Stock Market More to Come!

Stock-Markets / Stock Markets 2016 Oct 18, 2016 - 12:15 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: The long-term trend is up but weakening. Potential final phase of bull market.

SPX Intermediate trend: The uptrend from 1810 continues, but it has entered a corrective phase which could extend into November.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

More to Come!

Market Overview

Last Tuesday, what had been expected for some time finally happened: SPX broke the 2145 level which had acted as support for the past 2 weeks, and had a decline which spanned forty-one points. Two days later, more weakness took it all the way to 2115, breaking below the previous correction low of 2120, but the bears could not keep it at that level, and by the end of the day it had retraced most of the decline and closed seventeen points higher at 2132. In the process, it finally breached the trend line from 1810. I think it's fair to say that the accelerated phase of the correction which had been predicted is now on its way.

That does not mean that the decline will continue at this rate into November, although lower prices are certainly expected. Trading in a range is mostly over. But the bears -- who have won some battles over the past five or six weeks only to see the bulls regain the lost ground shortly afterward – will have to continue to fight tooth and nail for more territory. While the trend line from the February lows has been breqched, they will have to contend with a broad range of support which extends from 2040 to 2120, and it is unlikely that they will have time to plow through all of it between now and the end of November.

Analysis

Daily chart

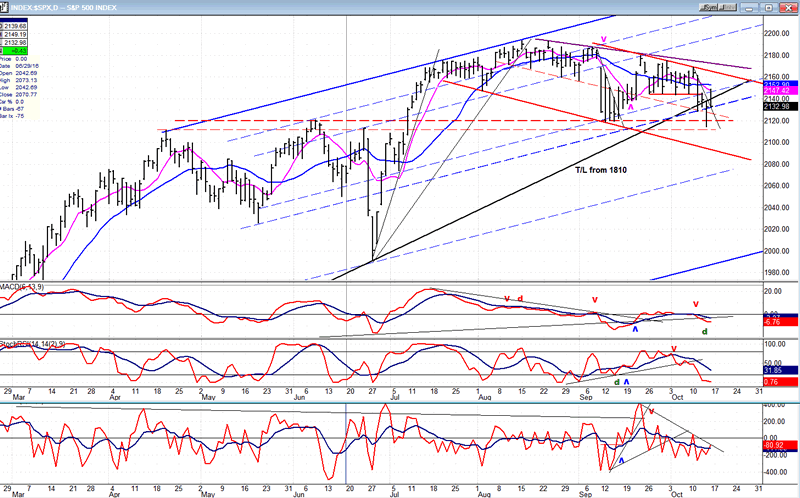

It is easy to see on the chart why the bears are having so much trouble taking prices down in spite of the assistance from bottoming cycles. The eight-month trend line connecting 1810 and 1992 was finally broken last week and, at that, not very decisively. On Friday, SPX even rallied back above it, and closed only slightly below. Last week was the second attempt at selling off the index. Both times it barely scratched the surface of the support level provided by former peaks in April and June. But that's not the full picture!

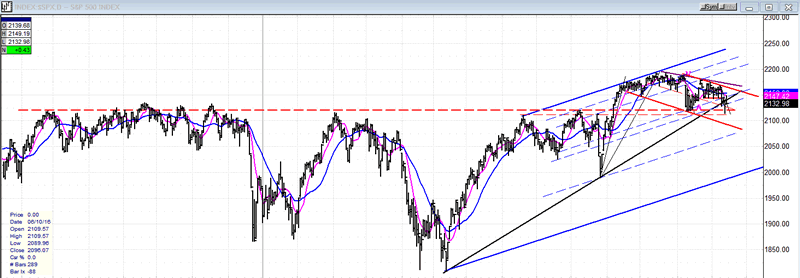

The support shown here is only a small fraction of what extends all the way to January 2016. Below, a condensed version of prices going back to that date shows you what the bears are up against and why they find it difficult to make more headway. Being aware of this long-term pattern also makes one realize why a decline below 2050 would start to look worrisome for the bull market. When SPX is eventually able to penetrate below 2000, (which would take massive selling) it will have a difficult time getting back above what will have by then become transformed into a solid brick ceiling.

