December Might Be the Next Buying Opportunity in Gold

Commodities / Gold and Silver 2016 Oct 17, 2016 - 05:17 PM GMTBy: John_Mauldin

By Jake Weber, Garret/Galland Research

By Jake Weber, Garret/Galland Research

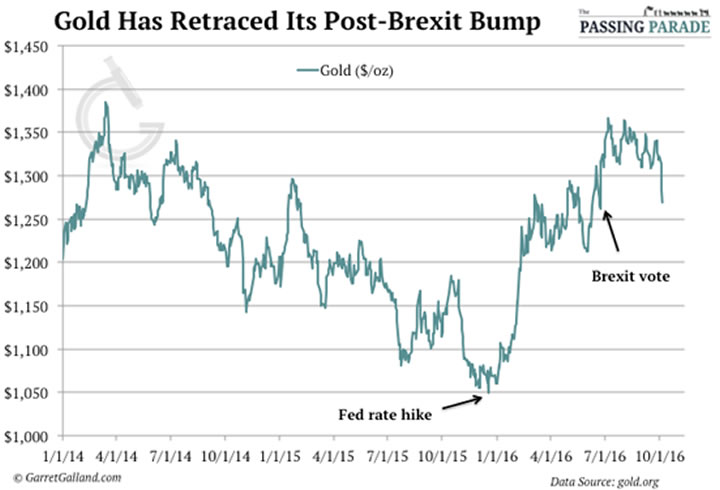

There’s no doubt gold has had a good run in 2016. Its recent selloff has caused it to give up most of its post-Brexit gain. Still, the yellow metal is up nearly 20% on the year. And a new buying opportunity may be on the horizon.

Concerns about another Fed rate hike are dragging down the price. Those worries are fueled by a continued pickup in US economic data in recent weeks.

That increases the odds that the supposedly data-dependent Fed will hike rates again before the end of the year.

How likely is a hike?

Most think the Fed won’t increase interest rates at the next meeting. After all, the meeting is only a week before the US presidential election. That means the December 14 Fed meeting is when the next potential rate hike might be made.

The futures market for Fed funds is a reasonably accurate forecasting tool. It involves institutions putting real money on the line. It shows the odds of a rate hike this year are slightly higher than a coin toss.

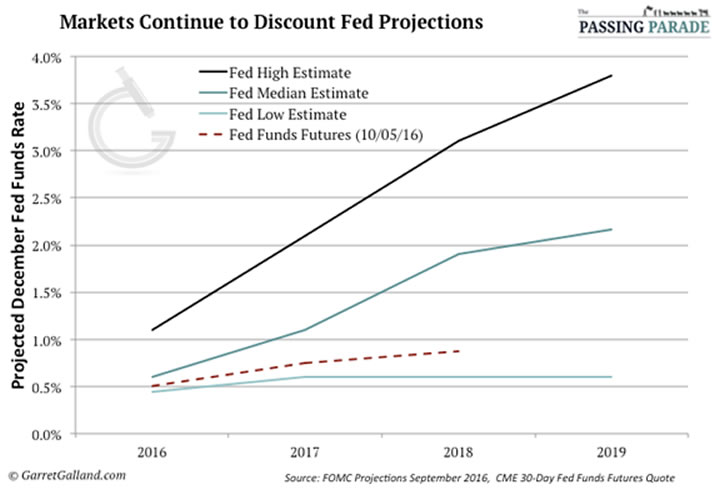

Of course, the median Fed forecast at the beginning of this year was for four rate hikes. Yet here we are in October, and it’s doubtful the Fed will move rates at all in 2016.

This speaks volumes about the Fed’s credibility problem. It has simply been crying “wolf” for far too long. The market no longer believes it. For proof, look at the difference between the market’s and the Fed’s projections for future rates.

As you can see, the Fed funds futures still show the target rate below 1% all the way out to 2018. The Fed keeps adjusting its outlook to reflect lower rates in the future. But that outlook is still far more optimistic than the market’s.

The divide within the Fed is growing

Three out of the 10 voting members of the Federal Reserve Board argued for a quarter-point hike at the September meeting. The last time three voters dissented was December 2014.

Perhaps that is why the markets are now figuring out the Fed will hike the rate in its December meeting, just like it did in 2015.

Barring some very negative economic data between now and December 14, I think Yellen will try to regain credibility with a rate hike. Based on that possibility, the recent selloff in gold markets may be justified.

The next buying opportunity

Look at the size of the debt bubble. And consider the dire consequences of a higher interest rate. Can you see that any dip in the gold price should be considered a buying opportunity?

While we could see a 25-basis-point increase in December, I expect the Fed to then revert to jawboning. I doubt they will actually follow through with a series of hikes in 2017.

Once the market realizes the Fed is nothing more than a paper tiger, gold should rebound and trade above $1,300 again by early 2017.

Recent comments by Chicago Federal Reserve Bank President Charles Evans support this view. “I am less concerned about the timing of the next increase than I am about the path over the next three years,” he said following a speech on the US economy.

If forced to choose between the Fed and market expectations for the rate path, I ’ll side with the markets. Gold may continue to slide in the short term, but it’s hard to see what has changed that will make the Fed’s latest forecast any more accurate or lead it to begin aggressively hiking rates.

Free report reveals: How to Effectively Eliminate Stock Market Risk with This Proven Investment Strategy

Here’s the real reason why most investors lose money in the market... and once you understand how to do this one thing, you’ll know how to pick great stocks that can create stable growth AND provide protection from downturns.

Click here now to get this free special report from Garret/Galland Research.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.