After the Debate, the Deluge?

ElectionOracle / US Presidential Election 2016 Sep 30, 2016 - 01:36 PM GMTBy: David_Galland

Dear Debate-Watchers,

Dear Debate-Watchers,

“I guess he is a buffoon after all. Too bad.”

Those words were written by a dear friend and, until the lights went out on the first presidential debate, the most ardent of Trump supporters.

For the debate, a group of us had gathered at the Social Club at La Estancia de Cafayate here in the Argentine outback.

Most of our group were expats who, yearning to be free, have voted with our feet. Therefore, not indicative of broader US demographics.

It’s safe to say the audience was hopeful that Trump would wipe the proverbial floor with Mrs. Clinton. Within a few minutes, however, it became apparent it was not The Donald holding the mop handle.

If proof was ever needed that Hillary is a skilled politician, the debate provided it. She speaks in complete sentences, adroitly dodges sticky questions, and wields the rhetorical knife like a Colombian sicario.

Of course, Hillary had help. It often seemed as if the moderator had sat in on Hillary’s debate preparation, studiously taking notes as her team made helpful suggestions on questions he could use to blindside Trump or topics to be quickly passed over should they arise. Topics such as war-starting and email-server emptying.

But the moderator’s lack of impartiality ultimately didn’t matter, because, to the great detriment of the American Dream, The Donald could hardly string together a single coherent thought. Trump huffed and puffed—and oddly, sniffed—but in the end couldn’t have blown out a paper match.

When he did make an understandable point, as often as not, I disagreed. For instance, it seems like he’s advocating imposing a fresh round of trade tariffs, something that history has proven time and again to be a bucket of cold water over the free flow of goods and services. And he appears to favor using US military muscle to “take the oil” of Middle Eastern countries.

So, here we are.

And by “here,” I mean on the verge of electing the ultimate statist and an unindicted conspirator in too many shady deals to list here.

The Real Problem

As mentioned last week, this month’s edition of Compelling Investments Quantified, released yesterday, leads off with a fairly deep dive into the regulatory morass gunking up the workings of the US and global economies.

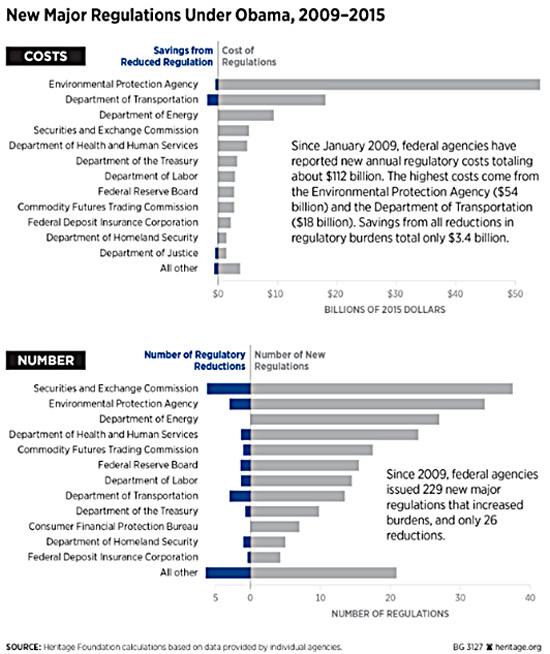

To give you the smallest sense of the situation, the graphic below shows the stunning increase in regulation under Obama.

As you can see, the biggest new burden foisted on the economy is an aggressive ramping up of the Environmental Protection Agency, Grand Inquisitors of the Holy Church of Weather Worriers.

While I have long held the attitude that anyone wanting to be a politician is possessed of serious character flaws, I confess to caring about Trump winning the debate and, more to the point, prevailing in the November election.

My reasons were not that he is a man of stellar character with a firm grasp on the issues, but rather because it is clear from his many public actions that he is not a politician in the conventional sense.

Therefore, the Pollyannaish side of me hoped that, upon taking office, he would stop providing water and nutrients to the growing bureaucracy that is literally destroying the US economy, as well as the very idea of America.

And by the latter, I mean a corner of the Earth where private property rights are respected and where everyone has a decent shot at attaining whatever it is they deem to be success.

You know, the America where rugged individuals are considered archetypical.

Instead, the American entrepreneur is forced to struggle through a minefield of politically correct landmines and hundreds of thousands of pages of laws and regulations.

Should he or she succeed financially, the government celebrates such success with progressively punitive taxes.