With last week's action, we seem to have formed a (red) trend channel for the current correction. The amount of distribution which has been established on the P&F chart suggests that it could take us down to about 2050 (with a potential reserve to 2000). That would keep the index within the red trend lines since this is about where the extended bottom channel line would be by the end of November.

The MACD is currently showing some positive divergence to intra-day prices, but not to closing prices from which it is calculated. We can ignore it for the time being.

This chart and others below, are courtesy of QCharts.com.

Hourly chart

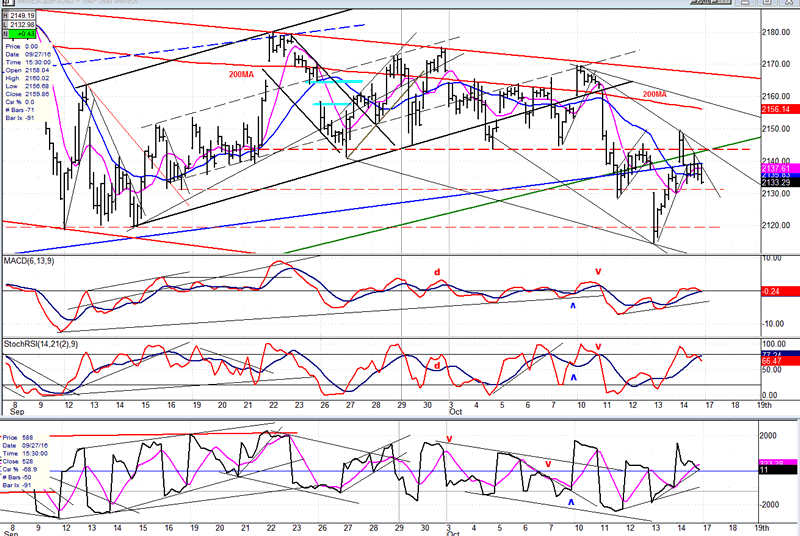

As the cycles apply more and more pressure, the price trend is steepening. This can be seen on the hourly chart. Steeper and steeper channels can be drawn within the red one. The upward correction from the 2120 low clearly came to an end at the beginning of last week and, with more weakness expected into the end of the coming week, we may not be quite ready for the next consolidation/rally in a downtrend.

The sharp recovery which took place on Thursday and Friday is most likely over. The oscillators are all beginning to roll over and the daily indicators are still in a downtrend (as are the weekly ones). This strongly suggests that lower prices should be expected over the near-term.

Some leading & confirming indexes (Weekly charts)

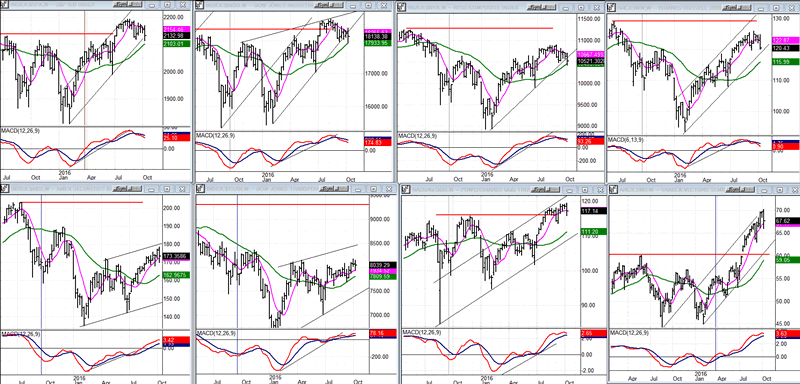

The rolling over process is best observed on the main indexes: SPX, DJIA, and NYA (top left), but the NYA has not yet made a new high, and all the previous trading of the early 2016 period which is seen on the condensed chart above is above it and therefore providing resistance. There are three others which are in the same fix: XBD and TRAN (bottom left), and IWM (top right). The red line indicates the level of their 2016 tops for each index. The two weakest, as you can see, are XBD and TRAN. Although they, too, have rallied since the February low, the pattern is clearly corrective and they are not expected to make a new high, even if the bull market continues a little higher after this correction.

