Gold Mining Shares in a World of Hurt

Commodities / Gold and Silver Stocks 2016 Oct 07, 2016 - 10:26 AM GMTBy: Dan_Stinson

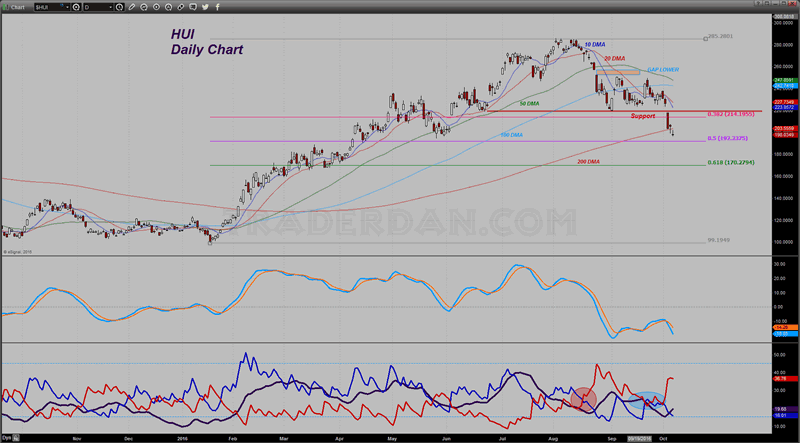

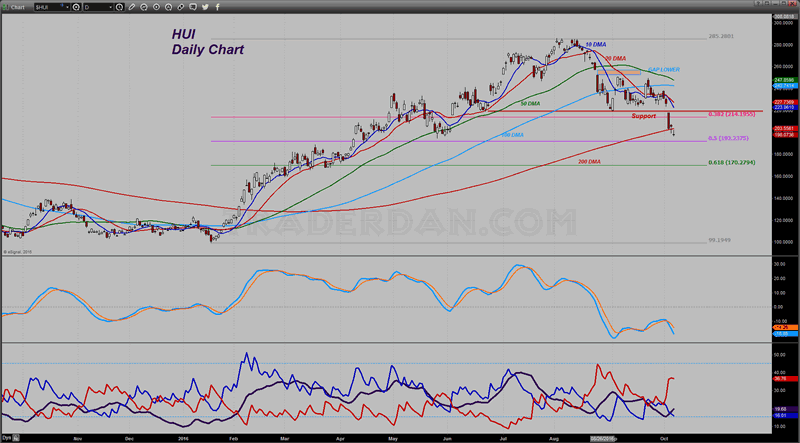

The HUI is coming unglued on the charts with the index falling below long term chart support at the 200 day moving average in today’s session. It had not been below that key technical indicator since early February of this year.

The HUI is coming unglued on the charts with the index falling below long term chart support at the 200 day moving average in today’s session. It had not been below that key technical indicator since early February of this year.

We are also now seeing the 50 day moving average and the 100 day both moving lower.

More importantly, the ADX line, is now beginning to rise as the price moves lower. This is ominous as it suggest, NOT CONFIRMS – that the possibility of a trending move lower in the shares is underway.

The index is a mere 6 points away from having retraced exactly half of the entire move up this year. You can see that 50% Fibonacci retracement level coming in near 192.

That really is the last line of defense for the bulls. They either hold it there or it is non unreasonable to expect a move all the way back down to 170.

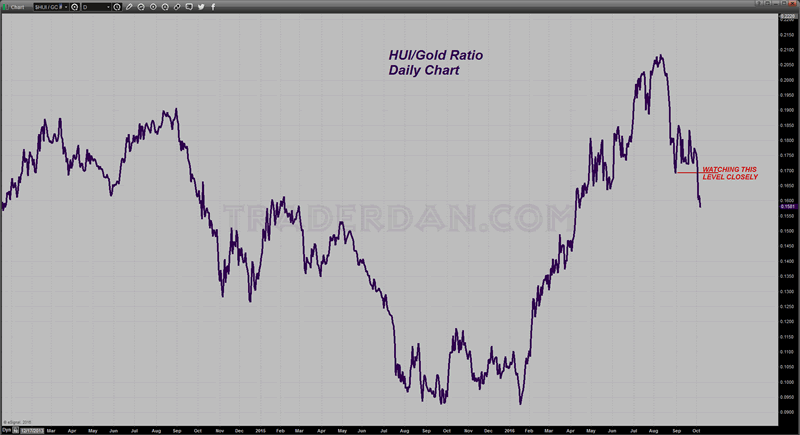

The other problem with the mining share weakness is that it is telegraphing more losses in the gold price itself. Look at how sharply the HUI/Gold ratio is now falling.

The one saving grace that I see in the gold area is the fact that the reported gold holdings in GLD have yet to experience a substantive drop. Look out if that starts to happen.

We have a payrolls report due tomorrow morning for the month of September. If it is strong, gold is not going to hold. The only hope for the bulls right now is that the report is weaker or weaker than the average pre-report guess.

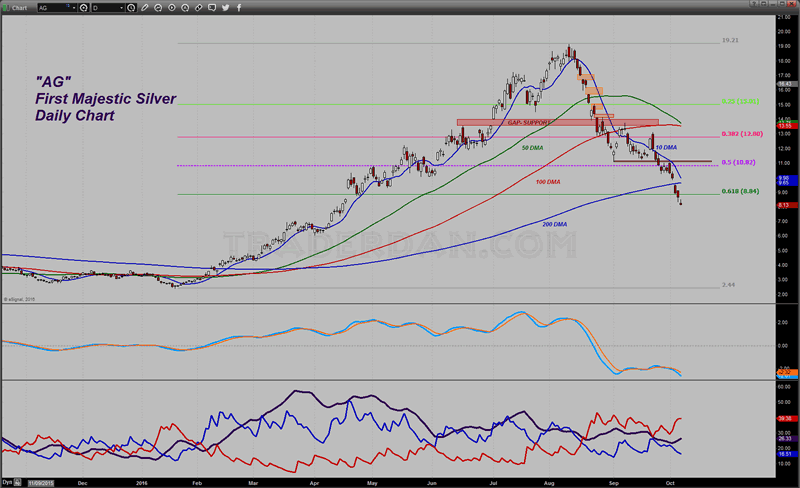

By the way, First Majestic, cannot get any upside traction.

This suggests that silver has further yet to fall.

It is amazing to me to watch a stock lose 60% of its value in the matter of 2 months.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.