European banks may be more important than the Fed this week

Stock-Markets / Financial Markets 2016 Sep 20, 2016 - 03:27 PM GMT It’s like déjà vu all over again. The SPX Premarket has tested the lower trendline of its Orthodox Broadening Top, but pulled back.

It’s like déjà vu all over again. The SPX Premarket has tested the lower trendline of its Orthodox Broadening Top, but pulled back.

ZeroHedge observes, “If yesterday one could "explain" the overnight stock levitation due to the move higher in crude oil, today there is no such catalyst with WTI down modestly, and yet the broader push higher across European stocks and US equities has reappeared following yesterday's muted close on Wall Street ahead of key central bank data on deck. Some have attributed the 0.4% rise in futures to the latest dip in the dollar, while a modest bond rally as the countdown to crucial policy decisions by the Bank of Japan and the Federal Reserve entered its final stretch, put taper tantrum concerns on hold if only for the time being.”

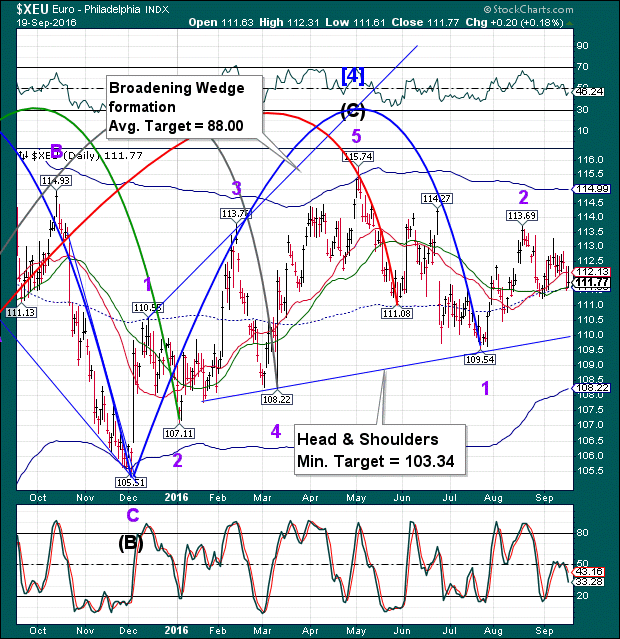

The Euro has been testing its 50-day Moving Average for two days. Could today’s test be the charm? XEU is approaching its Master Cycle turn window, which may happen by the end of the week.

Deutsche Bank is fast approaching a point of no return as it challenges its prior lows.

ZeroHedge reports, “After a tumultuous week for Deutsche Bank which saw the DOJ demand a $14 billion settlement for the bank's past RMBS transgressions, it was another bad day for the giant German lender, whose stock and contingent converts tumbled after the investing community realized that even a modest $5.5 billion final settlement would leave it perilously undercapitalized and likely scrambling to raise more cash.”

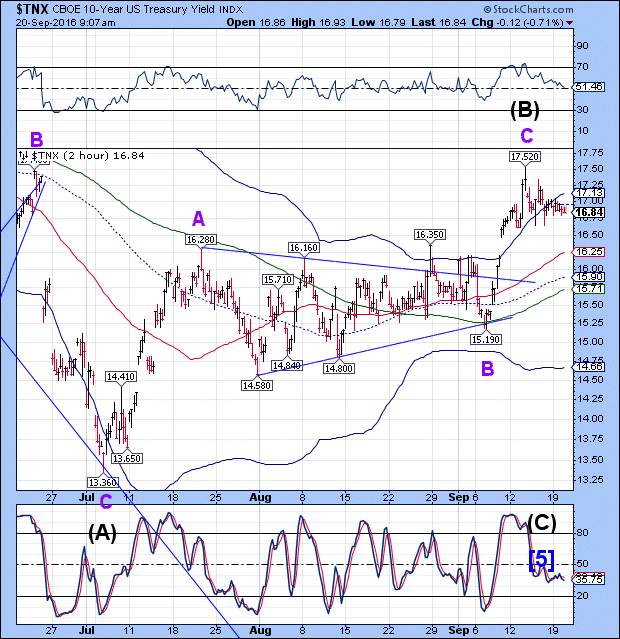

TNX is tentatively lower, but hasn’t broken any lows so far. There appears to be some support at 16.60 to 16.65. Once that level is broken, we may see TNX decline more strongly.

There’s dissention in the ranks as Bloomberg reports, “There’s uncommon dissent in the ranks of the Federal Reserve’s primary dealers over the central bank’s interest-rate decision this week.

Two of the Fed’s 23 preferred bond-trading partners -- Barclays Plc and BNP Paribas SA -- are betting against their peers and the bond market by forecasting officials will raise rates Wednesday. It’s the first time more than one dealer has gone against the consensus during the week of a policy meeting since last September, data compiled by Bloomberg show. Economists at both banks say traders have too steeply discounted officials’ intent to hike after the Fed has remained on hold for longer than expected.”

USD appears to be range-bound for the moment.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.