China’s Rocketing Housing Market Real Estate Bubble

Housing-Market / China Housing Market Oct 14, 2016 - 10:28 AM GMTBy: Harry_Dent

No question about it. China definitely takes the cake when it comes to bubble creation. The government encouraged everyday people to speculate in stocks in late 2014 and 2015 to help offset the slowdown in its gargantuan real estate bubble. The stock market bubbled 160% in one year and then crashed 50% (and you can be sure there’ll be more losses to come after a year of propping up a market that has merely gone sideways…)

No question about it. China definitely takes the cake when it comes to bubble creation. The government encouraged everyday people to speculate in stocks in late 2014 and 2015 to help offset the slowdown in its gargantuan real estate bubble. The stock market bubbled 160% in one year and then crashed 50% (and you can be sure there’ll be more losses to come after a year of propping up a market that has merely gone sideways…)

Then to cushion that 2015 stock crash, the government made loans easier for real estate again. Bank loans surged by 7.5 trillion renminbi (RMB) in 2015 and are on track to surpass 15 trillion RMB by the end of this year. About half of these loans are in mortgages.

So what happened?

After flattening for three years, real estate prices went totally bananas again. They’re up 59% in the hottest large city, Shenzhen, since February 2015. They’re up 35% in Shanghai.

Just look at this bubble in Tier 1 cities. Real estate is up 48% since just February 2015! Since early 2010, it’s up 107%. That’s clearly the orgasmic phase of this bubble.

Shenzhen is the large industrial city outside of Hong Kong and it is now the next bubble city. Property prices there have surpassed Shanghai and Beijing prices for the first time.

But there are a number of Tier 2 cities that are bubbling even faster. Seven major cities have seen more than 50% growth in the square footage sold in the last year. These include:

- The amount of square footage sold in Changzhou in the last year has increased by 138%.

- Changsha saw an increase of 107%.

- For Tianjin it’s 107%.

- In Fosh, it’s 103%.

- In Zhengzhou, 94%.

- Hangzhou, 82%.

- And Jinan, 65%.

Chinese billionaire Wang Jianlin calls it “the biggest bubble in history.” And the richest man in China, with a net worth of more than $30 billion, has been selling all of his real estate as fast as he can since early 2014. That’s what you call “the smart money!” Just like Baron Rothschild, selling a bit earlier rather than later is always prudent because bubbles tend to crash twice as fast as they build and real estate gets illiquid the fastest.

A Bubble Looking for a Pin

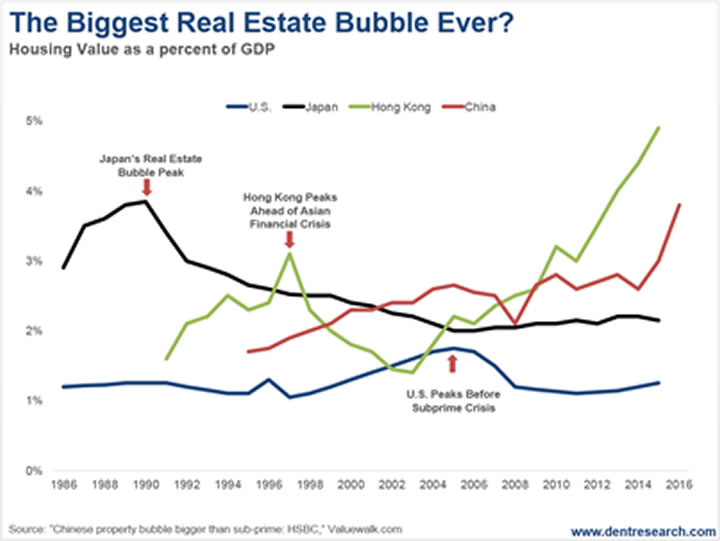

For more evidence of how bubbly China’s real estate is, look at this next chart from HSBC. It shows the total value of residential housing as a percentage of GDP, as is possibly the best measure of the situation over there.

China’s ratio (the red line) is currently 3.27 times GDP, and forecast to hit 3.72 times by year-end!

Japan’s great bubble (the black line) peaked in 1990 at 3.7 times GDP. Shortly after, property prices fell through the floor, losing 67%!

Hong Kong’s 1997 bubble peak (green line) was at 3.04 times.

The U.S. bubble peak (the blue line) in early 2006 was at 1.75 times.

And, as if that wasn’t bad enough, remember that China’s GDP per capita is only $8,240. It’s not nearly as rich as Japan ($44,647), Hong Kong ($36,117) or the U.S. ($56,000). It should not have debt or real estate at similar extreme values. Yet it does!

Hong Kong still holds the honors for the greatest bubble of all thanks to affluent Chinese laundering their money there, just like they are laundering it into other major English speaking cities around the world. Hong Kong’s housing value to GDP is now at 5.0 times and projected to go to around 5.5 by year-end.

Talk about a bubble looking for a pin!

Chinese property owners are in for a rude awakening ahead!

But let me leave you with the most absurd thing I’ve seen since 400 sq. ft. condos in Vancouver selling for $500,000…

The new trend in Shenzhen is 66 sq. ft. “closet condos,” with a fold down single bed, selling for $132,000. That’s $2,000 per sq. ft.! That’s pricier than Vancouver’s tiny condos, only in a city where the typical person earns a little less than $20,000 a year! It takes about seven times their income to buy a closet studio apartment.

If that ain’t a bubble, I don’t know what is!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.