Gold Stocks Head for Final Bottom Before Huge Rally

Commodities / Gold & Silver Stocks Jul 30, 2008 - 11:09 AM GMTBy: Michael_Swanson

I believe the next few days are going to be key days for gold stocks just as May was a key time for the S&P 500 and the broad market. If you were following me then you'll know that I took short positions against the general market back in May. However I did not short at the exact top. In fact I got in a little early and let the S&P 500 go up a percent above my entry point. I was convinced when I got in that the market was about to make a critical top - one that would last for the rest of the year - but I wasn't sure at the exact price or moment that it would come. I was only certain that it was coming within a week, so I decided to just start to build a position. Of course it worked fantastic as the market has fallen apart since then.

I believe the next few days are going to be key days for gold stocks just as May was a key time for the S&P 500 and the broad market. If you were following me then you'll know that I took short positions against the general market back in May. However I did not short at the exact top. In fact I got in a little early and let the S&P 500 go up a percent above my entry point. I was convinced when I got in that the market was about to make a critical top - one that would last for the rest of the year - but I wasn't sure at the exact price or moment that it would come. I was only certain that it was coming within a week, so I decided to just start to build a position. Of course it worked fantastic as the market has fallen apart since then.

Gold stocks are now in a similar critical position - however, instead of topping out they appear to me poised to put in a final bottom - one that should last for the rest of the year and lead to a huge rally.

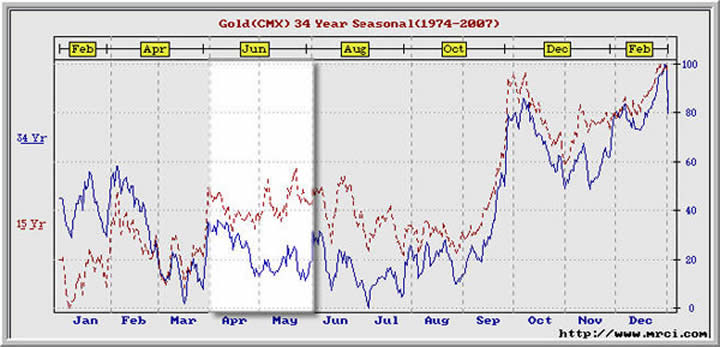

On May the 6th I wrote an article titled "Know This Seasonal Pattern for Gold Stocks," which included the above chart. In this I article I wrote the following:

"As you can see gold has a tendency to make a peak in the April-May time period and then consolidate through the end of August and then breakout in September and have its best months through the end of the year. This seasonal pattern held true in this gold bull market except for last year when the whole stock market experienced its first subprime meltdown last August. If it wasn't for that the same seasonal pattern probably would have held true again."

"If the pattern repeats then we can expect gold stocks to rally until the end of the month and then retest their lows, maybe even making a slight minor low, in June or July and then base for a few weeks and breakout at the end of August or September to rally through the end of the year. This would fit the scenario I came up with yesterday from the overall gold and gold stock chart patterns."

Gold stocks have unfolded so far almost exactly as this forecast called for. However, what is interesting is that by several key yardsticks gold stocks are now extremely oversold when compared to the price of gold.

As Dave Skarica points out in his monthly newsletter , ""The XAU to gold ratio has traded between .16 and .27. Basically when the ratio is under a fifth of the price of gold (.20) gold stocks are cheap when compared to the metal, especially when the ratio gets under .19. As we are about to go to press the XAU to gold ratio is getting close to .18; this is the lowest level since the spring 2003 bottom in gold stocks. What is interesting is that was the start of a huge 9 month rally in gold stocks, which saw the XAU gain over 75% in value."

Gold stocks also tend to lead the metal. So when the XAU/gold, HUI/gold, and GDX/gold relative strength ratios are declining it tends to be bearish for the metal and when they rise it tends to bullish for both stocks and the metal. All of these ratios are now at extreme oversold levels.

Another indicator that I follow closely to gauge the long-term picture for gold stocks is the 200-day Bollinger Bands. These bands expand when a market is experiencing volatility and is locked in an uptrend or downtrend and contract when a market is consolidating. When the bands come together they always signal a looming expansion - which comes when a new uptrend or downtrend is established. The banks also tend to act as long-term support and resistance levels. so with the HUI lower 200-day Bollinger Band now at 385 the HUI is near long-term support.

