Broken Central Banks: 4 Quick Pix

Interest-Rates / Central Banks Oct 25, 2016 - 04:57 PM GMTBy: Jim_Willie_CB

The Western central bank franchise system is totally broken, totally insolvent, and totally corrupt. It invites the Gold Standard return. The entire financial system is built upon a debt-based monetary system. The debt saturation process has run its full course. The central bank heads have been covering the sovereign debt for the last five years, having rendered their balance sheets as ruined. Debt is at obscene levels, like $19.7 trillion for the USGovt. No debt limits are in place anymore, a signal that most likely it has already defaulted. A hidden game is underway, with control lost to the creditors, even as they attempt to salvage their debt holdings. The major central banks continue to manage badly the great game, where money is fake phony and a farce. A titanic battle is underway, where the Eastern nations are discarding their USTreasury Bonds, and doing so in tremendous volume while they set up the many platforms and pieces to the Gold Standard.

The Western central bank franchise system is totally broken, totally insolvent, and totally corrupt. It invites the Gold Standard return. The entire financial system is built upon a debt-based monetary system. The debt saturation process has run its full course. The central bank heads have been covering the sovereign debt for the last five years, having rendered their balance sheets as ruined. Debt is at obscene levels, like $19.7 trillion for the USGovt. No debt limits are in place anymore, a signal that most likely it has already defaulted. A hidden game is underway, with control lost to the creditors, even as they attempt to salvage their debt holdings. The major central banks continue to manage badly the great game, where money is fake phony and a farce. A titanic battle is underway, where the Eastern nations are discarding their USTreasury Bonds, and doing so in tremendous volume while they set up the many platforms and pieces to the Gold Standard.

The US Federal Reserve monetary policy of hyper-inflation has failed to revive the USEconomy, failed to legitimize the debt securities, failed to halt the financial corruption, and failed to stem capital destruction. The official monetary policy has only succeeded in preventing the failures of almost all big Western banks. They are all insolvent, mostly supported by narco money laundering in the hundreds of $billions. The Eastern super-powers are leading a campaign to put aside the US$-based financial system, isolate it to the sidelines, while arranging a new system. The Gold-based system will be complete with its currency, sovereign debt securities, transfer systems, global offices, and debt rating agencies, maybe even debit cards. The East strives to install the Gold Standard as the remedy to the ongoing global financial crisis. The West has made exactly no movement toward solution, remedy, or enforcement against bond. Four graphs display the broken unfixable bizarre situation.

Graph 1 – BALANCE SHEET DESTRUCTION

Central bank balance sheets could take decades to normalize, so the conventional thinking goes. Their balance sheets will never return to normal. Most assets of toxic paper are far more worthless than junk bonds. A normalization process would require at least 50 years of more financial repression and deep corruption. A massive global debt writedown of sovereign bond is coming, on the back end of the Global Financial RESET. Think paradigm shift of the most disruptive type while power shifts eastward. The risk of war rises.

The big Western banks find themselves in an impossible Catch-22 situation. The markets are addicted to QE and its destructive money hyper inflation. Federal Reserve policymakers have acknowledged that their $4 trillion balance sheet will not shrink any time soon. Also, Bank of England officials talk of crisis fighting tools as semi-permanent fixtures. In Asia, the Bank of Japan has developed a new monetary policy framework that features admitted infinite QE. The financial crisis the balance sheet volume to GDP ratios for the Bank of England and USFed have peaked at around 25%, the highest level ever recorded. Uncharted territory has been entered.

The USFed balance sheet ratio to GDP previously reached 23% in 1940 during World War II. The Bank of England ratio approached 20% in the 1730s during the South Sea Bubble scheme, 1816/17 during the Great Re-coinage, the 1830s/1840s following other wars, and in the immediate aftermath of WW2. In every scenario above, the central banks managed to unwind their balance sheets. But then the great unwinding took decades, up to 60 years in some cases. This time is different. No economic growth is anywhere remotely on the current horizon, nothing sufficient to unwind the tremendous debt burden. This is where the conventional analyst turns stupid, even locked in fantasy. They assume the GDP growth has been around 3% in recent years, when it has been closer to minus 4% or minus 5% each year since 2008 in a fierce recession with strong feedback loops. We are not on the verge of economic expansion, which can relieve the balance sheet toxicity, but rather a financial reform to sweep away the USDollar and to render its USTreasury Bonds as near worthless paper. The next chapter will be centered upon the Gold Standard, first in trade payment, next in bank reserves, finally in currencies.

The installation of the Gold Standard will render almost all US$-based debt securities as toxic paper, much like African Govt Bonds. QE might have bought time for the big US banks, but it guaranteed the kill of the USEconomy as host, and the default of the USGovt debt. No semblance of return to normalcy can come. This is why war is being vigorously pursued, to retain power.