As a symbol of the New American, I would nominate campus Safe Spaces, such as the one promoted on the sign shown here, from the hallway at Hofstra University where the presidential debate was held.

I will now briefly pause, dear readers, to let out a string of loud and very politically incorrect expletives.

That out of the way, and falling in line with what it means to be an American in this day and age, I must confess to feeling “triggered” by the implications of Trump’s debate pratfall.

After the Debate, the Deluge?

During the debate, Mrs. Clinton made it clear that—rather than reversing the tide of regulation and taxation, prerequisites to getting the US economy off the blocks—she is going to double down.

Starting by ensuring that those individuals whose energetic pursuit of success has resulted in them earning above-average incomes are forced by the state to “pay their fair share.”

We all know how unfair that statement is, given that the top 1% of income earners already pay about half of all income taxes, while the bottom 80% pay just 20% of the total. And a very large percentage of that total pay no taxes at all.

Mrs. Clinton is aware of these facts, but fairness and facts have no role to play in Progressive America. The only thing that counts is how the narrative plays with the rubes.

Will she be worse than Obama in terms of regulations and implementing punitive taxes? Based on her history and stump speeches, the Magic 8 ball points to “YES.”

The following quote is from a Clinton-fawning article in the Huffington Post, entitled, “The Future of America Is Being Written in This Tiny Office.”

“...Clinton’s plans are as unambiguously progressive as any from a Democratic nominee in modern history—and almost nobody seems to have noticed.”

Among those plans are free college for the 50% or so of Americans who are already not paying any taxes; subsidies so no one has to pay more than 10% of their income on child care; guaranteed paid family leave; new layers of special treatment for non-whites and non-heterosexuals; new regulations to help unions regain their bargaining power and even, in her own words, to “rewrite the rules” on capitalism.

And so, at the very point in time when the US desperately needs to cut away the bureaucratic Kudzu holding back capitalism, the country is falling into the hands of a socialist sociopath who views the state as a hammer to be unhesitantly used to beat society flat.

In addition to higher taxes for those on the wrong side of the income divide, and more handouts for those on the right side, I think we can correctly anticipate some other consequences of Zer election as La Presidenta, many of which will have implications for investment markets:

- Bank bashing. Mrs. Clinton has promised, when elected, to burden the banks with even more regulations. Coming on top of the massive Dodd-Frank bill, the flow of bank funds, which in a healthy economy provides upwards of 90% of total money supply (M4), will continue to remain frozen.

- Dastardly deeds done to dirty energy. Oil, gas, nuclear, and in particular coal—are going to come under even greater pressure. Fracking is going to get fracked.

- Obamacare is dead, long live Hillarycare. Make no mistake, Hillary and her brain trust will set about “fixing” Obamacare by adding yet more bureaucracy. Universal healthcare was her pet project back in the day. She is plenty peeved Obama pulled off his version of it and so will go to great lengths to make it her own again.

- Political correctness on steroids. The morning after she is sworn in, Hillary will get to work pandering to the miscellany of special interest groups to win a second term. With George Soros on her arm and supported at every turn by the not-so-invisible hand of Silicon Valley, she’ll find ways to assure Black Lives Matter in every way they think they should matter. Ditto, the Hispanic populations and every other non-white male demographic, especially Bernie’s Millennials, who will be a far bigger factor in the next election than they are in this one.

- An economic circus, but not of the funny sort. The US economy—and most of the world’s largest economies—have suffered extensively at the hands of government bureaucrats who, through ignorance or deliberate malfeasance, have burdened it with regulations to the point of breaking.

However, given that Clinton will have grand plans to make her tenure historically significant for something more than possessing a womb, you can expect a tidal wave of new regulation designed to create a more perfect world.

As the new wave of regulations will threaten to kill the already gagging golden goose, the Clinton administration will need to get very creative to keep the deficits from running amok.

I can’t even begin to guess how, but literally anything that can be imagined is on the table. Wage and price controls, higher estate taxes, big penalties for companies with assets overseas (unless, of course, her hubby is on the board), confiscating foreign-held assets… really, anything is fair game.

- Prosperity on hold. Most importantly, instead of turning back toward the light, a Clinton victory ensures that the current economic stagnation and the attendant societal tensions will only worsen. Rig for a long dark night and for the deluge that is all but certain.

While the blame for the precarious situation the US finds itself in could justly be placed at the feet of any number of players, and extends well back in history, at the risk of angering some dear readers, in terms of the here and now, I choose to throw a razzberry in the direction of Donald Trump.

