Has Dow Theory Lost its Relevance: Stock Market Ignored it and Rallied to New Highs

Stock-Markets / Stock Markets 2016 Sep 30, 2016 - 01:29 PM GMTBy: Sol_Palha

"A stop sign is a gift for you to learn that moving in the same direction won't take you any place new." ~ Rex Steven Sikes

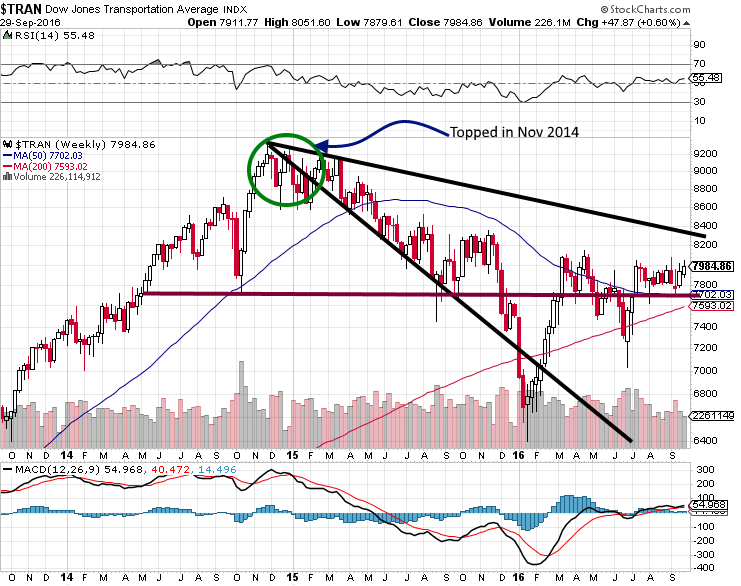

The transports topped out in November of 2014, and according to the Dow theory this is a big negative; the Dow industrials should have followed suit. Instead, the Dow soared higher paying no heed to this theory proving to a large degree that this theory has lost its value. After all, it is a theory and the definition of a theory is "a supposition or a system of ideas intended to explain something, especially one based on general principles independent of the thing to be explained."

That is why way back in 2006 we offered a Dow theory Alternative that has proved to be far more accurate and reliable than the Dow theory. Just to let this sink in, the transports topped out almost two years ago and instead of trending lower the markets have surged to new highs. If you look at the above chart, the Transports appear to be finally gathering momentum and to break out.. In the Dow theory alternative, we stated it was the Utilities that lead the way as opposed to the Dow transports, well let's see if that holds true.

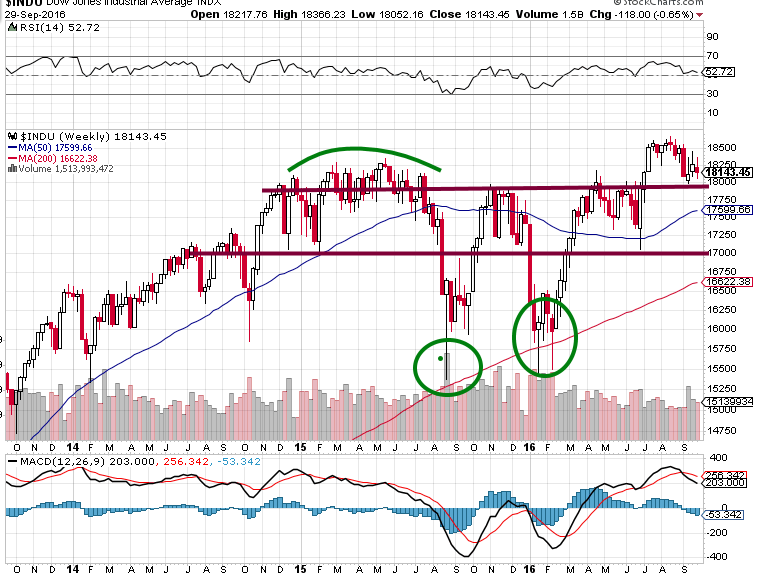

In the chart above, the utilities topped after the Dow transports, let out some steam and then soared to new highs. Even though the correction appeared to be strong, the Dow utilities held above the main uptrend line. Right off the bat, we can see that the Dow utilities are a better barometer of what one should expect from the markets. The Utilities topped in Feb of 2015, and after that the Dow trended sideways before correcting, illustrating that they follow the lead of the Utilities and not the Dow transports.

The Dow utilities bottom towards the end of August 2015 and rallied until Nov of 2015 before pulling back again. The Dow followed in the utilities footsteps. It bottomed in Jan of 2016, while the utilities bottomed on Dec of 2015; once again leading the way. After that utilities rallied until July 2016 before pulling back.

The Dow rallied until Aug of 2016, proving again that the utilities are a better indicator of market direction than the Dow transports. At this point, it appears that the utilities are building momentum to take off again. If the pattern holds, then the Dow should follow in its path.

It is also interesting to note that after almost two years of two years of doing nothing, the Dow transports are also attempting to break out.

Something to keep in mind

Paying attention to what the utilities are doing going forward could prove to be rewarding. Once the Dow utilities start to trend upwards, it should serve as a strong signal that the Dow is going to follow in its path

Conclusion

The Dow utilities and the Dow industrials both traded to new highs which means rather than leading the way up; they are propelling individuals to draw the wrong conclusion. The Dow Theory ceased to work properly a long time ago and in the era of hot money; today it is having a hard time trying to be of relevance. The alternate Dow Theory that focuses on the utilities is a better option. Thus, maybe it is time to put this 100-year-old theory to rest; we will let you be the judge.

"Impiety. Your irreverence toward my deity." ~ Ambrose Bierce

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.