Warren Buffett Is the Latest Billionaire To Jump Ship From The Markets

Stock-Markets / Financial Markets 2016 Sep 27, 2016 - 12:54 PM GMTBy: Jeff_Berwick

Right now the market is perceived to be so dangerous that it’s even chased the most fearless value investors to the sidelines.

Right now the market is perceived to be so dangerous that it’s even chased the most fearless value investors to the sidelines.

Just this evening, in the Presidential debate, Trump warned that the stock market was a bubble “about to pop”.

Now, the bearish billionaire circle has grown even wider with the addition of Warren Buffett.

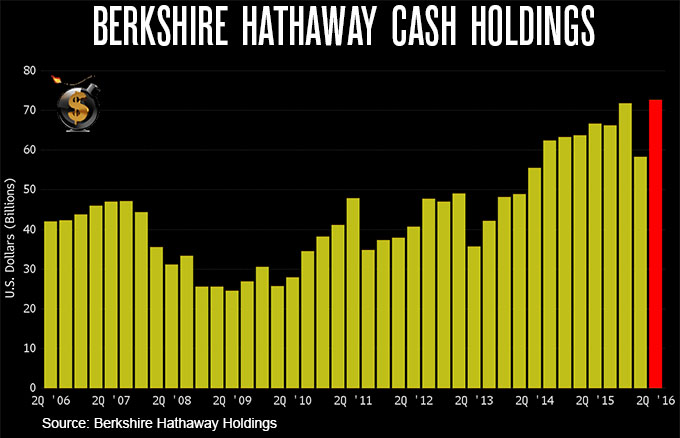

The “Oracle of Omaha” as he’s known, currently has more money outside the markets than ever before in his five decades running Berkshire-Hathaway.

This is a striking fact considering that Buffett is very well known for his long-term investment strategy – an approach that requires one to constantly have most of their capital tied up in order to generate consistent returns.

That’s right, as the S&P 500 is near record highs, Warren Buffet is more out of the market than he has ever been and waiting for a collapse.

That the 86 year old has so much dry powder, shows his anticipation of a massive market crisis and quite possibly the biggest buying opportunity of his life. Just like us, Buffet is ready to survive and prosper through this calamity.

And with asset prices at all time highs and CNBC and Fox business puppets still perpetuating the great recovery myth, you might expect all these smart money billionaires to be piling into stocks to ride the upside. Instead they obviously know the “goldilocks” recovery holds true to its name’s fairytale origin.

They say “follow the smart money”… and Buffett is known as one of the smartest!

And even more multi-billion dollar fund managers are coming out and warning.

Tad Rivelle, the chief investment officer of TCW’s $195 billion investment fund, is yet another outspoken multi-billion dollar fund manager who’s expressed concern about the economy and monetary policy gone awry.

Rivelle mentioned in a Bloomberg interview last week that he thinks it’s “Time to leave the dance floor” because, to paraphrase, corporate debt is piling up faster than income is increasing.

In a note to investors Rivelle argued, “Face it: the central banking Emperors have no clothes.” he continued:

“…The Fed could continue to use its printing press to falsify capital market signals, but to what end? When a central bank buys an asset with an electronically printed dollar, a “something for nothing” trade has taken place. Unless everything we understand about economics is plain wrong, the Fed cannot go on blithely adding printing press dollars to the system and expect no ill effects.”

The letter continues:

“Our counsel remains as it has been: avoid those assets that will be broken in the coming de-leveraging while keeping a ‘steady as she goes’ attitude towards the future purchase of those assets that will merely bend when the flood comes.”

He actually called the coming de-leveraging, “the flood”. Even the language of these top money people is biblical in nature.

When we first began ringing the alarm bells about an impending financial crisis last summer, we were nearly the only ones doing it. Then, month after month, some of the biggest names in money and finance have not only climbed aboard our bandwagon, but have practically stampeded past us.

Now, we can barely keep up with the amount of people warning of impending doom.

Last summer we made a call for subscribers that earned 4,500% in just three days by calling the market crash in late August correctly.

And, our Senior Market Analyst, Ed Bugos, has just reissued a very similar play in an alert to Premium subscribers on September 16th.

There is no guarantee we’ll make another 4,500% gain in a short amount of time, of course. But it is virtually the exact same investment play we made last summer which made a fortune.

And, that was before we had the likes of Soros, Trump, Rothschild, Jim Rogers and numerous other billionaires, also feeling the same way as us.

We are now less than a week away from the end of the Jubilee Year and if our call is right, we could again make mind boggling returns in just the next few weeks or months.

And, the best part about this type of an out-of-the-money shot is that you can put a small amount of money into it and possibly make large returns… and if it is wrong, you lose just a small amount of money.

Subscribe to TDV Premium and get immediate access to Ed Bugos’ pick in his alert of September 16th.

If the ship’s going down, and soon, it’ll be much more enjoyable making a massive investment return off of it than going down with everyone else.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.