That’s because he arrogantly failed to properly prepare for the debate. As a consequence, he walked into one sucker punch after another and, when smacked, had no snappy retorts prepared to steer the debate back to themes less flattering to his opponent.

By failing to prepare, he let down the millions of people who had allowed themselves to become reengaged in the political process and who dared hope the cultural Marxism overrunning the nation could be slowed.

Of course, there is another possible explanation for Trump’s performance. Maybe he did prepare rigorously for the debate—and according to his campaign co-chair, he did—in which case, could his dismal performance be a sign that, per my friend’s assessment, he actually is a buffoon? Or, as they say in Texas, he’s all hat and no cows.

Regardless, his dismal showing has fully exposed the tender belly of what was left of the American dream, granting a big opening for the progressives to move in for the kill.

Game Over?

Given the debate disaster, is it game over for Trump and, by extension, America?

It’s impossible to say. On the one hand, demoralized as Trump’s supporters may be, the idea of President Hillary is probably enough to get them off their couches come election day.

In fact, much to my surprise, following the debate, Trump’s fundraising efforts soared. And while I have heard from many Trump supporters who share my assessment of his debate performance, every one of them appears to remain committed to their candidate come election day.

However, as far as independents go, I think his performance may have poisoned that well for good.

At the end of the day, it will all come down to turnout. Whereas prior to the debate, Hillary couldn’t get any respect, I don’t think anyone who watched could deny that she appeared more presidential.

Condescending? Arrogant? Slippery? Absolutely.

But at least she was coherent.

I cannot tell you how it pains me to write these words, because I tend toward optimism in my life. Despite having removed our family from ground zero, I had hoped the driving force behind Trump’s near miraculous candidacy—an up-swelling of popular anger at the poor condition the bureaucrats have left the country in—heralded a step back toward the path of sanity for the United States.

Maybe Trump just had a really bad day and will do well enough in what’s left of the campaign season to prevail. And maybe, if elected, he’ll surround himself with smart people and then wander off to the nearest golf course like his predecessor.

At this point, given the choice between the anti-capitalist crook and the big unknown that is Donald Trump, I would still have to pull the lever for Trump and hope for the best.

However, after the dismal debate, the future has just gotten a lot more unpredictable.

David

P.S. This just in, from hard science site, WattsUpWithThat.com

“US Presidential Candidate Donald Trump has signaled a drastic revision of US environmental policy, by nominating high profile climate skeptic Myron Ebell to head his proposed “EPA transition” team.”

There’s hope after all! Here’s the story.

Speculator: More Than Just a Good Read

Doug Casey, my longtime friend, former business partner, and closest neighbor here in Argentina, has done something pretty special. Following his dreams of many years, he—along with co-author John Hunt—has written the first in a series of novels.

The first, Speculator, introduces us to the lead character, a highly intelligent, adventurous, and philosophically sound individual whose life path has led him to a mining district in the African jungle. I don’t want to give away the plot, but as the book unfolds, the hero becomes entangled in a deadly fraud and, to make things worse, is unfairly targeted by the US government.

After reading Speculator while still a work in progress, I wrote Doug to congratulate him on creating a compelling page turner. But it’s more than that. The book’s philosophical revelations, smoothly weaved into the fabric of the action and adventure, give it the sort of credentials you might find in a novel by Ayn Rand.

That makes it the sort of book that will not only keep you up late at night—I read it in just a couple of sittings, which I almost never do—but that you’ll want to share with people you care about, especially children and grandchildren.

Congratulations, Doug, I am very much looking forward to the next installment. Here’s a link to the Amazon page.

Here Come the Clowns

Man Has Baby! In an attempt to not trigger anyone, here’s a fair warning that for today’s clowns feature I will be discussing “transgender” issues in an unflattering fashion. You see, this week our senses were assaulted by a headline that a Man Has Given Birth to a Baby—a World First!

Really? How did that come about? You know, it would seem impossible, men lacking a uterus and all.

So, here’s the deal. A woman who decided she wants to live as a man, meets a man who has decided he likes playing dress-up and living as a woman. As the relationship evolves, they fall in love. And have sex.

Lo and behold, apparently managing to figure out which parts go where despite their gender confusion, the woman in the relationship gets pregnant. But because she dresses up as a man, voilà, we have headlines that a “man” has managed to get pregnant.

Surely I can’t be the only person who views this sort of alternative reality skeptically?

And with that, I will sign off for the week, thanking you for reading and reminding you we now have a commenting feature at the bottom of this page if you wish to weigh in on any of today’s topics.

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.