon. And using the St. Louis Federal Reserve FRED database, we find that home purchase or rental costs are roughly double what they were in 1999. If housing costs had risen only by the headline rate of the Consumer Price Index, they would now be $1039/month. They are in fact 40% higher.

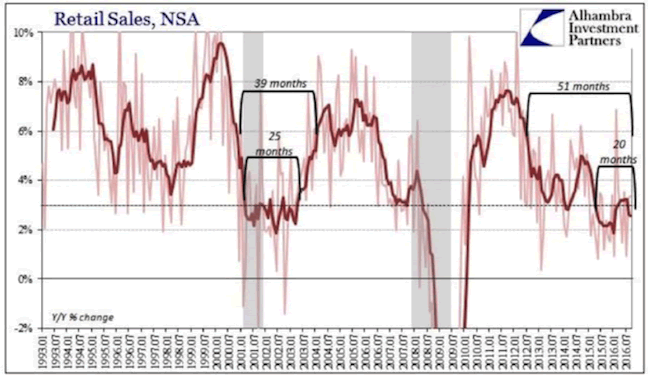

Is it any wonder, then, that retail sales are in the doldrums? The consumer is simply running out of available cash.

The chart below from Jeff Snyder at Alhambra Partners (hat tip, John Vogel) shows that the year-over-year growth in retail sales is lower now than it was before we entered the last two recessions. Some of my technical chartist friends would draw a line showing lower lows and lower highs and call this an “ugly chart.” The trend since 2011 is indeed ugly and disconcerting.

What else happened about 2011? The real cost of Obamacare began to trickle through the system and started reducing the effective disposable incomes of those who Bill Clinton recently called “the people who were busting it.” The very real impact of the cost increases for healthcare and other necessities is overwhelming.

And healthcare costs are projected to rise about another 9% in 2017. And in Connecticut, health insurance will go up by 25%, and in Tennessee BlueCross BlueShield coverage will go up 62%. (In fairness, I should note that in some locations in Indiana, costs are expected to go down 12%!)

Is it any wonder that 47% of Americans have less than $400 saved up for an emergency?

Insurers are pulling out

One factor seems to correlate with healthcare cost increases: fewer choices. We were told that one of the positives of the ACA was that there would be lots of competition, which would hold the price down. This is not the reality in many counties and states.

Alaska and Alabama are expected to have only one insurance carrier each in the ACA marketplace next year. More than 650 counties in the US will have only one insurance provider on their ACA exchanges in 2017, up from 225 in 2016 (To see how many providers there are in a certain state, go to this handy table from The Kaiser Family Foundation.)

Obamacare’s price controls make the problem worse. Insurers can charge older customers up to three times more than younger ones. But older people generate more than enough claims to overwhelm those higher premium costs.

This is why insurers are pulling out of the program. They can’t make it work when the customer profile is skewing toward older and sicker and regulations prevent insurers from charging any more. But raising premiums wouldn’t work, either, because then people couldn’t afford to buy insurance.

This is what a death spiral looks like. I see no way to pull out of it unless something miraculous happens to reduce healthcare costs.

FREE Report: How the High Priests of Economics Are Leading Us to Monetary Hell

Contrary to common belief, it’s not greedy Wall Street brokers that are wrecking the US economy—but academic policymakers like the ones employed by the Federal Reserve. And they all have the best intentions… Read financial-bestseller author John Mauldin’s riveting special report, How the High Priests of Economics Are Leading Us to Monetary Hell. Click here to get your free copy now. John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.