Pound Sterling Flash Crashes. Is the SPX Next?

Stock-Markets / Financial Crisis 2016 Oct 07, 2016 - 02:25 PM GMT Good Morning!

Good Morning!

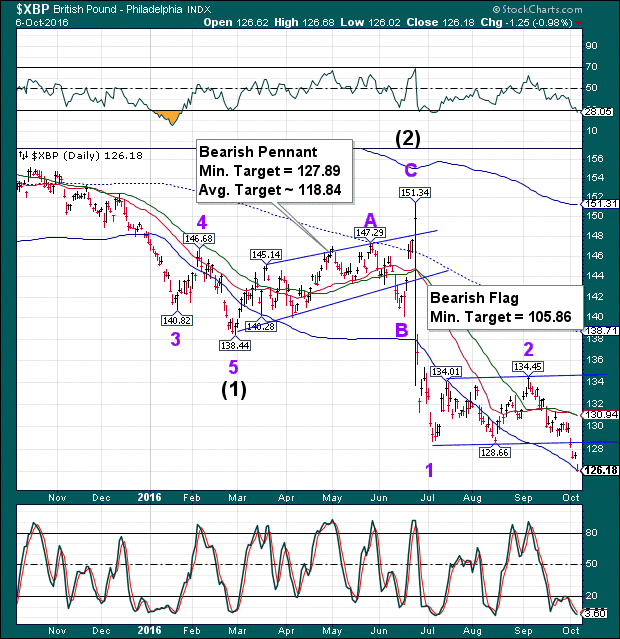

Last night’s flash crash in the Pound Sterling should not take us by surprise. It was merely fulfilling its Bearish Pennant objectives. In addition, it was within a Wave 3 of (3) scenario, which would tell us that there would be large gaps in trading as it descends.

ZeroHedge reports, “U.S. equity index futures fell, with European, Asian stocks also declining before the September payrolls data, following the stunning 2-minute "flash crash" meltdown in sterling which plunged as much as 6.1%, the most since Brexit and is set for its biggest weekly loss since 2009.

Sterling tumbled 2.1% to $1.2346, after earlier reaching $1.1841, the lowest since March 1985.”

Note that this decline was at the most illiquid time of the day.

The SPX Premarket spiked up to the 50-day Moving Average, but could not hold it.

We saw a payrolls miss this morning that may now move all the algos to the other side of the boat.

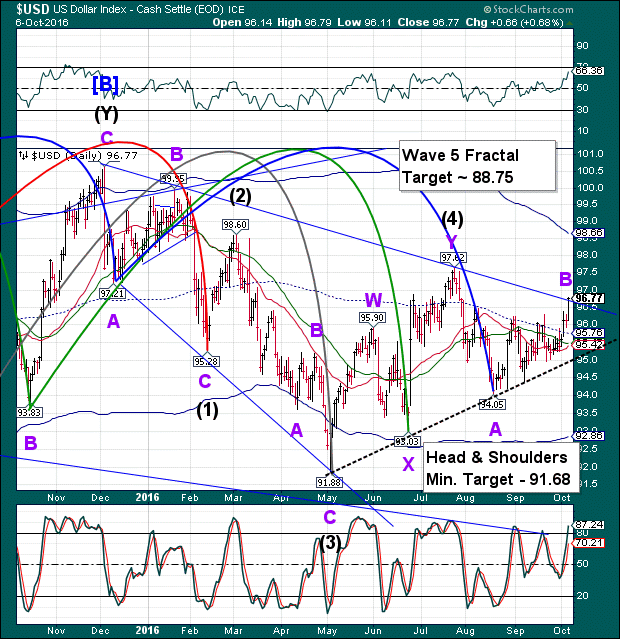

USD spiked to 97.21 this morning. However, it has moved back down to 96.70 as I write. B Waves may exceed their parameters, i.e. trendlines on occasion. However, the Cycles Model has been suggesting that the USD is at the limit of its move.

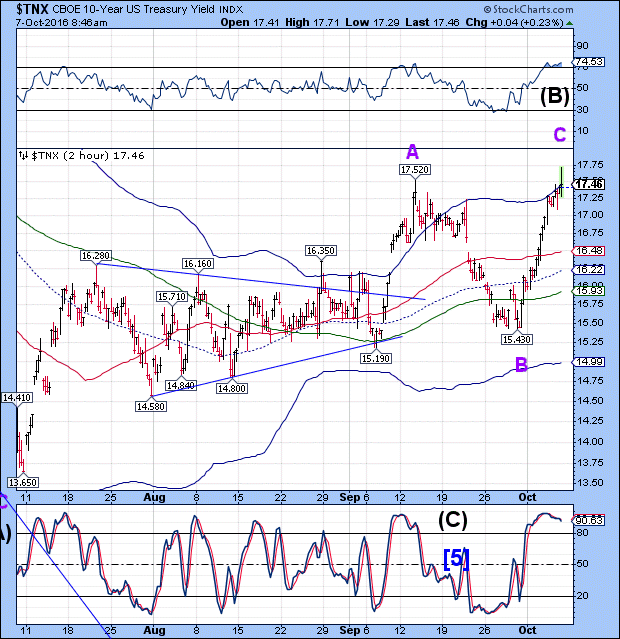

TNX may also be at the limit of its move. I had not originally thought this move would exceed the 17.52 high, but now it appears that this is a higher degree move.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.