Attention Please: Phase Two of the Gold and Silver Train Now leaving the Station. All Aboard?

Commodities / Gold and Silver 2016 Oct 19, 2016 - 03:37 PM GMTBy: Peter_Degraaf

Phase One began in January 2016, and slowed down from July until early October. (Charts in this commentary are courtesy Stockcharts.com, unless indicated).

Phase One began in January 2016, and slowed down from July until early October. (Charts in this commentary are courtesy Stockcharts.com, unless indicated).

The first sign of a turnaround can be seen in this chart:

Featured is PHYS the Sprott Gold Trust. Price produced an Upside Reversal (blue arrow), on Oct. 7th. Since it happened at the bottom of the rising channel and at the 200 Day Moving Average, this was an important clue. Confirmation occurred on Oct. 18th, with price breaking out above recent congestion. (See the zoom chart at right). The supporting indicators have turned positive (green lines), and the 50DMA is in positive alignment to the 200DMA (green oval), while the latter is in firm uptrend. The first target is at the green arrow.

This chart (courtesy www.macrotrends.net) is one of our favorite long term charts and we feature it often. It shows the gold price in comparison to the US Monetary Base. This index shows important turnaround points for gold, as seen in the early 1970's, 2001, 2009 and now in 2016. The amazing take-away from this chart is that gold is presently the cheapest it has been in at least 100 years! We may never see it this affordable again in our lifetime.

BATES, Larry:

"The greatest shock of this decade is that more people are about to lose more money than at any time before in our history. And the second biggest shock will be the incredible amount of money just a relatively small group of people will make at exactly the same time." (Author of 'The New Economic Disorder')

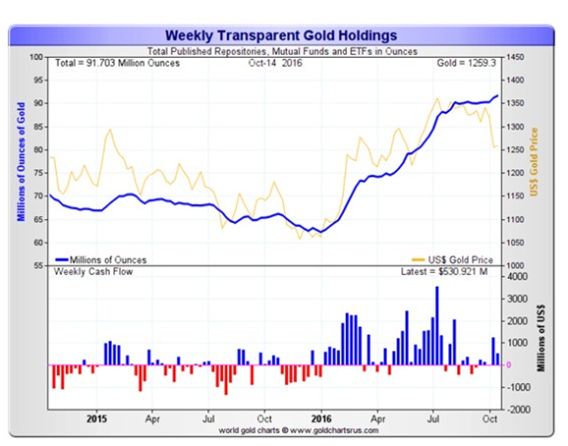

This chart courtesy Goldchartsrus.com shows investors are adding to ETFs and Trusts, in spite of lower gold prices during the past few months. This is positive divergence.

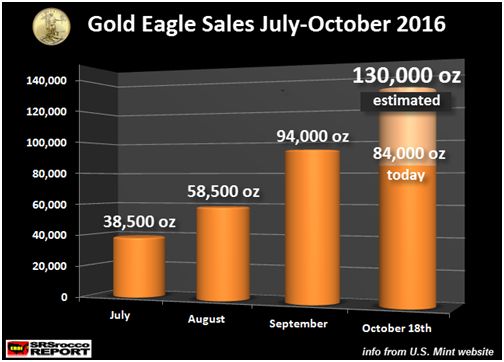

This chart courtesy SRSRoccoreport.com shows demand for US Gold Eagles is rising, despite a drop in the price of gold. It would appear that investors like a bargain.

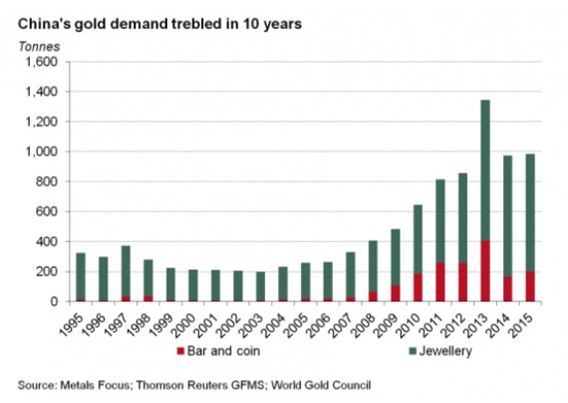

This chart courtesy sources listed shows demand for gold in China continues to grow. This demand provides a solid fundamental reason to own gold.

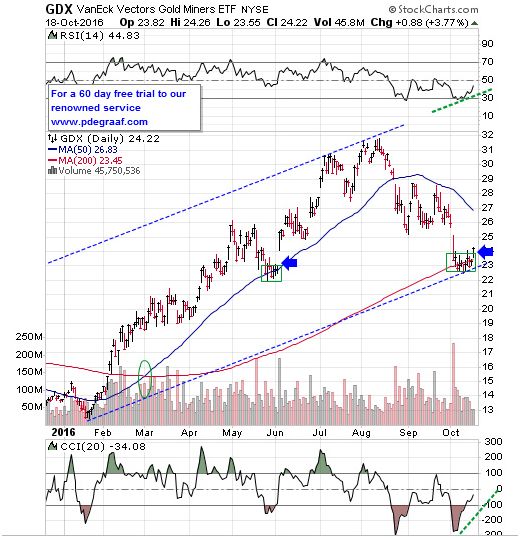

Featured is GDX the miners ETF. Price is currently carving out a similar pattern to the turnaround of May-June. The blue arrows point to breakouts from congestion. The blue channel shows the projected path. The supporting indicators are positive (green lines). The 50DMA is in positive alignment to the 200DMA (green oval), while the latter is in strong uptrend.

CICERO – 55 BC:

"The budget should be balanced, the Treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed lest Rome become bankrupt. People must again learn to work, instead of living on public assistance."