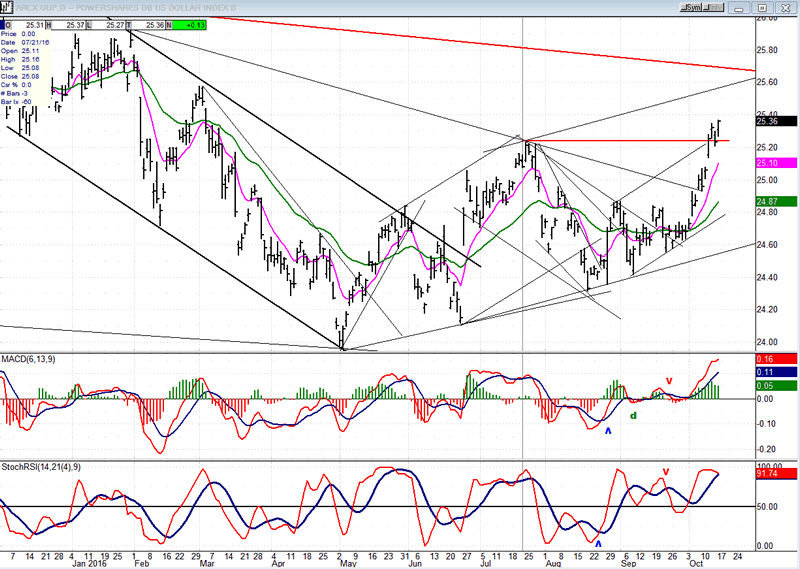

UUP (dollar ETF)

UUP has found buyers when it needed to, overcame the former high, and is heading for the top of its intermediate-term (18m) corrective channel. That will be a serious challenge to further advance and will determine whether the higher count is still feasible.

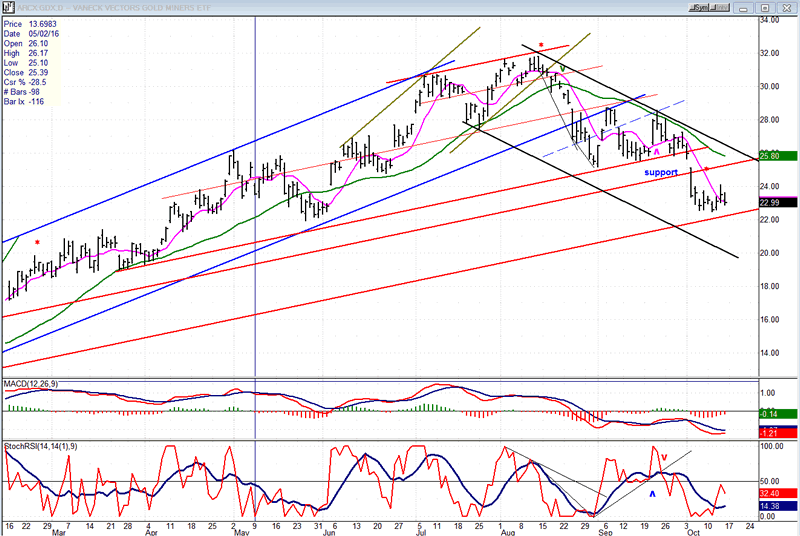

GDX (Gold Miners ETF)

GDX has done little since its last spell of weakness. There are good reasons for that! It is approaching a strong support line which could absorb new selling. It is also close to filling its 22 projection; about 22 would amount to a 50% retracement of its new uptrend. Recent strength in the dollar has contributed to its weakness, but it has handled it with minimum attrition. These are all good reasons to expect a rally before long. However, what kind is still undetermined. There is not enough of a base built to take prices very high.

Note: GDX is now updated for subscribers several times throughout the day (along with SPX) on Marketurningpoints.com.

USO (U.S. Oil Fund)

USO has continued to rally in what appears to be a corrective move, which is what we should expect. After such a sharp and prolonged drop, it will take a while to build a base which could support another significant advance – if that ever again takes place.

Summary

SPX -- as well as other major indexes -- is slowly succumbing to the pressure of bottoming cycles. It's a mini-battle of the titans with the cycles' increasingly relentless attack on the reinforced, concrete support -- which should continue into late November. It may eventually prove to be a bridge too far to turn the major trend, but it could damage it enough to prevent it from making a subsequent dynamic recovery.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.