Can we have a Stock Market Flash Crash?

Stock-Markets / Financial Crash Oct 19, 2016 - 03:26 PM GMT Good Morning!

Good Morning!

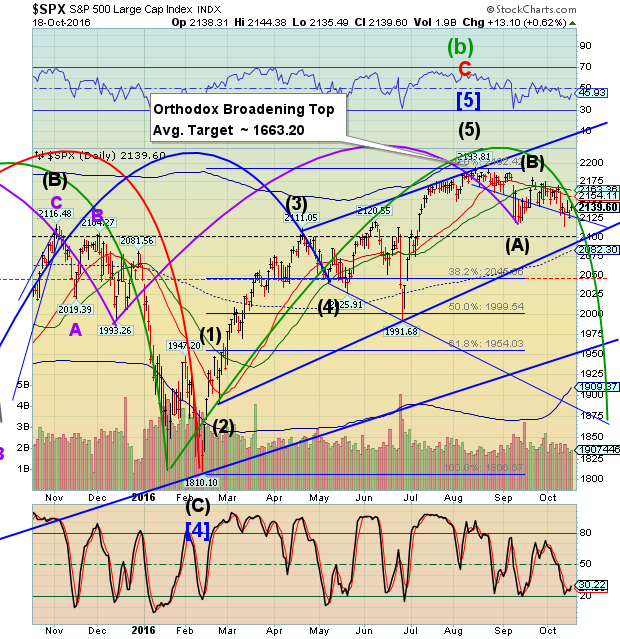

Could a flash crash happen in the next two days? The answer is yes. The Cycles Model implies that today may be the focal point for the two-week delayed Master Cycle low.

However, as you can see, only Waves 1 and 2 are complete. I am not sure that Waves 3, 4 and 5 can be finished in a day, so Thursday afternoon may be the ideal time…for a flash crash low. Here are the reasons.

First, The last Master Cycle low was on September 12 (272 days), exactly 14 days beyond the expected MC low due on August 29. Today is day 272 of the current Master cycle. We are opening the 14th day beyond the normal due date at 258 days.

Second, the current Cycle starting at the 2169.60 high is now 46 market hours long. Its next cyclical interval is 60 hours (8.6 days), which puts the next Cyclical low near Thursday’s close. There is a chance that the decline may stop at 56 hours, suggesting an alternate time at or shortly after noon on Thursday.

Third, this suggests a “limit down” of 7% (1989.27) may be possible, which may temporarily close the market. The second daily circuit breaker is at 13%. This puts a potential target at 1861.00 from yesterday’s close. As a reference point, the 2010 flash crash decline was “officially” 8.6 percent on May 6. The 2015 flash crash was “officially” 5.2% on the day of August 24. The 7% circuit breaker trigger is at 1989.27,very close to the Brexit low. The 13% circuit breaker level is at 1861.45, very near the 1867.01 August 24, 2015 low. Note that a break of the Cycle Bottom at 1909.37 would be likely to establish a new Cyclical decline.

Fourth, today is options and futures expiration for VIX. Commercial traders are heavily long the VIX, while retail investors and speculators are short the VIX.

Fifth, the NDX will have 56 hours of decline at the same time as the SPX 60 hours.

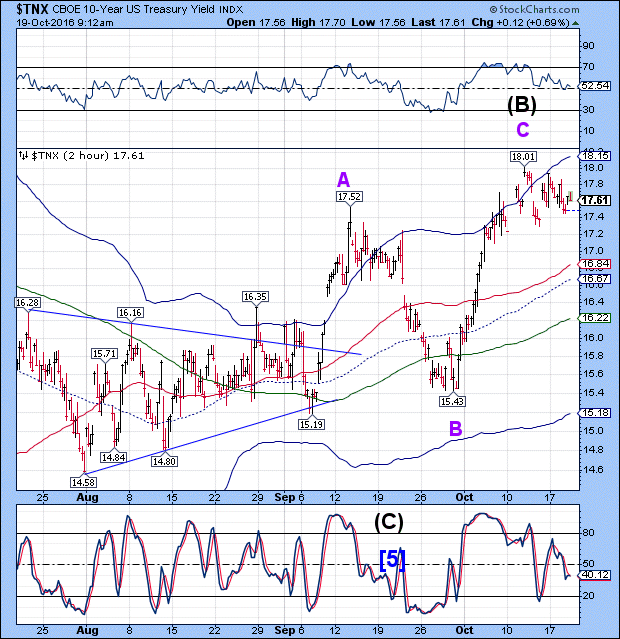

TNX has bounced this morning, but it doesn’t appear that it can go much higher. The decline may match the decline in SPX. The Cycles Model supports the idea of a decline, possibly to the 2-hour Cycle Bottom at 15.18.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.