SPX is testing the next level of support

Stock-Markets / Stock Markets 2016 Sep 26, 2016 - 03:02 PM GMT The SPX Premarket is challenging its Short-term support at 2156.02 and may open beneath it after closing beneath its 50-day Moving Average on Friday.

The SPX Premarket is challenging its Short-term support at 2156.02 and may open beneath it after closing beneath its 50-day Moving Average on Friday.

ZeroHedge reports, “While today's biggest event for both markets and politics will be tonight's highly anticipated first presidential debate between Trump and Hillary, markets are waking up to some early turmoil in both Asia and Europe, with declines in banks and energy producers dragging down stock-markets around the world, pushing investors to once again seek the safety of government bonds (and yes, flattening the JGB curve even more much to the chagrin of the BOJ) and the yen.”

Wave (C) has begun, with the minimum target for Wave 1 of (C) at 2044.43, the December 31 closing price. Yes, the market remembers where it has been and will revisit those stops on the return trip. Since the Head & Shoulders target is often a minimum one (usually Wave 3 of (C)), we may see the Wave 1 low closer to the Brexit low at 1991.68, setting up yet another potential Head & Shoulders formation.

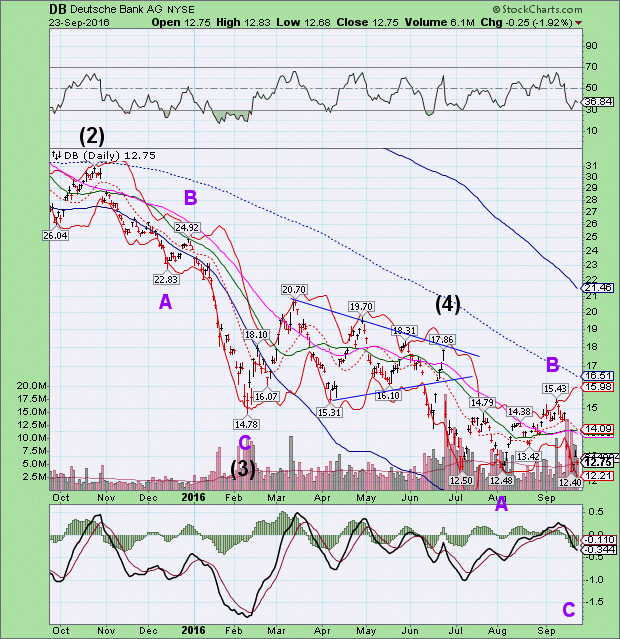

The catalyst for this move may be influenced by the actions in Deutsche Bank. It is now at 12.01 and declining.

It appears that DB may be in its final decline. Wave (1) of [C] was 24.76 points. Wave (3) of [C] was 16.04 points, a 64.78% ratio of (1). Using the same ratio, we come up with a minimum target of $5.40 per share for Wave (5). However, the normal Wave ratio for Ending Diagonals is 75-80% of the preceding Wave. This gives us a probable price range of $2.60 to $3.40 as selling runs out of control. We may even see a government takeover, essentially a bankruptcy, in which stockholders get nothing.

ZeroHedge observes, “With Deutsche Bank stock plunging to fresh all time lows in early trading after Merkel reportedly ruled out state aid the embattled German lender, the bank found itself in the unenviable position of once again having to defend its balance sheet to avoid further stock price declines, especially as doubts mounted if the German government response was due to a pre-emptive request for aid. DB quickly tried to squash such speculation when a bank spokesman said that "CEO John Cryan at no point asked the German Chancellor for the government to intervene in the U.S. Justice Department's mortgages case."

He added that Deutsche Bank will solve its problems without relying on help from Berlin, Germany's flagship lender said on Monday.”

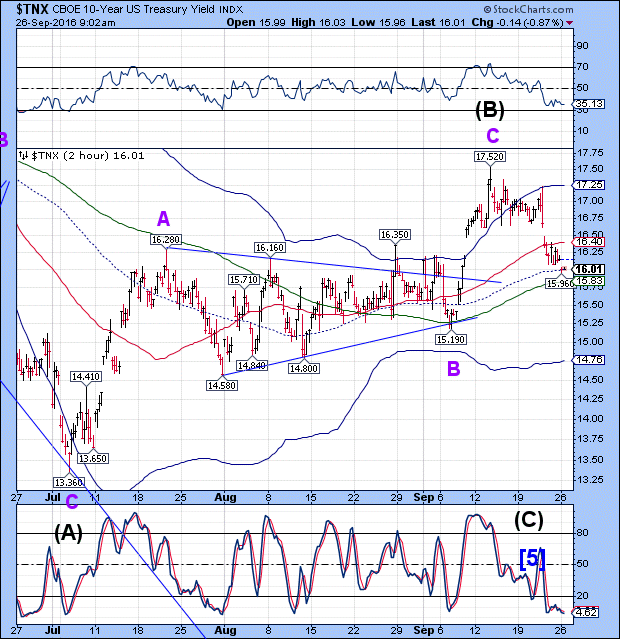

TNX has begun what appears to be an Ending Diagonal Wave (C). It still appears that TNX may make a deeper low, but I have reservations about this. The coming low may be neck-and-neck with the July 8 low at 13.65.

Bloomberg reports, “They’ve long been one of the most reliable sources of demand for U.S. government debt.

But these days, foreign central banks have become yet another worry for investors in the world’s most important bond market.

Holders like China and Japan have culled their stakes in Treasuries for three consecutive quarters, the most sustained pullback on record, based on the Federal Reserve’s official custodial holdings. The decline has accelerated in the past three months, coinciding with the recent backup in U.S. bond yields.”

Then we have the Trump vs. Clinton debate tonight. What more do we need for a breakdown?

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.