Tiptoeing Back into the Gold Miners

Commodities / Gold and Silver Stocks 2016 Oct 13, 2016 - 05:50 PM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger explains why he sees a "bottom in the cards," and outlines a trading plan to capitalize on the turnaround.

Precious metals expert Michael Ballanger explains why he sees a "bottom in the cards," and outlines a trading plan to capitalize on the turnaround.

Cutting directly to the chase, the correction in the gold and silver stocks and, more importantly for us, the miners (GDXJ) is rapidly coming to a close. Without embarking on a flight of verbosity and overstatement, here in a nutshell is why I see a bottom in the cards—and possibly a solid, tradeable bottom.

1. Sentiment: In January of this year, I couldn't even get a meeting with any fund manager or investment banker, let alone secure an order for financing. By July, I had those same people begging me for a piece of ANY gold/silver-related financing I could offer. Mining brokers went from the outhouse to the penthouse in record time, and with unprecedented velocity by the summer of 2016. Today, in October, we are right back to where we were in January. Those big managers of other people's money now own "too many issues," the quality of which was noticeably suspect in the late stages of the January-July advance. When my phone stops ringing for at least two weeks, I know we are near the lows.

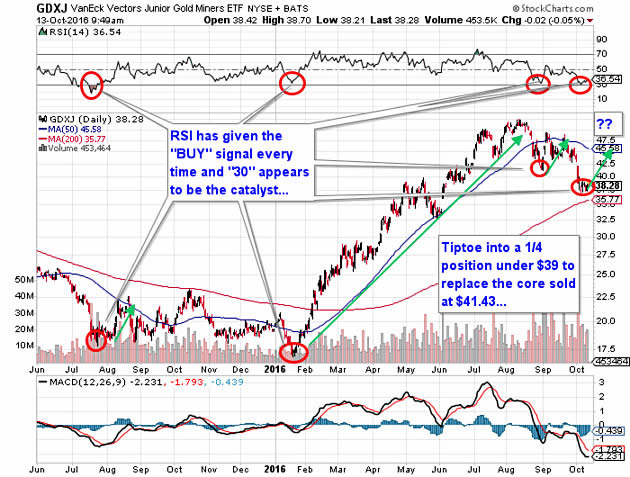

2. Relative Strength ("RSI"): Nothing more to say here other than "Observe the chart posted above."

3. COT: The Commitment of Traders report for tomorrow is going to see another sharp improvement as gold open interest has shrunk to 500,328, and that is down from 544,824 on October 4. This is the large Commercials unwinding their massive short position in gold futures and is normally a precursor for a reversal. However, it is not to be used as a timing tool as the unwinding can take weeks to play out.

4. Deal Flow: The number of financings for the junior exploration companies has suddenly and sharply dropped off a cliff as the mania that engulfed the space in the spring and summer has evaporated into nervousness and despair. Declining deal flow is normal into any correcting market but the severity of the plunge is bullish.

5. Strong U.S. Dollar mantra: Everyone and their hairdresser has now assumed a rate hike in December, and that, combined with the crashing British pound and the surging dollar-yen, has sealed the fate of all currencies against the Almighty U.S. dollar. But it should be noted that the U.S. is the largest debtor nation on the planet and that its purchasing power continues to erode against everything. For a superb primer on the state of affairs in the good ol' US of A, follow this link to yet another fabulous Michael Mahoney video called "USA's Day of Reckoning," where he talks about an economics term covered in this space numerous times over the past ten years—the velocity of money.

The vehicle of choice for me is the Gold Junior Miners ETF (GDXJ), and having completely missed the top in July-August above $50, I was stopped out two weeks ago at $41.43, triggering a lovely and very well-earned capital gain. Sadly, not having 75% of my net worth on the proverbial line every day was disturbing, and for the past three weeks, the lack of stress has transformed me into a slovenly "gentleman of leisure," complete with weight gain and addictive behaviors. Accordingly, in an effort to restore my spouse-annoying, dog-harassing self to normalcy, I am going to tiptoe back into the GDXJ market by buying the opening this morning with 25% of allocated capital. I might be early or I might be dead on, but the only "technical" tool I am using is the RSI numbers. Every other technical "tool" is veritably useless, as are the geeks that read tea leaves from the bottom of the cup.

Now I have to go drag Fido out from under the shed and unscrew the bolt locks on the powder room door. We need normalcy in order to allow the Gold and Silver Gods bless us with $1,400 gold by Christmas.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts and images courtesy of Michael Ballanger.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.