SPX Triangle has Broken Down

Stock-Markets / Stock Markets 2016 Oct 21, 2016 - 04:16 PM GMT Good Morning!

Good Morning!

SPX Premarket has breached yesterday’s low at 2133.44 this morning. The short-term direction is down and the next support point appears to be the Cycle Bottom and trendline at 2124.63. Free fall may begin below those supports.

Fed Governor Daniel Tarullo will be giving a speech at Columbia Law School at 10:15 am.

ZeroHedge writes, “Asian stocks and S&P futures fall modestly and European shares are little changed as traders digested the surprising reticence from yesterday's ECB meeting and weighed earnings reports from companies including Microsoft, which soared to all time highs after beating non-GAAP estimates, and Daimler. The dollar jumped to 7 month highs, pressuring EM currencies and pushing the euro to its weakest level since March and below the Brexit lows, after Mario Draghi shut down talk of tapering, while the Yuan dropped to the lowest since 2010 after the PBOC cut the fixing by most since August; commodities declined on speculation U.S. monetary policy will diverge from stimulus measures in Europe and Asia.”

We are seeing more outflows of money out of the market, so who’s buying?

ZeroHedge observes, “For the last 7 days, something odd has happened at the end of the day... stocks haven't ripped higher into the close.

While no confirmation has been received, we are hearing increasing chatter on desks about probes over index ETF rebalancing shenanigans which many have argued have been responsible for the ubiquitous end of day ramps in US equity markets over the last few years. Note that VIX has collapsed during this time but stocks have gone nowhere...”

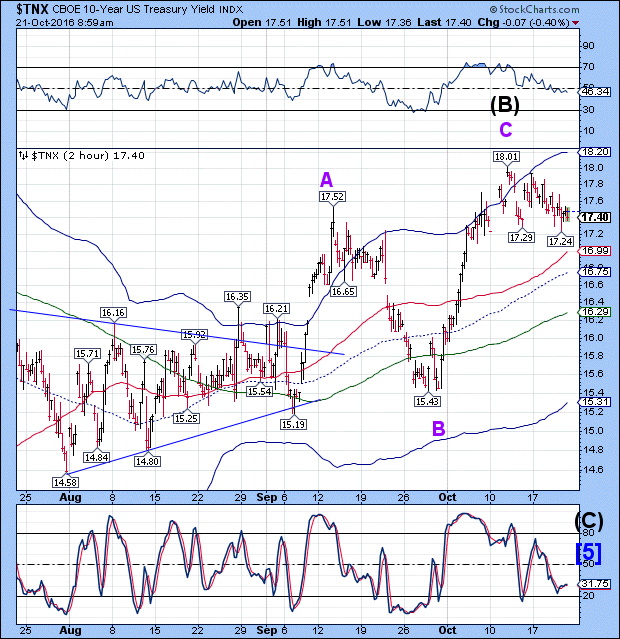

TNX is lower, but not significantly. Short-term, the path appears to be down.

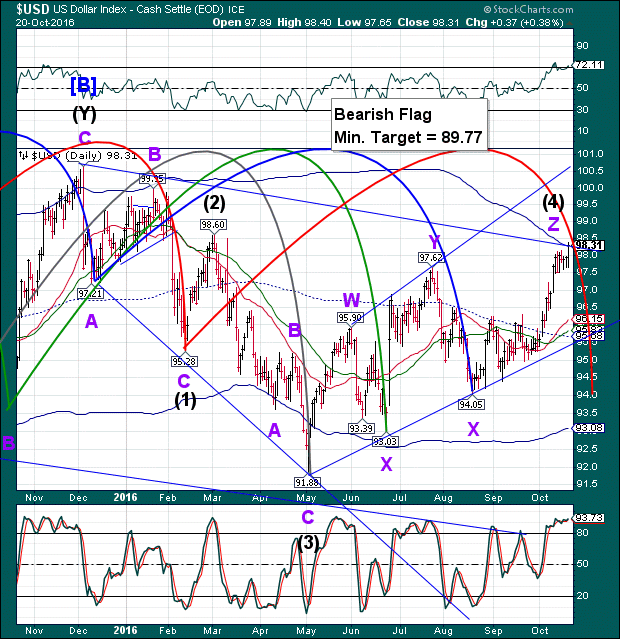

A fly in the ointment is the USD, which has made a new overnight high of 98.73. It will take some time to reassess the Wave structure. One thing I must add, however, is that USD is due for a Master Cycle low in the next two weeks.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.