Massive Chinese Debt And Why They Are On A Gold Buying Binge!

Interest-Rates / China Debt Crisis Sep 28, 2016 - 12:51 PM GMTBy: Chris_Vermeulen

China’s debt is a staggering $24 trillion with 247% of annual GDP as of last year, which is, in fact, an increase of an astounding 465% within a decade. The total borrowing by both the financial and non-financial sectors was only 78% of the GDP in 2007 and has since increased to 309% of GDP according to economists at Nomura Holdings Inc. led by Yang Zhao and Wendy Chen.

China’s debt is a staggering $24 trillion with 247% of annual GDP as of last year, which is, in fact, an increase of an astounding 465% within a decade. The total borrowing by both the financial and non-financial sectors was only 78% of the GDP in 2007 and has since increased to 309% of GDP according to economists at Nomura Holdings Inc. led by Yang Zhao and Wendy Chen.

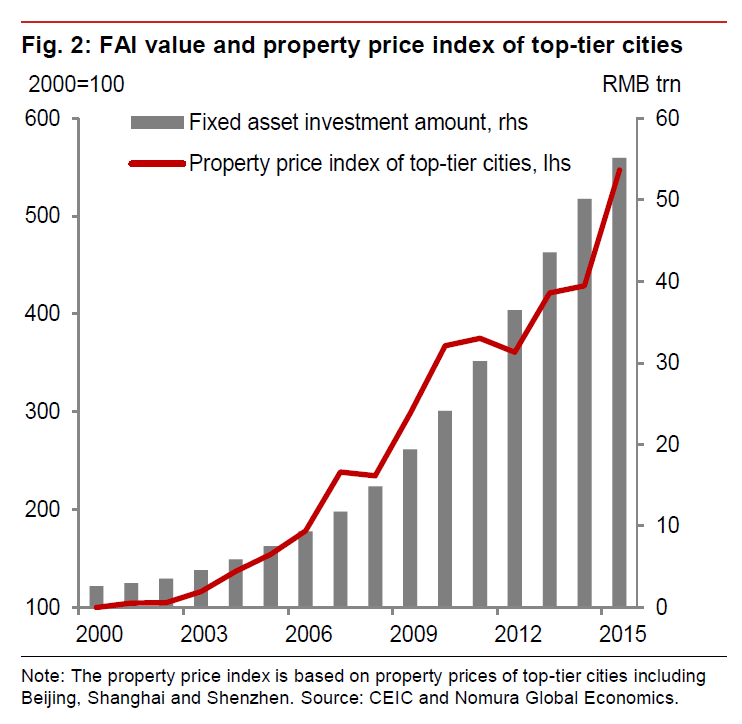

Some naysayers believe that the leverage in China is still far below that of what the U.S. was in 2007 previous to the financial crisis. However, they neglect to note that the property sector has increased by 4.5 times between 2000 and 2015 within the top-tier cities. Experience suggests that such a rise is both unsustainable and "bubbly." A sharp drop in the property prices will increase the leverage to astounding levels, thereby threatening their economy.

Huge Fiscal Deficit Challenge

The IMF has forecasted that China will have a moderate budget deficit of 3%, which sounds very comfortable. The IMF has merely considered the government's debt so as to arrive at said figure, which accounts for less than 20% of public spending. The local governments and municipalities in China account for over 80% of public spending.

When the total figures are considered, this balloons to 10% according to the IMF, whereas, Goldman Sachs believes that number is much higher - above 15%. These numbers are far worse than those in the United States directly before the financial crisis of 2008. Learn more here: fiscal deficit

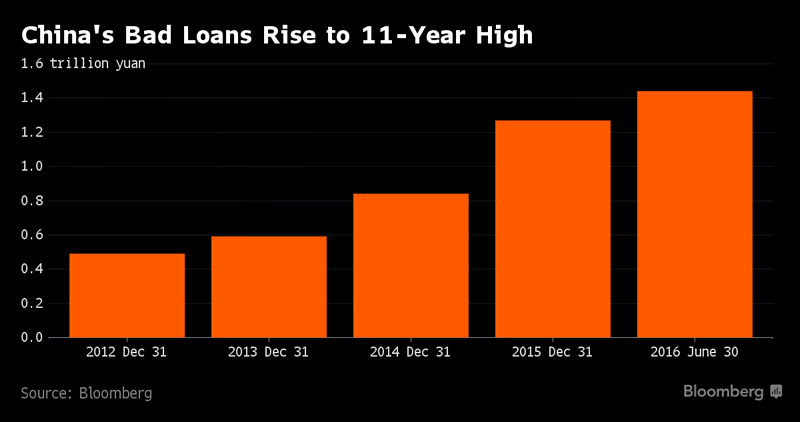

Most state-owned companies are taking on more debt in order to pay off their earlier debt. Bad loans soar, as shown in the chart below. The government has not allowed any major firms to become bankrupt in order to keep their job numbers propped up. If they start to let companies fail, unemployment numbers could skyrocket!

