Confirmed Stock Market Sell Signals

Stock-Markets / Stock Markets 2016 Oct 11, 2016 - 05:43 PM GMT SPX has crossed beneath the bottom trendline of the Triangle formation. This confirms the trend change in SPX.

SPX has crossed beneath the bottom trendline of the Triangle formation. This confirms the trend change in SPX.

ZeroHedge points out that the Risk Parity trade is deleveraging this morning, causing the breakdown. This practice is akin to the “portfolio insurance” used up to the crash of 1987, but with leverage, since yields are so low.

This may be a fast-developing situation, as each level of breakdown instigates more selling. There is a vicious feedback loop that may be unstoppable until selling is exhausted. That may take SPX beneath the February 12 low at 1810.10.

The next level of possible support may be the Head & Shoulders neckline at 2135.00.

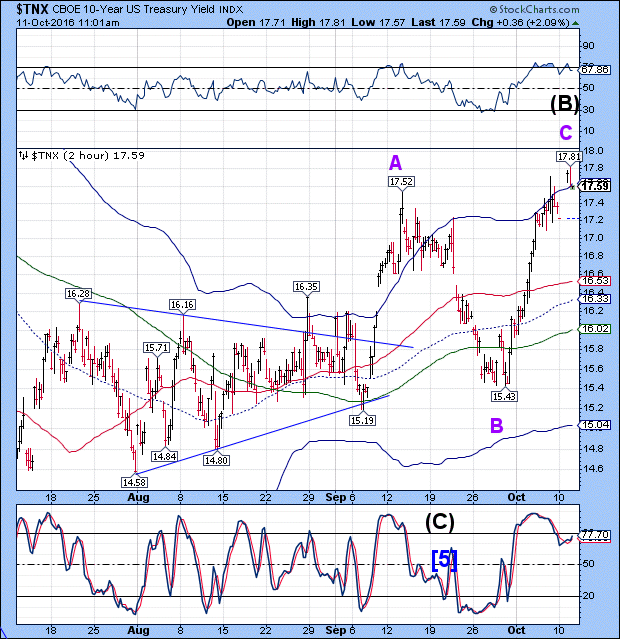

As pointed out this morning, TNX is in the target zone for its high and may be reversing as I write. It has crossed beneath its Cycle Top support/resistance at 17.63 and is in the position for an aggressive sell signal.

Another game changer for the markets is the 3-month Libor rate, which is at its highest point since 2009.

Bloomberg writes, “If the London Interbank Borrowing Rate was a musical artist, or an actor, or a sports team, we'd be calling 2016 its comeback year.

Not since the financial crisis of 2008 has Libor, to which almost $7 trillion of debt including mortgages, student loans and corporate borrowings, is pegged — experienced such a surge. The three-month U.S. dollar Libor rate has jumped from 0.61 percent at the start of the year to 0.87 percent currently — a 42 percent rise — ahead of money market reform that's due to come into effect on Oct. 14.”

So we may be seeing a lot of chaos in the money markets and a loss of liquidity in the prime money funds area. It may also influence LIBOR rates going forward. I have not done a Cycles analysis of LIBOR, but it appears that, for the short run, LIBOR may be due for a respite, since a possible Master Cycle low may be due over the next two weeks. But the pullback may be shallow and a resumption of the uptrend may cause greater concerns as the yields resume their advance.

VIX has broken out and is also on a confirmed buy signal. The higher lows and breakouts help to make this happen.

The NYSE Hi-Lo Index is also on a confirmed sell, provided it closes beneath its mid-Cycle resistance today. I would feel more comfortable when it also drops below -16.00 (intraday or closing) as a final confirmation.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.