Gold Rises 1.5%, Silver Surges 3% After Fed Stays Ultra Loose At 0.25%

Commodities / Gold and Silver 2016 Sep 22, 2016 - 01:56 PM GMTBy: GoldCore

Gold was up 1.5% and silver surged 3.1% yesterday after Janet Yellen again failed to raise rates from record lows at 0.25%. The Fed maintained ultra loose monetary policies which are again creating stock and bond market bubbles in the U.S. and other countries.

Gold was up 1.5% and silver surged 3.1% yesterday after Janet Yellen again failed to raise rates from record lows at 0.25%. The Fed maintained ultra loose monetary policies which are again creating stock and bond market bubbles in the U.S. and other countries.

Fed’s Yellen To Engage In QE Again?

Global stocks and commodities also rose on continuing relief that the Fed continues ZIRP and remains ultra loose along with the BoJ, BOE and ECB whose policies are even looser. The BoJ also maintained ultra loose monetary policies at negative 0.1 percent rate and said it would continue buying government bonds at the current pace for the time being.

Spot gold prices hit a two-week high of $1,336.8 an ounce after the Fed said that it would keep rates at record lows. Silver rose to as high as $19.86 and both precious metals have consolidated on those gains in Asian and European trading.

Euro gold rose to €1,194/oz and sterling gold to £1,024/oz.

The Federal Reserve signaled once again that zero interest rate policies (ZIRP) will continue. It suggested once again that it might raise rates by 0.25% to 0.5% by the end of this year – but only if the labour market improved.

Yellen found herself forced to defend the Fed against Donald Trump’s claims that political pressure and bias is influencing monetary policy – possibly favouring the Democratic incumbents.

The BoJ dropped its explicit target of increasing base money, the amount of money it prints, by an annual whopping 80 trillion yen ($788 billion). Analysts said was a tacit admission its aggressive asset-buying was becoming unsustainable and was not having the desired effect.

Years of massive money printing have completely failed to jolt the economy out of decades-long stagnation. Indeed, it can now be argued that the massive QE programmes of the Fed, BOE and indeed the ECB have failed to ignite robust and sustainable growth in the major economies.

Employment in the euro zone is rising faster than expected but research released by the European Central Bank yesterday suggests that this may continue, but at a cost to productivity and potentially to long-term economic growth.

Since the 2008 crash, the Federal Reserve has created more than $4.3 trillion to bailout banks and in an attempt to stimulate growth in the economy. While the Fed finished its bond buying programme in 2014, its balance sheet is now very poor and it may be unable to sell the bonds bought for fear of interest rates moving higher again.

The U.S. economic recovery is weak and there is the strong possibility of a recession. The massive levels of debt at all levels of U.S. and indeed western society make any meaningful recovery highly unlikely.

The U.S., and much of the western world, is now dangerously addicted to cheap money and the attendant debasement of the dollar and all fiat currencies. Yellen will continue pushing the drug of cheap money, much of which ends up on Wall Street and in increasingly bubble like global stock and bond markets.

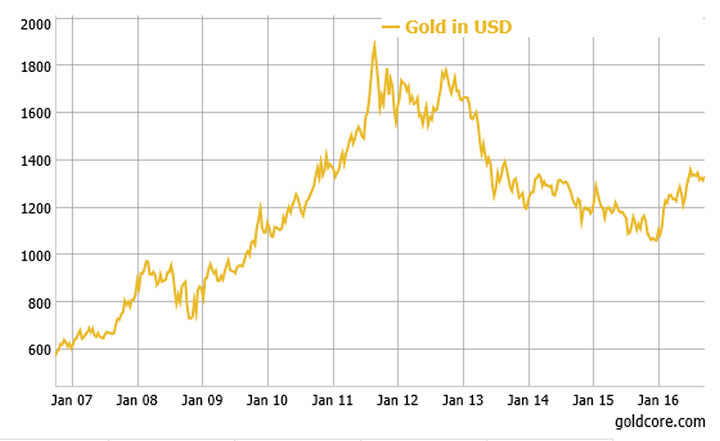

Gold in USD – 10 Years

We continue to disagree with the consensus that the U.S. will increase interest rates in any meaningful way. Indeed, we think it quite possible that the very poorly state of the U.S. economy will be acknowledged in the coming weeks. Likely soon after the U.S. election.

Then the narrative regarding rising interest rates will quickly change. Rather than raising interest rates, there is the real possibility that they actually go lower. Renewed QE is quite likely and negative interest rates are quite possible.

This type of monetary backdrop, in conjunction with the very real global macroeconomic, geo-political and systemic risks of today, means that the outlook for gold and silver has arguably never been better.

Gold Prices (LBMA AM)

22 Sep: USD 1,332.45, GBP 1,019.59 & EUR 1,186.68 per ounce

21 Sep: USD 1,319.60, GBP 1,015.96 & EUR 1,183.81 per ounce

20 Sep: USD 1,315.40, GBP 1,011.02 & EUR 1,175.84 per ounce

19 Sep: USD 1,315.05, GBP 1,007.99 & EUR 1,177.36 per ounce

16 Sep: USD 1,314.25, GBP 995.68 & EUR 1,170.08 per ounce

15 Sep: USD 1,320.10, GBP 998.26 & EUR 1,174.23 per ounce

14 Sep: USD 1,323.20, GBP 1,001.40 & EUR 1,177.91 per ounce

Silver Prices (LBMA)

22 Sep: USD 19.88, GBP 15.22 & EUR 17.69 per ounce

21 Sep: USD 19.43, GBP 14.95 & EUR 17.43 per ounce

20 Sep: USD 19.17, GBP 14.78 & EUR 17.15 per ounce

19 Sep: USD 19.12, GBP 14.65 & EUR 17.13 per ounce

16 Sep: USD 18.91, GBP 14.36 & EUR 16.85 per ounce

15 Sep: USD 18.96, GBP 14.32 & EUR 16.87 per ounce

14 Sep: USD 19.04, GBP 14.42 & EUR 16.96 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.