Stock Market May Turn Ugly This Week

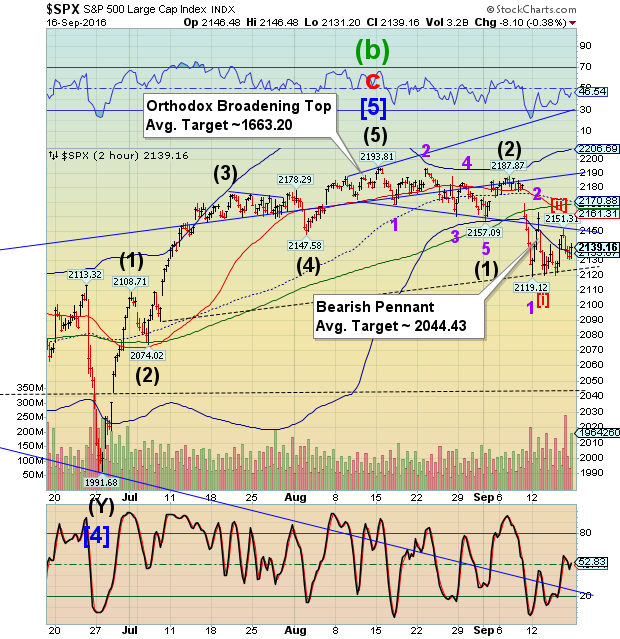

Stock-Markets / Stock Markets 2016 Sep 19, 2016 - 05:05 PM GMT The SPX Premarket is higher this morning, but short of Thursday’s high or the trendline.

The SPX Premarket is higher this morning, but short of Thursday’s high or the trendline.

ZeroHedge reports, “Stocks across the board, and US equity futures are broadly in the green this morning as markets shrug off the terror-related events in the NYC area over the weekend. There wasn’t a single positive “reason” for the green price action but the bond “tantrum” that caught the attention of stocks beginning back on 9/8 is increasingly fading and investors are hopeful this week’s central bank decisions (BOJ and FOMC both on Wed 9/21) will further ease yield anxieties.”

However, the threat of terrorist activities is increasing. Is this just a smokescreen or the real thing? The Cycles Model suggests a low on Wednesday. Let’s see what happens.

The EuroStoxx Index is attempting to rally, but may be caught beneath mid-Cycle resistance at 2977.00. This is a very stretched Master Cycle. A Primary Cycle low may be due on Wednesday, suggesting more downside to come. The Cycle Bottom support may be a reasonable target, in this case.

7

7

Dana Lyons comments, “uropean stocks attempted breakouts of key short and longer-term trendlines earlier this month; each of them appear to be failing.

With the past week’s global equity selloff, a great number of notable trendlines came into play across the stock universe. Most of them were of short-term consequence, although yesterday, we touched on the fact that U.S. small-caps and mid-caps were testing trendlines stemming back to 2009. In general, most encounters saw prices hold above their respective trendlines. It was not unanimous, however. One area where we are seeing a potential breakdown of key trendlines – 2 of them, in fact – is in European equities. Specifically, we’re talking about the Dow Jones STOXX Europe 50 Index.”

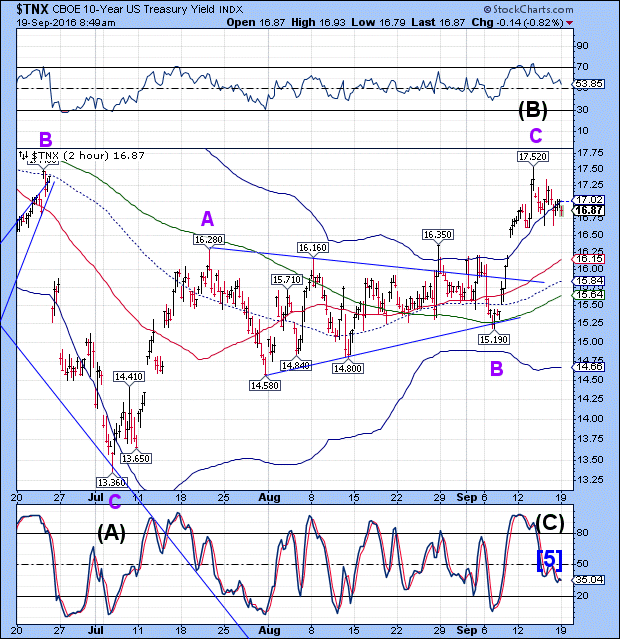

TNX has begun its breakdown, although timidly, for now. The decline from the top was impulsive, suggesting more to come.