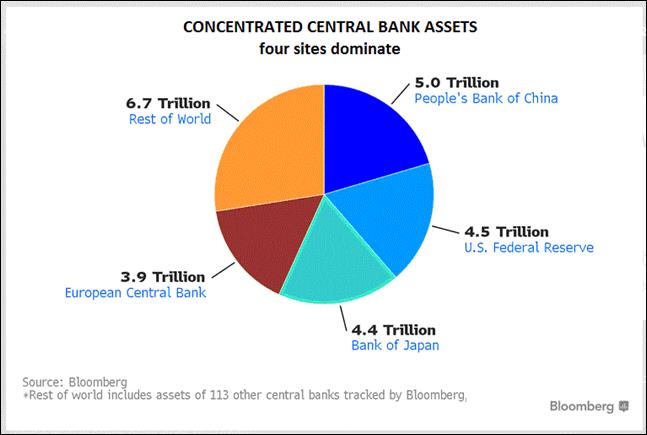

Graph 2 – CONCENTRATION OF CENTRAL BANK ASSETS

Big Central Bank assets have jumped the fastest in five years to $21 trillion. The toxic sovereign bond bubble is the largest bubble in history. Four major central banks control 75% of all central bank assets. Any currency reform must come from a major nation and its lead. The majority of the world’s central bank assets are controlled by four sites: China, the United States, Japan, and the European Union. The next six each account for an average of 2.5%, namely the central banks of Brazil, Switzerland, Saudi Arabia, the United Kingdom, India, and Russia. The major nations control toxic vats of deeply impaired debt paper which nobody wants.

The big four central banks are often called the major central banks. They are from the so-called industrialized nations, when in fact they are from former industrial states with a strong leaning toward New Third World status. They control the global financial structure and rig markets in order to keep it stable. If any changes are to come to the USDollar and the King Dollar reign of terror, the reform will be done by a major central banks with support from an alliance of other nations. Do not expect reform. Instead expect a revolution from the East, as it installs the Gold Standard in certain key spots. The best one can expect is a dual financial universe, where the USDollar is gradually phased out.

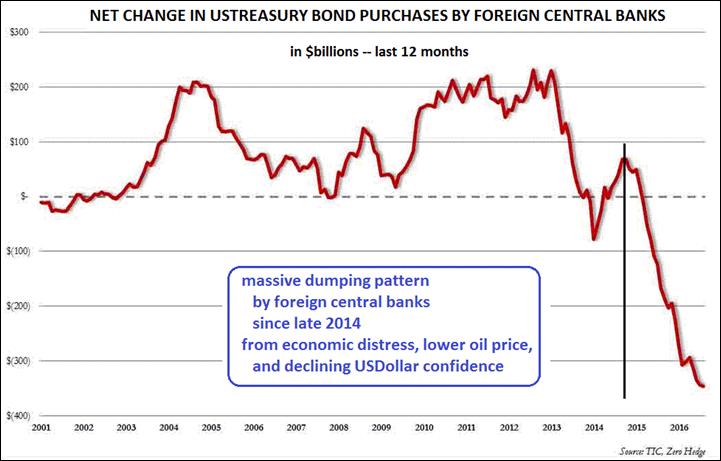

Graph 3 – Dumping of USTreasury Bonds in Worldwide Trend

A truly massive international dumping of USDollars has entered a second powerful phase. The Saudis and China recently dumped huge blocks of USTreasury Bonds. Foreign central banks liquidated a record $346 billion in USGovt debt securities in the last 12 months, the trend having accelerated. Numerous factors contribute to the dumping, which manifests the fading global confidence in the USDollar. Amplified Quantitative Easing (QE) volume soaks up the large volumes dumped on the bond market, further eroding the faith in fiat currency.

One month ago, a troublesome sharp decline was seen in the USTreasurys held in custody, which is the formal way to describe central bank holdings kept at the USFed computer banks. The amount fell by over $27.5 billion in a single week, the biggest weekly drop since January 2015. One month later the trend continues with powerful force, enough to capture global attention. The custody volume fell sharply again by another $22.3 billion in the past week, pushing the total amount to $2.805 trillion, another fresh post-2012 low. The foreign central banks have continued their relentless liquidation of US debt securities held in the USFed’s official custody account. History is being made, as global sentiment and conditions are changing in fierce mode. The King Dollar throne is having its legs removed, kicked out, and cut off. Most financial analysts refuse to put the factors in such stark terms, but the Jackass does so naturally and without hesitation. Three dynamics can be identified as the principal proximal factors, detailed in the Hat Trick Letter for the October edition in the reports.