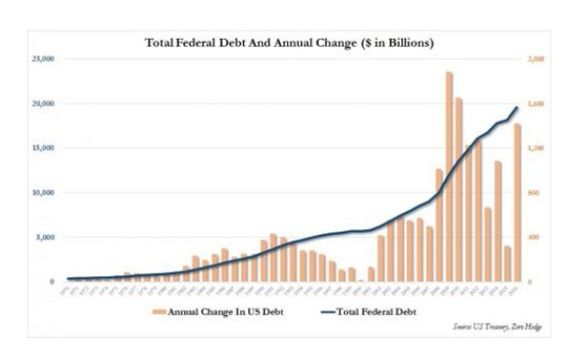

This chart courtesy US Treasury and Zerohedge.com shows US debt is rising sharply. This debt will never be repaid. It will be inflated away, or cancelled via bankruptcy. In either case gold owners will benefit, as gold will rise in price. One of the most important energy sources for a rising gold and silver sector is government debt.

BASTIAT, Frederic:

"The law can be an instrument of equalization only as it takes from some persons and gives to other persons. When the law does this it is an 'instrument of plunder.'" (From his booklet: The Law).

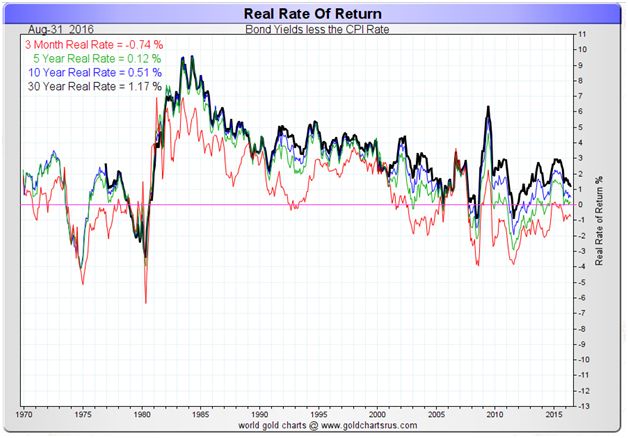

This chart courtesy Goldchartsrus.com shows another bullish factor for gold. Whenever the 'real rate of return' is below 2%, and especially below 0% (short term rates are -0.74%) investors flock to gold. In view of the fact that the calculation in this chart is based on the official CPI rate, the actual real rate of return is still lower, as the government uses 'seasonal adjustments' in almost every statistic they provide.

BURKE, Edmund (1729 – 1797):

"How often has public calamity been arrested on the very brink of ruin, by the seasonable energy of a single man? Have we no such man amongst us? I am as sure as I am of my being, that one vigorous mind without office, without situation, without public functions of any kind, (at a time when the want of such a thing is felt, as I am sure it is) I say, one such man, confiding in the aid of God, and full of just reliance in his own fortitude, vigor, enterprise, and perseverance, would first draw to him some few like himself, and then that multitudes, hardly thought to be in existence, would appear and troop about him."

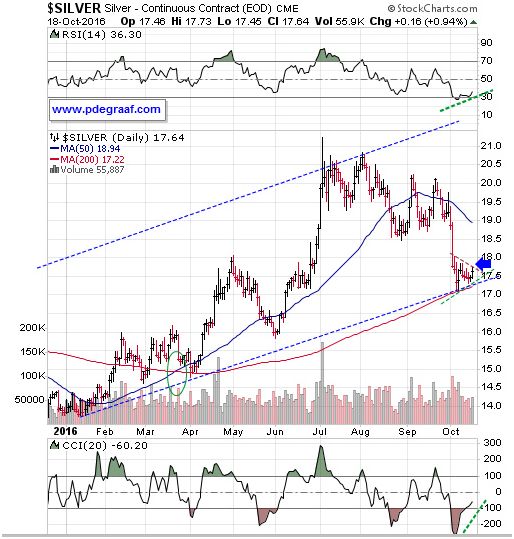

Featured is the daily silver chart. During a gold bull market, silver can be expected to outperform gold, based on historical precedent. The uptrend is clearly defined within the blue channel. Price is carving out a small pennant formation right at the 200DMA. Remember the golden rule: During a bull market, every dip near or below the 200DMA (rising red line on the chart), is an opportunity to buy. The supporting indicators (green lines) are positive and the 50DMA is in positive alignment to the 200DMA, while the latter is rising.

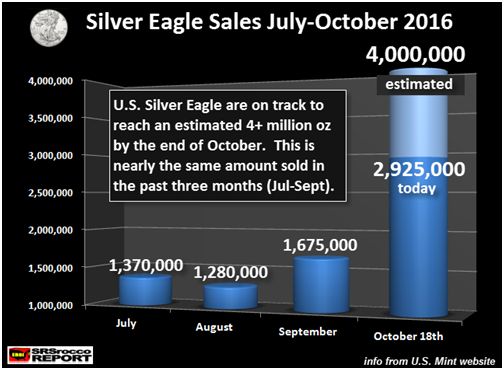

This chart courtesy SRSRoccoreport.com shows sales of Silver Eagles at the US Mint are rising sharply this month. It is investment demand that will drive the current bull market in silver.

Peter Degraaf is NOT responsible for your trading decisions. Please do your own due diligence.

By Peter Degraaf

Peter Degraaf is an on-line stock trader with over 50 years of investing experience. He issues a weekend report on the markets for his many subscribers. For a sample issue send him an E-mail at itiswell@cogeco.net , or visit his website at www.pdegraaf.com where you will find many long-term charts, as well as an interesting collection of Worthwhile Quotes that make for fascinating reading.

© 2016 Copyright Peter Degraaf - All Rights Reserved

DISCLAIMER:Please do your own due diligence. Investing involves taking risks. I am not responsible for your investment decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.