Growth Is Struggling

With growth struggling, and in order to merely reach those of the beaten down estimates of the Chinese government, it appears highly unlikely that China will be able to manage their debt overhang.

In light of the forthcoming five-year congress of the communist party, the government will not want to push through unpopular reforms, although they are indeed necessary. The Chinese debt binge has reached such a vast amount that the experts now believe that in order to raise the GDP by $1.00, China must take a credit of $4.00, which is most certainly a sign of an impending crash that will have both global repercussions and further consequences!

Major Investors Who Have Raised Concerns About China

Legendary investor George Soros finds an “eerie resemblance” between the U.S. prior to the financial crisis and the current Chinese situation. “It’s similarly fueled by credit growth and an eventually unsustainable extension of credit,” Soros told the Asia Society in New York in April, reports Bloomberg.

Similarly, BlackRock Chief Executive Officer Laurence Fink has also raised concerns about the Chinese debt.

The famous short seller Jim Chanos is short on China while stating that it "is the gift that keeps on giving on the short side," reported CNBC, in May of 2016.

China Shifting From Dollars To Gold!

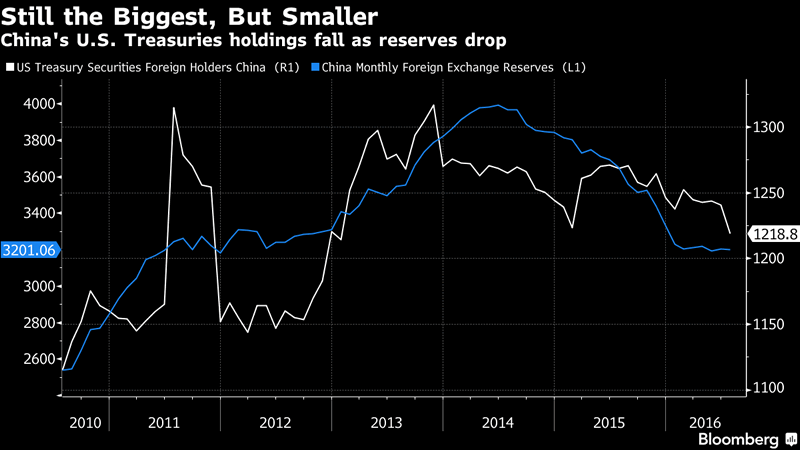

China is gradually reducing its’ holding in U.S. treasuries. In July, it held $1.22 trillion in US bonds, notes, and bills, which represents a drop of $22 billion since June of 2016. This is the largest drop, in three years according to U.S. Treasury Department data that was released on Friday, September 16th, 2016.

There are many who believe that China’s mammoth holdings of US Treasuries will restrict it from dumping them. However, Bocom strategist Hao Hong said, "The gold reserve on the China balance sheet has almost doubled since 2009. By holding gold, and moving away from a US-dollar centric system, we actually require less U.S. dollars," reports Zero Hedge.

China’s gold holdings, which was a paltry 395.01 tons in the second quarter of 2000, has now risen sharply to 1,828 tons, according to the World Gold Council.

With the Chinese Yuan set to enter as the fifth currency in the International Monetary Fund’s SDR (Special Drawing Right) on October 1st, 2016, the Chinese are propping up the gold-backed Yuan as a fierce competitor to the U.S. dollar!

"The recently-opened Shanghai Gold Exchange differs greatly from the London Gold Exchange in one fundamental area: In Shanghai, buyers take physical delivery of gold whereas London deals in paper-based gold futures contracts. In Shanghai, ‘what you buy is what you get' whereas in the West, gold is a virtualized commodity," Tom McGregor, Commentator and Editor at CNTV (China Network Television), told Sputnik.

Conclusion

Similar to that of other developed nations, the Chinese debt has also reached "bubbly" proportions. However, the Chinese are leaning towards gold in a big way, as witnessed in their latest holdings. They know that during the next crisis those nations with a large gold backing will not only survive, but will become prosperous as well!

China is most certainly going to increase their gold reserves even further in the future. Imagine if only a portion of their U.S. treasury holdings are shifted to gold - the yellow metal will go parabolic. Therefore, keep an eye on gold and be well prepared to buy it when we reach that last dip before the bull run.

Want to know where gold, silver and mining stocks are within their bull/bear market cycles? Or do you want to know when and how to take full advantage of these next major moves?

Follow me at www.TheGoldAndOilGuy.com

Chris VermeulenChris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.