A month ago was observed a massive $343 billion in USTreasury sales by foreign central banks in the period July 1st 2015 to July 1st 2016, something truly unprecedented in size. Fast forward to the latest monthly update, which was posted as July data. All have gone worse. The running latest 12 months (LTM) in foreign central bank sales shot up to a new all time high $346.4 billion. Thus over one third of a $trillion in USTreasurys were sold in the past 12 months. Recall that in three months late in 2015, the Chinese sold $250 billion in USTBonds, which forced the IMF inclusion of the RMB into their formal basket of currencies. The dumping has been global, massive, and without precedent. China is the major seller, while the Saudis are the newest sellers. The broken Outhouse of Saud requires the funds to offset the collapse of the Petro-Dollar, and to backstop the country’s soaring budget deficit made worse by the obscene Yemen War.

The official story is told that private investors, both foreign and domestic, are soaking up hundreds of $billions in central bank holdings being sold on the bond market. The other dubious story is that bond yields are rising slightly, given the newfound concerns the USFed, the Bank of Japan, and maybe even the EuroCB will soon taper their purchases. The bigger factor (surely not private investors) is the USFed ramping up hidden QE volume in a huge way, buying the massive bond dumpings, all kept secret and quiet so as not to disturb the pristine AAA rating of the USTBond toxic paper. Expect continued debt monetization of theUSGovt deficit, of which perhaps 75% is supported by the African style printing press. The USEconomy cannot grow its way out of the debt. They will monetize it until it default on the global stage.

The QE process cannot take in all the dumped USTBonds without psychological damage. The USDollar confidence is eroding globally. Faith in the USDollar is eroding very quickly. The nation is moving along in the US isolation process, identified as rogue nation on the financial front, terrorism front, laced vaccine front, and war front. Just the Jackass opinion.

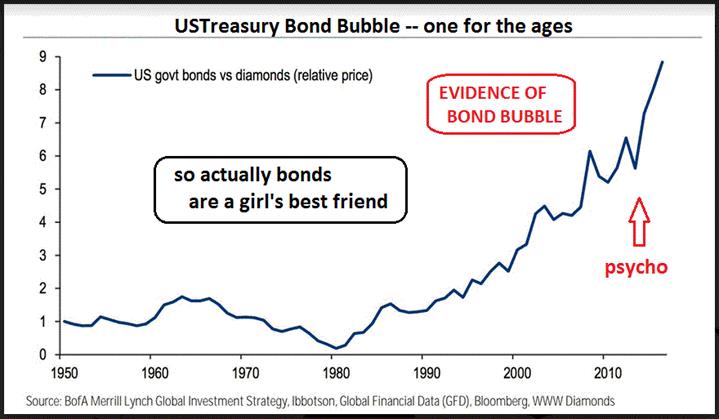

Graph 4 – Evidence of USTBond Bubble (versus Diamonds)

The USTreasury Bond bubble is the second biggest asset bubble is history, behind the residential real estate bubble in the last decade. The USTBonds are a massive sanctioned Ponzi Scheme, signifying the default of the USGovt debt and failure of its sovereign bond. The Elite controllers talk of a flight to safe haven, when in reality it is a leap into a black hole and toxic vat. Motive is to keep USGovt borrowing costs to minimal levels while the debt soars toward the $20 trillion mark. The gigantic black hole attracts legitimate capital from around the world. All will be subject to heavy losses. The USTreasury Bond asset bubble is supported by three major forces: the USFed monetary hyper inflation, the Interest Rate Swap derivative contract, the bond carry trade managed by Wall Street banks. More details are provided in the Hat Trick Letter for October.

The relation between top tier assets should remain stable, such as diamonds, special gemstones, classic art works & sculptures, special jewelry items, icon properties, and more. However, the bond price for USGovt debt has gone haywire, rising far beyond anything reasonable. Check out an unusual chart above, for the bond value versus the standard benchmark diamond price. This is a clear visible nasty bond bubble, which will burst just like the US housing market bubble that nobody in the mainstream moronic arenas expected. The Jackass correctly forecasted the housing market bust one year before it occurred. No longer are diamonds a girl’s best friend. It is USTBonds.

GOLD TRADE NOTE INTRODUCTION

The Gold Trade Notes for trade payment might be coming into view, initially with commodity transfers, later swap contracts, and finally gold-backed short-term notes which supplant the USTBill. One might think of used newspapers on the floor, or of the dodo bird. The trade might be made in exchange for either goods delivered or USTBills held. Detect a growing connection to finished goods being withheld from delivery. This is probably another sign of refusal of USTBills as payment. As footnote, be sure to know that the preliminary steps to the Global Currency RESET will not be laid out in full disclosure for public benefit. It represents a tremendous investment opportunity for the elite, which they never tend to share. In fact, the RESET might be well along before it is even recognized. End to EuroRaj main thoughts and open analysis, for which much gratitude is given. The Jackass believes a few critical elements to the RESET are in place. More details on DIP Financing feature is included in the September Hat Trick Letter report.