This may be a 5-week decline, as TNX does not expect to see a Master Cycle low until the week of October 24.

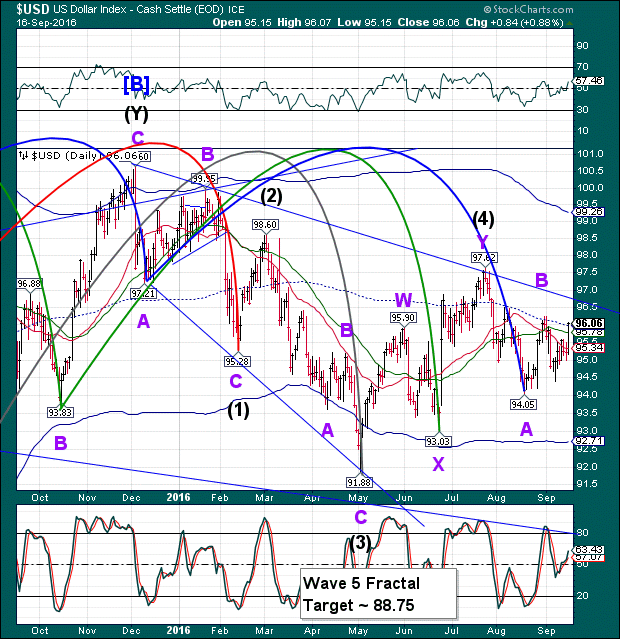

The USD has reversed off its Friday high after making a very sharp retracement to the mid-Cycle resistance at 95.99.

The Cycles Model suggests that there may be a decline to its fractal target by the week of October 24.

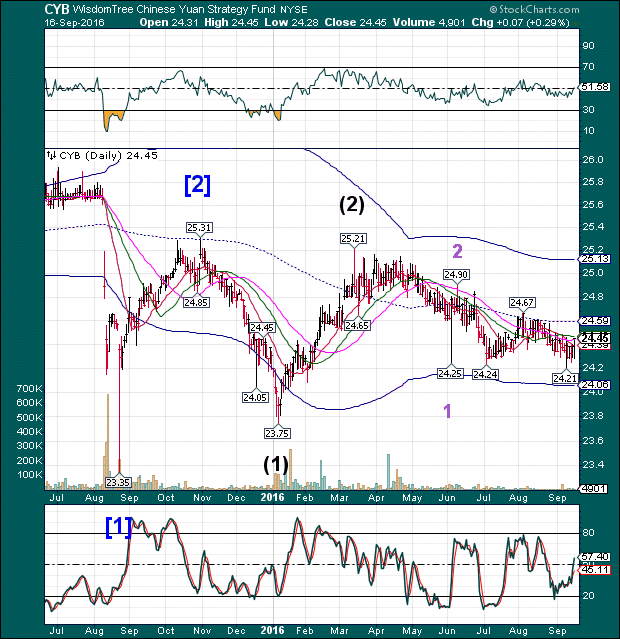

The Yuan broke down, making a new low on Friday, September 9. Since then the PBOC has declared war on the Yuan shorts.

ZeroHedge reports, “When last week Hong Kong's overnight CNH funding rates exploded to the highest since January, many ascribed it to the liquidity scarcity ahead of Chinese holidays on Thursday and Friday. However, we claimed that as the PBOC continues its struggled to prevent USDCNH from rising above 6.70, pushing funding costs to stratospheric levels was precisely one of the tools it was using.”

We are seeing things turn south on multiple fronts. This could turn into na ugly week.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.