These 2 Debt Instruments Pose Peril to Millions of Investors

Interest-Rates / US Bonds Oct 14, 2016 - 10:40 AM GMTBy: EWI

A billionaire says the search for yield is overriding credit judgment

A billionaire says the search for yield is overriding credit judgment

In a world of low and even negative rates, bond investors are so hungry for yield they're willing to accept high levels of risk.

For example, bond investors are increasingly embracing debt instruments known as covenant lite loans, which provide minimal protection should the issuer get into financial trouble.

Stay informed. Stay prepared. See what we see ahead for U.S. markets -- now, via this risk-free offer to the Financial Forecast Service.

*********

[Editor's Note: The text version of the story is below.]

In a world of low and even negative rates, bond investors are so hungry for yield they're willing to accept high levels of risk.

For example, bond investors are increasingly embracing debt instruments known as covenant lite loans, which provide minimal protection should the issuer get into financial trouble.

Investors should pay close attention to this development, because this is exactly what happened before the 2007-2009 financial crisis.

Our April 2007 Elliott Wave Financial Forecast warned subscribers beforehand:

The only reason that the crisis has yet to spread to the corporate debt market in general is that lenders continue to slacken underwriting standards, just as they previously did in the mortgage sector. Consider, for instance, the latest boom instrument, a corporate product known as "covenant lite," bank loans that "subject borrowers to few of the usual performance requirements that have been standard in the past." Standard & Poor's says that $41 billion in lite loans have already been issued in 2007, a figure that is greater than that of the last 10 years combined.

Remember, cov-lite loans free the debt issuer from meeting normal fiscal disclosures and financial metrics, so the risk to lenders is high.

With that in mind, consider this (Bloomberg, Sept. 27):

Just 35 percent of new leveraged loans issued in 2016's first half had traditional covenants that require regular financial check-ups, compared with 100 percent in 2010.

A billionaire investor noted that "the fact that there are no covenants tells you that people are substituting yield for credit judgment."

But financial optimism is also reflected in the popularity of yet another high-risk debt instrument.

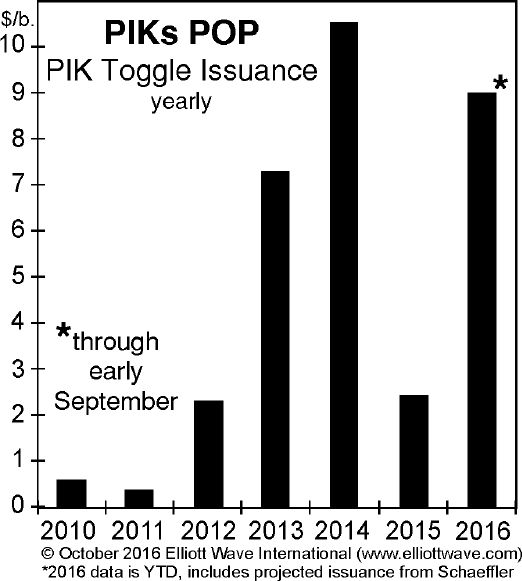

Here's a chart and commentary from our October Financial Forecast:

Another bond market revisitation from the last credit mania is the "red-hot" market for payment-in-kind (PIK) bonds. ... PIK bonds allow the issuer to pay interest in additional debt rather than cash. September is set to become the busiest month ever for PIK issuance, led by German auto component maker Schaeffler AG's $1.5 billion issue, the largest in history. Similar to the heightened risk associated with buying cov-lite loans, seasoned investors acknowledge the peril of buying PIK bonds.

As we've noted before, credit implosions develop when lenders relax credit standards and investors reach for yield.

This might well be the time to play it safe.

This article was syndicated by Elliott Wave International and was originally published under the headline These 2 Debt Instruments Pose Peril to Millions of Investors. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert

Unleash the power of the Wave Principle Much like a great sports play; to appreciate a great market forecast, you have to see it. In fact, we'd like to show you four. Our examples do indeed show what can happen when Elliott analysis meets opportunity. But we're not asking you to attend a class in 'good calls.' In each of these four markets, the unfolding trends have (once again) reached critical junctures. You really, really want to see what we see, right now. Get your report -- How to Find Real Opportunities in the Markets You Trade -- FREE |

Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.