SPX Making Irregular Waves, Making Another Large Retracement

Stock-Markets / Stock Markets 2016 Oct 18, 2016 - 03:19 PM GMT SPX Premarket appears to be headed for the 50% retracement level for the prior decline and the probable top of Wave (a) at 2142.45. We have a probable repeat of Wave 1, where the impulse is smaller than the total decline, including Wave [b].

SPX Premarket appears to be headed for the 50% retracement level for the prior decline and the probable top of Wave (a) at 2142.45. We have a probable repeat of Wave 1, where the impulse is smaller than the total decline, including Wave [b].

ZeroHedge writes, “If yesterday's session was dominated by concerns about Fed tightening and rising long-end rates, today fears about a hawkish Fed have subsided, and as a result European, Asian stocks and S&P futures all rose amid speculation Federal Reserve policy will remain accommodative after yesterday's dovish comments by Fed vice-Chair Stan Fischer who offset Friday's hawkishness by Rosengren and Yellen.”

The Cycle from the 2179.99 high to the 2169.60 high was 86 hours. SPX has complete 40 hours of its decline from the 2169.60 high. I don’t think that we may see a flash crash in the next 3 hours, but we may see a significant low at or near 60 hours (Thursday afternoon). Note that hour 43 occurs at noon, so we may see the turn down at that time. The alternate is that the turn may occur at 40.5 hours, making it within the first half hour of trading, so be alert. All sell signals are intact this morning.

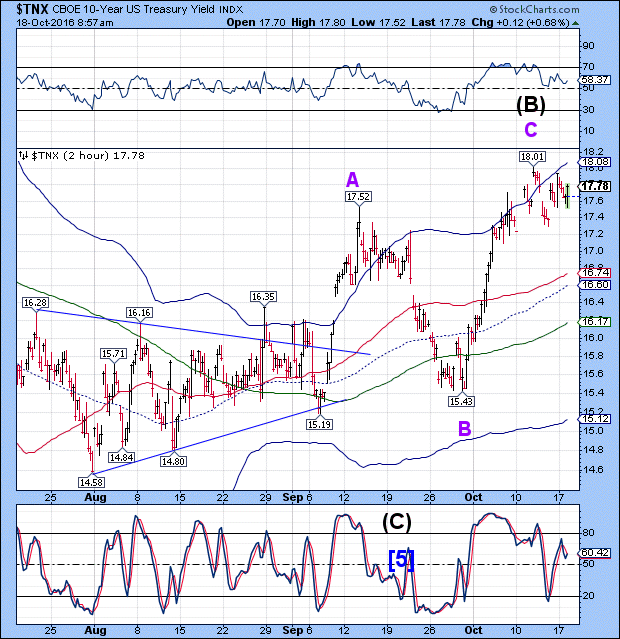

TNX is elevated this morning, but there may be a limit to its bullishness. It appears that the current Wave structure may still be accurate.

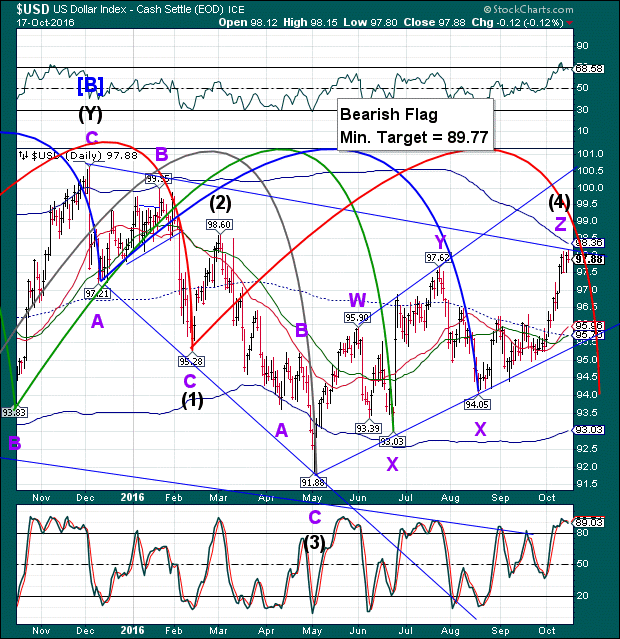

USD appears to be probing lower. There is no reversal pattern, yet. Today is a Pi date and it appears to be making an inverted Trading Cycle high. It, too may see a turn near mid-day.

I have a very busy schedule outside the office most of the day, but intend to make a commentary in the early afternoon.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.