I Don’t See How Germany Can Contain the Deutsche Bank Collapse

Companies / Financial Crisis 2016 Sep 30, 2016 - 09:43 PM GMTBy: Graham_Summers

Let’s talk about Deutsche Bank (DB).

Deutsche Bank is the 11th largest bank in the world. It has assets of $1.8 trillion and over ~$60 trillion in derivatives on its books.

From a balance sheet perspective, DB’s balance sheet is 50% the size of Germany’s GDP. By way of comparison, imagine if JP Morgan was a $9 TRILLION bank. That’s effectively DB’s status in Germany.

However, it’s DB’s derivative book that is the real problem as far as the markets are concerned. As I mentioned before, DB has ~$60 trillion in derivatives. And unlike the other derivatives giant of the financial world (JP Morgan with $52 trillion in derivatives), DB is based in Europe.

What are the differences?

Europe is where Negative Interest Rate Policy (NIRP) Brexit and exposure to a banking system that is entirely too laden with debt has proven a disastrous cocktail.

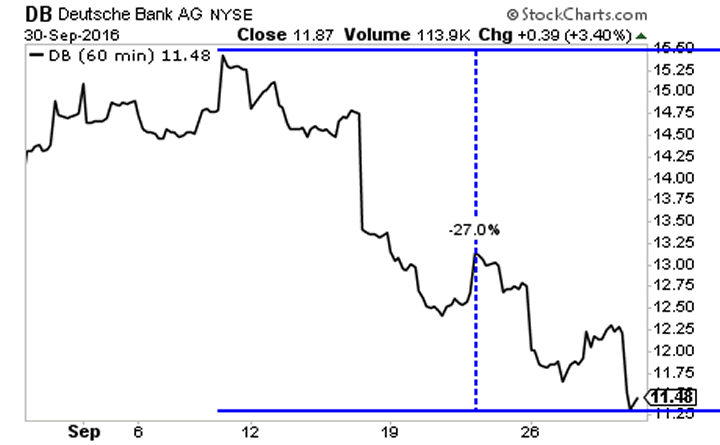

What precisely has hit DB remains to be seen. But something happened in the first two weeks of September that triggered a market meltdown. DB shares have fallen straight down a total of 27% since that time.

Now we are in full-blown panic mode. This bank is too big to bailout and too big to bail-in. Moreover that massive derivatives book connects DB to over 200 financial entities. Unwinding it will be catastrophic.

This could very well lead to a 2008 type Crash. To be blunt, I don’t see how Germany or the ECB can contain it.

Seriously at this point, if you’re not taking out a trial subscription to our Private Wealth Advisory newsletter, I don’t know what else to tell you.

First of all, I’ve lead subscribers to close 112 STRAIGHT WINNING TRADES. This is a record in investing, even greater than our 74 trade winning streak back in 2012.

In September alone we’ve closed WINNERS of 6%, 8%, 11%, 14% and 19%.

And the last time we closed a LOSER was in NOVEMBER 2014.

So… you’re talking about closing nothing but winners for nearly TWO YEARS STRAIGHT, SETTING A RECORD FOR LONGEST WINNING STREAK.

If you don’t believe me, you can take out a trial for 30 daysfor 98 cents.

If you find Private Wealth Advisory is not what you’re looking for, simply email us and you won’t be charged another cent.

However, I have no doubt you, like our other subscribers will stay with us. Most subscribers make enough money on a single one of our trades to cover the cost of an entire YEAR’S subscription (just $199).

Indeed, less than 10% of subscribers choose NOT to stay with us. And the ones that DO cancel do so because they’re simply not active investors and prefer owning a single mutual fund.

I know you’re not that kind of investor. You’re looking for regular market crushing gains and minimal losers to grow your capital like a rocket ship.

To take out a 30 day trial subscription to Private Wealth Advisory for just…. 98 cents.

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.