Stock Market Down Monday?

Stock-Markets / Stock Markets 2016 Oct 10, 2016 - 08:56 AM GMTBy: Brad_Gudgeon

The SPX could take a plunge Monday, but the set up is there for a nice rebound into October 14th. I think we finally get my False Break of the Rising Wedge and the rebound that takes us above 2200 SPX. October 14th should be the high for the year.

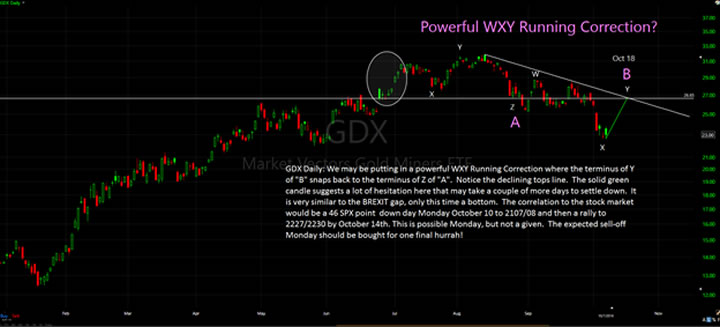

GDX and the gold complex are due for a nice rebound rally, but much damage has been done. A move back into the mid 26.00 area for GDX is the minimum expectation for an October 18 top. It may take a couple of more days to get kick started as the buyers are hesitant and selling into rallies.

There is also a solid green candle on the daily chart that bothers me in the very short term.

Any selling in the stock market on a gap down Monday, with a concurrent gap up in the gold futures, will likely be a drag on the PM’s into Tuesday.

We are setting up for a nice post election sell-off:

We now offer free auto trading. BluStar subscribers now have access to free auto trading via Auto Shares.

We are now offering a 2 day half-price sale. Offer ends October 11, 2016.

Another thing I wish to mention: please don’t trade this or any other forecast verbatim without getting proper updates from the author. Tracking the tock market is much like tracking the weather: you need to have regular updates. Things can and do change. With the changes, come strategy changes.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.