The point is it takes a six month or longer period of consolidation to make the bands contract - and in bull markets such periods of consolidation lead to new bull runs. Gold stocks have tended to begin such bull runs in late August through the beginning of September to fit their historic seasonal pattern.

Since they peaked in March gold stocks fell hard into May and then traded in a sideways range with resistance at 470 on the HUI gold bug index and support in the 390-400 area. Below that support is at the lower 200-Bollinger Band currently sitting at 380.

If gold stocks are going to go into a bull run and match their historic seasonal and technical patterns then this current move down from the middle of July to now will mark the final corrective wave for gold stocks during this consolidation pattern. Consolidation patterns have a tendency of exhausting bulls. They get hopeful when a market rallies up to resistance, but when it then turns around and falls back to support many of them get disgusted and sell. The time of consolidation wracks their patience and causes many people to get shaken out right before a new big sustainable rally begins.

Momentum indicators for the HUI and XAU, such as the daily stochastics are now oversold. Once they bottom and begin to rally I expect them to test their July highs within a few weeks. I then expect that they'll consolidate a bit more and then breakout by the end of August to begin a new bull run.

I am fairly certain that this bottom will come over the five trading sessions, and likely in the next few days. What I'm not sure about as I write this Tuesday night though is whether the gold stocks have already bottomed or whether they have a little more to go. The 400 level on the HUI may prove to be the floor. If it is not then I'd expect to see a very quick and short lived dip down to the 380 level and then a just as fast and furious reversal back above 400 to put in a final bottom.

The point is I feel like I am in the same situation as I was back in May when I took my short positions. I saw clear signs that then that the broad market was going to top within a week and just held my nose and took a position. Now gold stocks are in the exact spot - a key timing point is looming - and now is the time to buy or start to average in.

This article is an excerpt from a WallStreetWindow subscription article. To receive my stock picks and all future articles just click here .

By Michael Swanson

WallStreetWindow.com

Mike Swanson is the founder and chief editor of WallStreetWindow. He began investing and trading in 1997 and achieved a return in excess of 800% from 1997 to 2001. In 2002 he won second place in the 2002 Robbins Trading Contest and ran a hedge fund from 2003 to 2006 that generated a return of over 78% for its investors during that time frame. In 2005 out of 3,621 hedge funds tracked by HedgeFund.Net only 35 other funds had a better return that year. Mike holds a Masters Degree in history from the University of Virginia and has a knowledge of the history and political economy of the United States and the world financial markets. Besides writing about financial matters he is also working on a history of the state of Virginia. To subscribe to his free stock market newsletter click here .

Copyright © 2008 Michael Swanson - All Rights Reserved.

Disclaimer -

WallStreetWindow.com is owned by Timingwallstreet, Inc of which Michael Swanson is President and sole shareholder. Both Swanson and employees and associates of Timingwallstreet, Inc. may have a position in securities which are mentioned on any of the websites or commentaries published by TimingWallStreet or any of its services and may sell or close such positions at any moment and without warning. Under no circumstances should the information received from TimingWallStreet represent a recommendation to buy, sell, or hold any security. TimingWallStreet contains the opinions of Swanson and and other financial writers and commentators. Neither Swanson, nor TimingWallstreet, Inc. provide individual investment advice and will not advise you personally concerning the nature, potential, value, or of any particular stock or investment strategy. To the extent that any of the information contained on any TimingWallStreet publications may be deemed investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Past results of TimingWallStreet, Michael Swanson or other financial authors are not necessarily indicative of future performance.

TimingWallStreet does not represent the accuracy nor does it warranty the accuracy, completeness or timeliness of the statements published on its web sites, its email alerts, podcats, or other media. The information provided should therefore be used as a basis for continued, independent research into a security referenced on TimingWallStreet so that the reader forms his or her own opinion regarding any investment in a security published on any TimingWallStreet of media outlets or services. The reader therefore agrees that he or she alone bears complete responsibility for their own investment research and decisions. We are not and do not represent ourselves to be a registered investment adviser or advisory firm or company. You should consult a qualified financial advisor or stock broker before making any investment decision and to help you evaluate any information you may receive from TimingWallstreet.

Consequently, the reader understands and agrees that by using any of TimingWallStreet services, either directly or indirectly, TimingWallStreet, Inc. shall not be liable to anyone for any loss, injury or damage resulting from the use of or information attained from TimingWallStreet.

Michael Swanson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.