Deutsche Bank Could Be the Demise of Germany

Stock-Markets / Financial Crisis 2016 Oct 04, 2016 - 02:43 PM GMTBy: Harry_Dent

The first bad news broke following the third quarter of 2015. Deutsche Bank reported a loss of $7 billion. The news just keeps coming with low or negative earnings thanks to bad loans in Germany and abroad.

The first bad news broke following the third quarter of 2015. Deutsche Bank reported a loss of $7 billion. The news just keeps coming with low or negative earnings thanks to bad loans in Germany and abroad.

In my February 19, 2016 edition of The Leading Edge, I issued a clear and stern warning about Deutsche Bank and about a second banking crisis looming. I explicitly said…

The Telegraph ran an article yesterday asking if Deutsche was the next Lehman. Is there an echo in the room?

Without a doubt, things are coming to a head at the bank. It's heavily exposed to the fracking industry in the U.S., which is sure to see continued rising defaults ahead. It has the largest derivatives exposure of any bank, at $54.7 trillion (and that's not a typo) out of the worldwide total of $550 trillion. And now, the U.S. Justice Department is slapping on a $14 billion fine for fraud in mortgage security sales.

Deutsche's market value is now only $16 billion. How can it afford to raise capital to pay this fine or to cover future large losses?

Even worse, the hard line that Merkel has taken against bailing out Italian banks (requiring bail-ins by larger depositors instead) has forced her into declaring that there can be no bail-out or assistance for Deutsche Bank, either.

She's obviously between a rock and a hard place. If she helps bail out Deutsche it would damage the euro. If she doesn't it could take the country down, and her along with it.

Evidence keeps mounting that Deutsche Bank could very well be the riskiest bank in the world (something I've been saying for months now).

The table below shows that Deutsche only has capital that is 2.68% of its assets - the worst of all major global banks. A healthy bank requires a level of 10% or more.

So much for how well capitalized the banks are after 2008!

The best bank of this risky bunch is Wells Fargo, with capital that is 8.01% of its assets. But it faces fraud problems of its own.

The riskiest top seven banks are all in Europe.

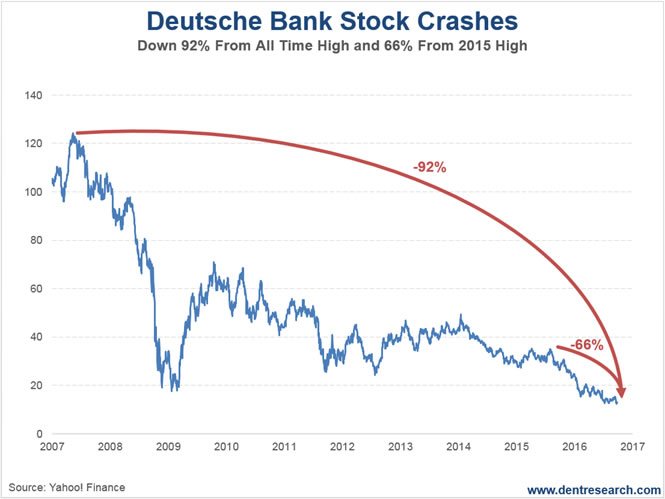

Unsurprisingly, Deutsche Bank's stock dropped another 6% on Monday, when Merkel declined aid. That puts it down 92% from its 2007, all-time high and 66% since August 2015!

How is it possible that Deutsche Bank - and most global banks for that matter - have seen stock prices decline massively in the last year, while the broader stock markets keep edging up?

Quite frankly, it isn't!

If the U.S. large-cap markets haven't already topped in early September, I say they'll do so before year-end… most likely in early December when the Fed comes back up against raising rates or losing all credibility.

And by then, Italy's 18% (and rising) non-performing loans and Deutsche Bank's $14 billion fraud fine will likely have come to a head.

Deutsche Bank and Italy look to be the most likely triggers for the next crash - one that will be far worse than the subprime crisis in the U.S. in 2008.

It won't be hard to bring down Germany given it has the worst demographic trends in the world into 2022! All we need is a trigger to reveal the underlying weakness created by the greatest debt bubble in history and the most irresponsible monetary policies ever, and this house of cards will collapse.

It looks to me like the fuse is lit…

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.