***A major hitch obstacle can be inferred. Payment in USD terms might be the clot in the artery. Demands might be for hard asset swaps, and the contract security from large scale commitment of commodities, facilities, and property. The swap trade is coming into view, a presage of the Gold Trade Note.***

The Jackass concludes the USD rejection could be lifting its head within a gathering storm, without clear identification. It is indeed difficult to identify all the elements when hidden deals at the highest level are underway, and friction is omnipresent. The Bobcat Corp rejection of USTBills at Pacific ports is a clear story. For every one story recounted, there are 10 to 20 not yet heard. My firm belief is that in Asian banking systems, they do not want the USTBills anymore. The banks in Asia are trying to dump them in heavy volume, not accumulate more worthless toilet paper. Finally the sharp blowback from printing QE money has hit. The USFed monetary policy saves the big insolvent banks, but kills capital. The result has finally seen manifested in USD global rejection, or at least hints toward the same. Asian banks still hold vast sums of USTBonds. They are not going to announce the rejection, but instead fight behind the walls for better terms of payment, even as they pursue the Gold Trade Note for payment at ports. It is coming, like daybreak follows the long night.

NEW SCHEISS DOLLAR & GOLD TRADE STANDARD

In time, expect an eventual refusal by Eastern producing nations to accept USTreasury Bills in payment for trade. The IMF reversal decision assures this USTBill blockade in time, and might accelerate the timetable. The United States Govt cannot continue on five glaring fronts of gross negligence and major violations. These violations have prompted the BRICS & Alliance nations to hasten their development of diverse non-USD platforms toward the goal of displacing the USDollar while at the same time take steps toward the return of the Gold Standard.

The New Scheiss Dollar will arrive in order to assure continued import supply to the USEconomy. It will be given a 30% devaluation out of the gate, then many more devaluations of similar variety. The New Dollar will fail all foreign and Eastern scrutiny. The USGovt will be forced to react to USTBill rejection at the ports. The US must accommodate with the New Scheiss Dollar in order to assure import supply, and to alleviate the many stalemates to come. The United States finds itself on the slippery slope that leads to the Third World, a Jackass forecast that has been presented since Lehman fell (better described as killed by JPM and GSax). The only apparent alternative is for the United States Govt to lease a large amount of gold bullion (like 10,000 tons) from China in order to properly launch a gold-backed currency. Doing so would open the gates for a generation of commercial colonization, but actual progress in returning capitalism to the United States. The cost would be supply shortages to the USEconomy, a result of enormous export increases to China.

The colonization has already begun, with secret deals galore. It is very unclear what deals are being struck in order to arrange for the USGovt to have a proper gold reserve hoard, for backing a new legitimate USDollar. Meetings at very high level are in progress, with little if any popular representation, only elite members present. Failure to produce a legitimate bonafide gold-backed currency would mean the United States must proceed with the New Scheiss Dollar, an illegitimate fake phony farce of a currency. It would be subjected to a series of devaluations. The result would be heavy powerful painful price inflation from the import front. The effect would be to reverse a generation of exported inflation by the United States. The entire USEconomy would go into a downward spiral with higher prices, supply shortages, and social disorder. However, the rising prices would come from the currency crisis, and not so much from the hyper monetary inflation. That flood of $trillions has been effectively firewalled off.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

"As a Golden Jackass subscriber, I greatly enjoy listening to your interviews because it really lends a sense of passion that lies behind the tremendous body of information and formulation that goes into your monthly research. Though I must admit, it scares the hell out of me most of the time. Still, I will not miss it for the world. I feel that having a truly objective insight from your research, in depth analysis, and accurate forecasts gives me and my family an important life saving advantage. And I mean that sincerely."

(MichaelS in Ontario)

"I have continued my loyal patronage of your excellent commentaries not so much because of my total agreement with your viewpoints, but because you have proven yourself to be correct so often over the years. When you are wrong, you have publicly admitted it. You are, I suppose by nature, an outspoken and irreverent spokesman for TRUTH against power, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerly assimilating any and all free information (articles, interviews, etc) that Jim Willie puts out there. Just recently I finally took the plunge and became a paid subscriber. I regret not doing this much sooner, as my expectations were blown away with the vast amount of sourced information, analysis tied together, and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com, which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.